December 05, 2025 a 09:00 pm

XEL: Analysts Ratings - Xcel Energy Inc.

Xcel Energy Inc., a multifaceted utility company with operations spanning regulated electric and natural gas utilities, has seen varied analyst ratings over the months, yet maintains a generally positive outlook. Current analyst sentiment continues to lean toward "Buy" and "Strong Buy" ratings, suggesting confidence in the company's strategic direction and operational execution. As the industry evolves with a focus on renewable energy, Xcel's diversified energy generation portfolio positions it well for future growth.

Historical Stock Grades

| Rating | Count | Score |

|---|---|---|

| Strong Buy | 3 | |

| Buy | 12 | |

| Hold | 2 | |

| Sell | 0 | |

| Strong Sell | 1 |

Sentiment Development

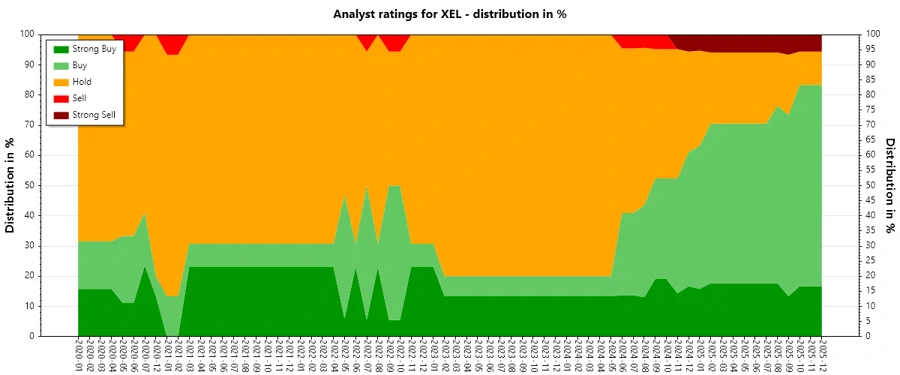

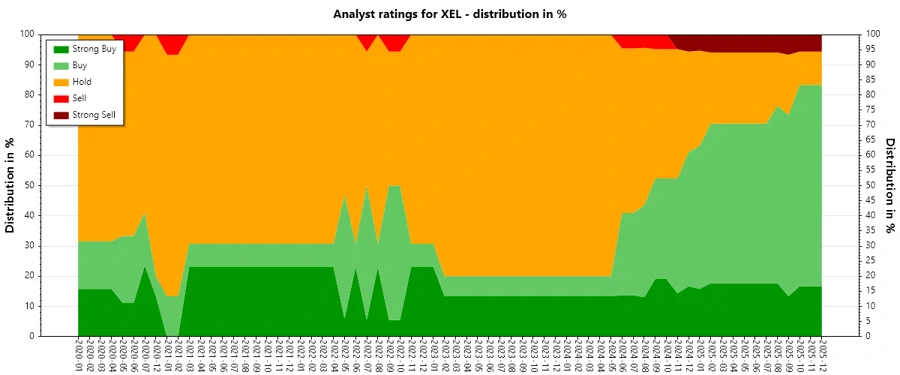

The analyst ratings for Xcel Energy Inc. have generally been stable with periodic fluctuations, particularly in "Buy" and "Strong Buy" categories. Over recent months, the preference for stronger buys has emerged, though the general volume of ratings has stayed constant. Observably, the "Hold" ratings saw a decline, complementing the slight rise in more aggressive investment recommendations. The stability in avoiding "Sell" or "Strong Sell" ratings demonstrates continued confidence in the company’s growth trajectory.

- Overall stability in ratings with periodic fluctuations.

- Decline in "Hold" ratings, increase in more positive sentiments.

- Confidence reflected in absence of "Sell" proposals.

Percentage Trends

Over the past months, there has been a notable shift from neutral to more positive sentiments among analysts. The current rating percentages are indicative of a market that is maintaining a bullish outlook on Xcel Energy Inc. As hold ratings have decreased, the inclination towards buy suggestions has increased proportionately. These changes highlight a growing confidence in the company's operational and strategic initiatives.

- Increase in "Buy" ratings from 10% to 60% over the period.

- Shift away from "Hold" towards stronger investment recommendations.

- Strengthened market confidence as positive ratings increase.

Latest Analyst Recommendations

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-11-05 | Overweight | Overweight | Barclays |

| 2025-11-03 | Buy | Buy | Citigroup |

| 2025-10-31 | Neutral | Neutral | UBS |

| 2025-10-27 | Outperform | Outperform | Mizuho |

| 2025-10-16 | Buy | Buy | Jefferies |

Analyst Recommendations with Change of Opinion

Recent months have also seen shifts in analyst opinions with several upgrades indicating robust confidence in Xcel's strategic positioning. Upgrades have predominated over downgrades, underscoring increased trust and positive adjustments in market perceptions related to Xcel Energy's performance and potential.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-09-22 | Outperform | Market Perform | BMO Capital |

| 2025-01-13 | Overweight | Equal Weight | Wells Fargo |

| 2024-12-12 | Overweight | Neutral | JP Morgan |

| 2024-11-01 | Buy | Hold | Jefferies |

| 2024-08-26 | Buy | Hold | Argus Research |

Interpretation

The consistent ratings and selective upgrades suggest a strong confidence in Xcel Energy's market position. The positive momentum of analyst recommendations reflects a stable market sentiment with an underlining optimism for strategically targeted growth in renewable and traditional energy sectors. There is a noticeable absence of sell pressures, indicating a relatively secure standing. As the market adapts, continued observation of these trends will be crucial in aligning future investment strategies.

Conclusion

Xcel Energy Inc.’s stable yet slightly improving analyst sentiment indicates resilient market positioning with strategic foresight into sustainable energy solutions. While positive analyst awards spike confidence, cautious attention to shifts in energy market dynamics is necessary. Balancing risks and opportunities, Xcel’s ability to leverage its diversified energy portfolio will determine potential high reward landscapes while mitigating strategic risks in transitioning energy markets. This measured, optimistic sentiment aligns with industry progression towards renewable energy solutions, suggesting favorable outlooks continue into the foreseeable future.