February 03, 2026 a 05:15 am

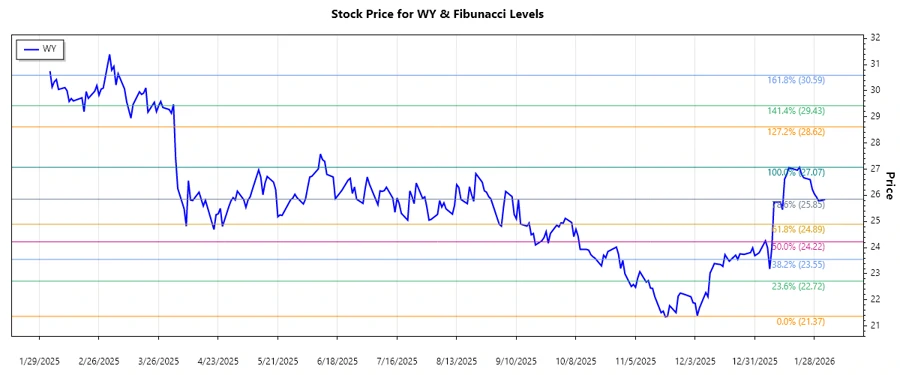

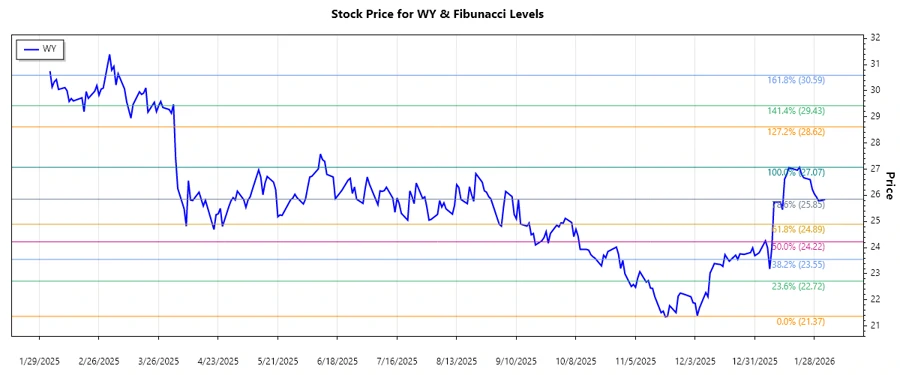

WY: Fibonacci Analysis - Weyerhaeuser Company

Weyerhaeuser Company, a major player in the timberland and wood product industry, has shown a volatile market performance. With its substantial timberland assets, the company's stock is influenced by housing market trends and sustainability practices. Recently, the stock displayed a significant upward trend, offering potential investment opportunities. However, the cyclical nature of this industry requires rigorous analysis of market trends. Investors should consider both technical indicators and broader economic signals when evaluating this stock.

Fibonacci Analysis

The recent analysis shows a prominent upward trend in Weyerhaeuser Company's stock from December 2025 to February 2026. This trend was marked by a low of $21.37 on November 20, 2025, and a high of $27.07 on January 21, 2026. Applying Fibonacci retracement tools gives us crucial potential support and resistance levels. Based on this range, we calculate the following Fibonacci retracement levels.

| Details | Value |

|---|---|

| Trend Start Date | 2025-11-20 |

| Trend End Date | 2026-01-21 |

| Low Price & Date | $21.37 on 2025-11-20 |

| High Price & Date | $27.07 on 2026-01-21 |

| Current Price | $25.84 |

Fibonacci Levels

| Retracement Level | Price Level |

|---|---|

| 23.6% | $25.85 |

| 38.2% | $24.96 |

| 50.0% | $24.22 |

| 61.8% | $23.47 |

| 78.6% | $22.40 |

Currently, the stock price is within the 23.6% retracement zone, indicating a minor pullback. This suggests a potential support level, and the stock may resume its upward trend if this holds. Technical patterns imply a possible continuation of the uptrend unless breached significantly.

Conclusion

Weyerhaeuser Company demonstrates promise with its sustainable business operations and market resilience. The recent upward trend suggests favorable market conditions, possibly supported by a stronger housing and construction sector. However, the cyclical nature of commodities and potential economic downturns pose risks. Investors should remain cautious and combine technical analysis with economic and market trends to make informed decisions. This stock represents a potential opportunity but should be approached with balanced awareness of broader market signals.