February 05, 2026 a 10:15 am

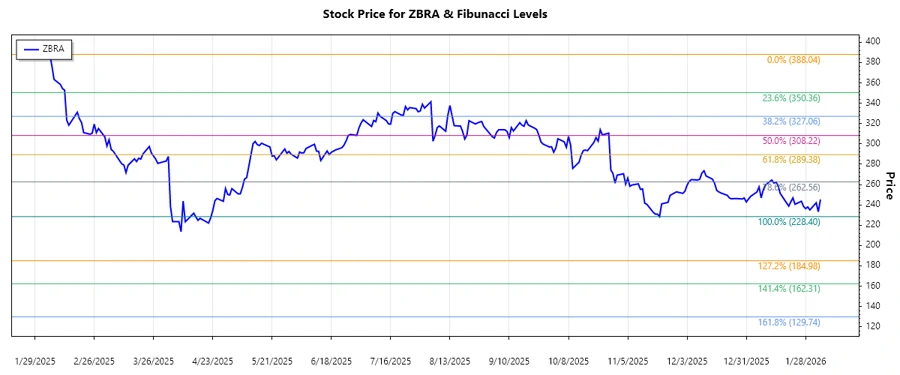

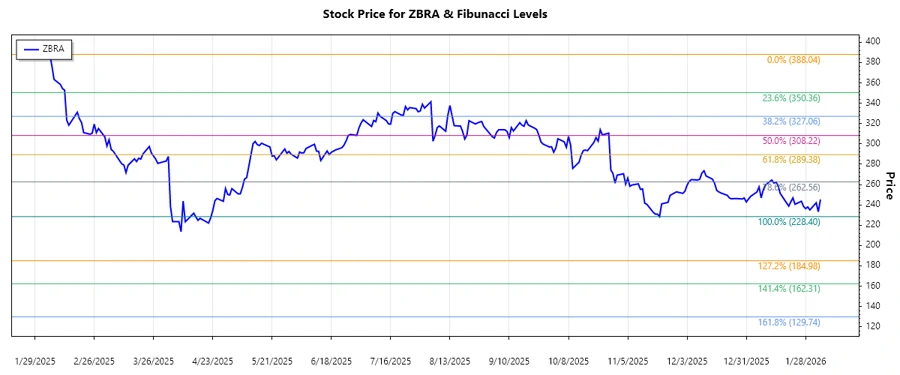

ZBRA: Fibonacci Analysis - Zebra Technologies Corporation

Zebra Technologies Corporation has experienced a downward trend over the analyzed period. With its historical data reflecting lower highs and lower lows, investors might be wary of upcoming resistance levels. However, the company's diverse portfolio in enterprise asset intelligence solutions could provide resilience in bouncing back amid fluctuating market conditions.

Fibonacci Analysis

The recent trend for Zebra Technologies (ZBRA) is identified as a downtrend. Utilizing Fibonacci Retracement, we calculate potential price levels based on this trend.

| Metric | Details |

|---|---|

| Start Date | 2025-02-05 |

| End Date | 2026-02-04 |

| High Point | $388.04 on 2025-02-05 |

| Low Point | $228.40 on 2025-11-20 |

| Fibonacci Level | Price Level |

|---|---|

| 0.236 | $264.67 |

| 0.382 | $295.76 |

| 0.5 | $308.22 |

| 0.618 | $320.68 |

| 0.786 | $338.75 |

Current Price: $245.25 is above the 0.236 Fibonacci level, indicating potential resistance as it could retrace to higher levels or confirm the downtrend.

Technically, if the current price stabilizes above $264.67, the downtrend may weaken, offering support back towards $295.76, or continue declining if it fails to stay above early retracement levels.

Conclusion

The downtrend observed in Zebra Technologies' stock presents certain risks, particularly for short-term investors. However, the presence of a stable support line at the 0.236 and subsequent Fibonacci levels offers potential buying opportunities. For long-term investors, Zebra's solid fundamentals and innovative solutions in asset intelligence provide potential for growth once market conditions stabilize. Careful attention should continue to be given to the stock's performance around these key price levels to predict further movement accurately. Analysts suggest monitoring economic trends that could influence Zebra's diverse business sectors, enhancing informed decision-making.