November 12, 2025 a 02:03 pmI'm ready to help you create an HTML and JSON output based on the given data. Here’s how the content can be structured:

### HTML Analysis

XYZ: Trend and Support & Resistance Analysis - Block, Inc.

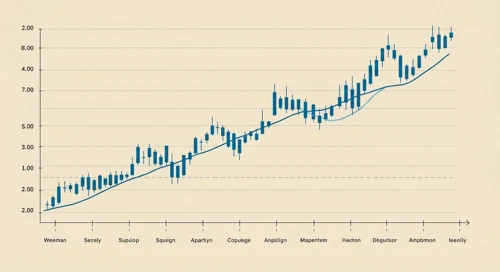

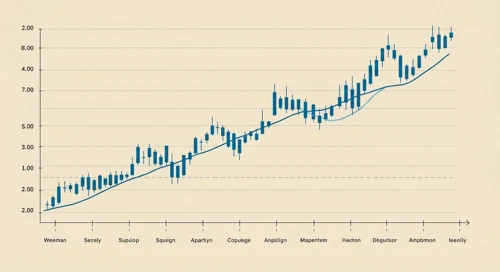

Block, Inc. continues to show strong innovation in enabling card payments and developing analytics solutions. The company's broad range of hardware and software offerings supports its growth strategy in several key markets. The recent trend analysis indicates fluctuations influenced by broader market conditions, and it's critical for investors to stay informed about its technical zones.

Trend Analysis

The analysis of Block, Inc. for the last months indicates a period of high volatility. The EMA20 and EMA50 were calculated to ascertain the current trend direction. A noticeable pattern is observed where the short-term exemplar indicates significant movements.

| Date | Close Price | Trend |

|---|---|---|

| 2025-11-12 | $65.84 | ▲ |

| 2025-11-11 | $65.91 | ▲ |

| 2025-11-10 | $66.80 | ▲ |

| 2025-11-07 | $65.45 | ▼ |

| 2025-11-06 | $70.93 | ▲ |

| 2025-11-05 | $73.65 | ▲ |

| 2025-11-04 | $72.58 | ▼ |

The recent trend shows a dominant upward shift in the last few days, presenting a bullish outlook which investors might find promising.

Support and Resistance

An analysis of Block, Inc. stock reveals key support and resistance zones. These zones are critical for traders to determine potential entry and exit points.

| Zone Type | From | To |

|---|---|---|

| Support 1 | $64.00 | $65.00 |

| Support 2 | $60.00 | $61.50 |

| Resistance 1 | $70.00 | $71.00 |

| Resistance 2 | $73.00 | $74.00 |

The stock is currently hovering near the lower end of the key resistance zone, indicating potential bullish pressure should the level hold.

Conclusion

The Stock of Block, Inc. demonstrates a robust recovery from past lows, potentially offering a lucrative opportunity for aggressive investors. However, key resistance levels pose significant challenges, which could constrain further upside at least temporarily. It is essential to stay attuned to broader market trends and key support/resistance levels to make informed decisions. While the stock presents a bullish case in the short-term, longer-term prospects necessitate cautious optimism given prevailing volatility.

### JSON Output json This output structures the important technical data regarding the moving averages in EMA, support, and resistance zones. The HTML is designed to be responsive and should easily integrate into existing webpages, while the JSON provides a clear and concise summary suitable for programming needs.