February 11, 2026 a 01:15 pmZTS: Trend and Support & Resistance Analysis - Zoetis Inc.

The stock of Zoetis Inc. (ZTS) has recently displayed signs of volatility, following various market conditions affecting the animal health sector. As a key player in this industry, Zoetis's stock has been in focus due to its diverse product line and global presence. Recent technical analysis indicates potential changes in market sentiment, influencing short-term and long-term trends. This detailed analysis will explore the stock's current trend, identifying key support and resistance zones.

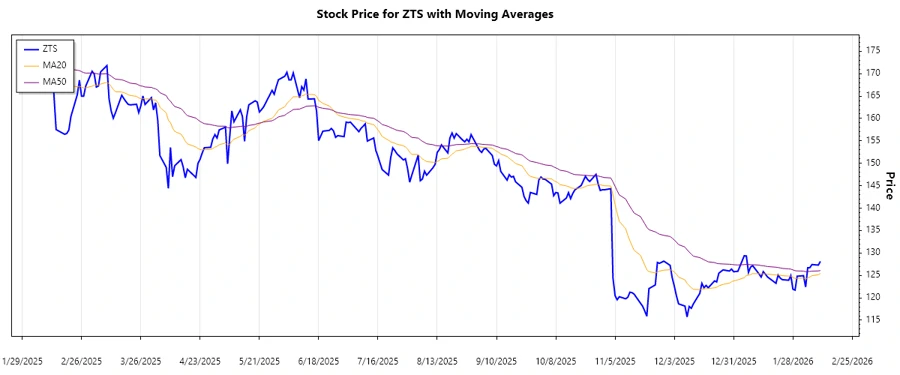

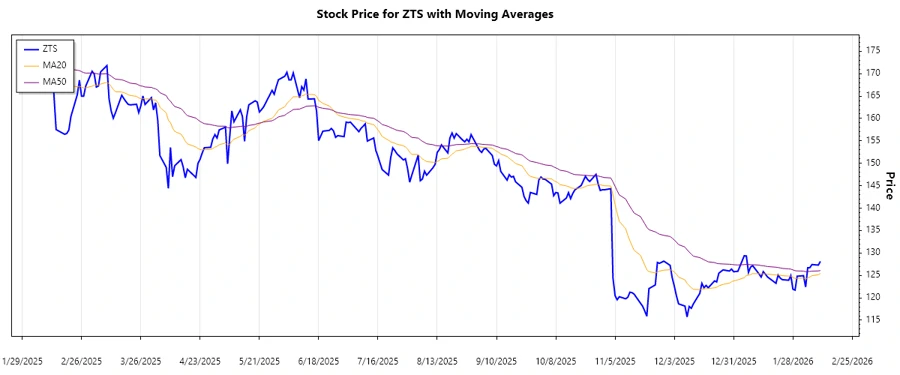

Trend Analysis

Upon analyzing the closing prices over the given period and calculating the exponential moving averages (EMA20 and EMA50), the following trends have been identified:

| Date | Closing Price | Trend |

|---|---|---|

| 2026-02-10 | 128.13 | ▲ Upward |

| 2026-02-09 | 127.30 | ▲ Slightly Upward |

| 2026-02-06 | 127.42 | ⚖️ Sideways |

| 2026-02-05 | 126.73 | ▼ Downward |

| 2026-02-04 | 126.70 | ▼ Downward |

| 2026-02-03 | 122.41 | ▼ Significant Drop |

| 2026-02-02 | 124.94 | ▲ Recovery |

Based on the EMA calculations, the current trend indicates a downward movement with sporadic recoveries. This indicates a bearish short-term outlook, with potential reversals.

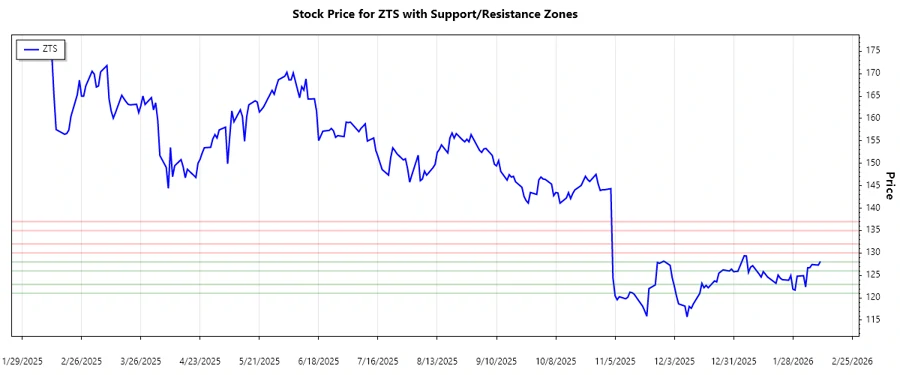

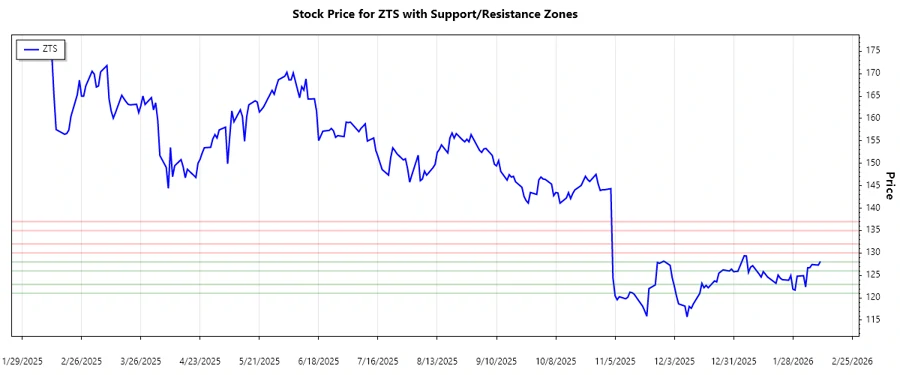

Support and Resistance

Identified support and resistance levels are calculated as follows:

| Type | Zone From | Zone To |

|---|---|---|

| Support | 121.00 | 123.00 |

| Support | 126.00 | 128.00 |

| Resistance | 130.00 | 132.00 |

| Resistance | 135.00 | 137.00 |

Currently, the stock's price is approaching the upper support zone, which might provide some stability and potential for rebound.

Conclusion

Zoetis Inc. (ZTS) presents a mixed technical picture due to recent fluctuations in market price. While the current trend suggests a downtrend, nearing support levels might offer buying opportunities if validated by volume and market indicators. Conversely, resistance levels indicate potential selling points if upward movement occurs. Analysts should remain cautious and monitor market conditions closely, as various factors, including sector performance and economic conditions, continue to influence stock dynamics. It’s vital to consider both technical data and broader market insights to make informed investment decisions.