September 21, 2025 a 03:31 am

WTW: Dividend Analysis - Willis Towers Watson Public Limited Company

Willis Towers Watson stands as a robust player in the insurance brokerage sector, showcasing a steady dividend profile. Despite challenges in the broader market, the company has maintained a consistent and moderate dividend growth over decades. With a substantial history of maintaining dividends, it offers a reliable option for income-seeking investors.

📊 Overview

Willis Towers Watson is positioned within the competitive insurance brokerage sector and maintains a moderate dividend yield, catering to income-focused investors.

| Metric | Detail |

|---|---|

| Sector | Insurance Brokerage |

| Dividend yield | 1.08 % |

| Current dividend per share | 3.47 USD |

| Dividend history | 23 years |

| Last cut or suspension | None |

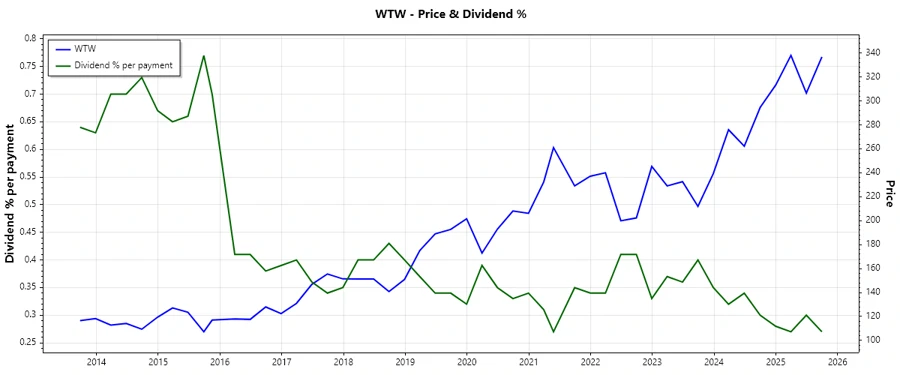

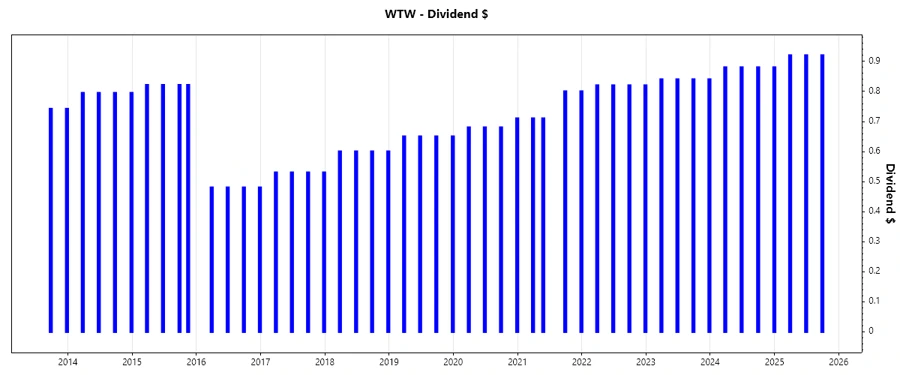

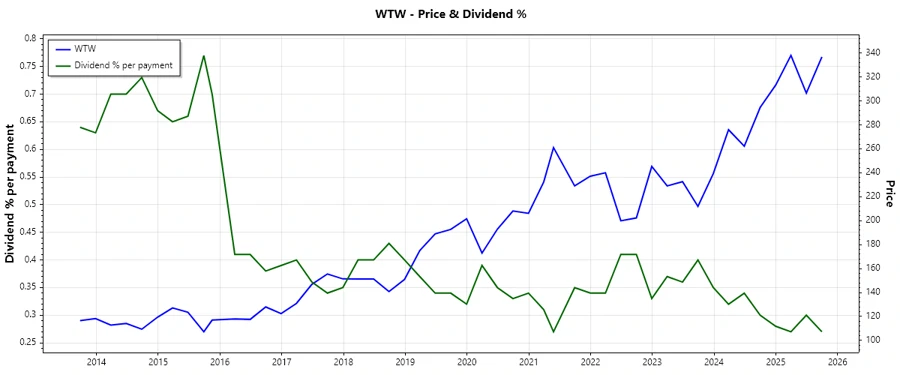

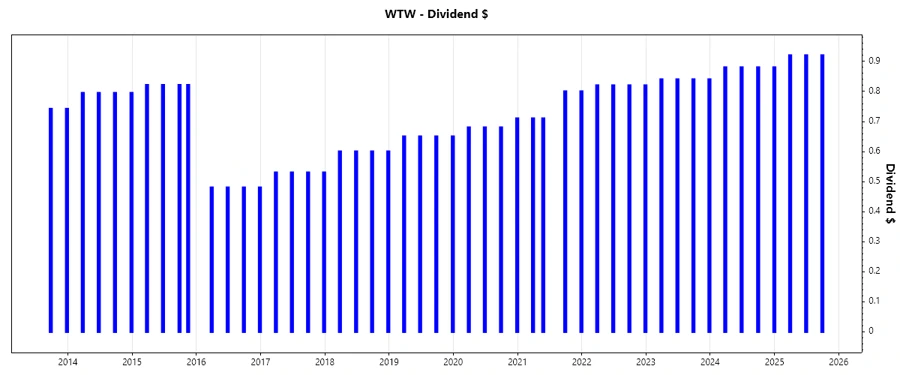

📉 Dividend History

The dividend history highlights Willis Towers Watson's commitment to returning value to shareholders with consistent payouts over the years. This stability is critical for sustaining investor confidence.

| Year | Dividend Per Share (USD) |

|---|---|

| 2025 | 2.76 |

| 2024 | 3.52 |

| 2023 | 3.36 |

| 2022 | 3.28 |

| 2021 | 3.02 |

📈 Dividend Growth

The dividend growth rate is a vital indicator of a company's ability to enhance shareholder value over time. Willis Towers Watson has shown modest growth in this domain, reflecting its steady performance.

| Time | Growth |

|---|---|

| 3 years | 5.24 % |

| 5 years | 6.25 % |

The average dividend growth is 6.25 % over 5 years. This shows moderate but steady dividend growth.

🔍 Payout Ratio

The payout ratio is crucial for understanding dividend sustainability. Willis Towers Watson's EPS-based and FCF-based payout ratios indicate a need for careful consideration in ongoing payout strategies.

| Key figure | Ratio |

|---|---|

| EPS-based | 253.33 % |

| Free cash flow-based | 26.43 % |

The EPS-based ratio is notably high at 253.33 %, which may raise sustainability concerns. In contrast, the FCF-based ratio at 26.43 % suggests a more conservative and manageable approach to dividend payments.

✅ Cashflow & Capital Efficiency

Evaluating cash flow and capital efficiency provides insight into the company's operational liquidity and capital utilization. These metrics are pivotal in assessing long-term financial health.

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Free Cash Flow Yield | 2.22 % | 4.36 % | 3.97 % |

| Earnings Yield | 3.68 % | 4.17 % | -0.31 % |

| CAPEX to Operating Cash Flow | 25.12 % | 17.99 % | 16.20 % |

| Stock-based Compensation to Revenue | 1.12 % | 1.32 % | 1.22 % |

| Free Cash Flow / Operating Cash Flow Ratio | 74.88 % | 82.01 % | 83.80 % |

Cash flow stability and a balanced capital structure are generally commendable, though the high dilution effect due to stock-based compensation merits attention.

📊 Balance Sheet & Leverage Analysis

Reviewing balance sheet and leverage metrics is fundamental for understanding the company's financial robustness and debt management.

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Debt-to-Equity | 54.70 % | 62.41 % | 74.70 % |

| Debt-to-Assets | 17.25 % | 20.42 % | 21.43 % |

| Debt-to-Capital | 35.36 % | 38.43 % | 42.76 % |

| Net Debt to EBITDA | 2.25 | 2.24 | 4.91 |

| Current Ratio | 1.07 | 1.06 | 1.20 |

| Quick Ratio | 1.07 | 1.06 | 1.20 |

| Financial Leverage | 3.17 | 3.06 | 3.49 |

While the increase in leverage indicates growing dependence on debt, the company's ability to cover debts with its asset levels remains balanced.

📈 Fundamental Strength & Profitability

Fundamentals and profitability assessments allow for a closer look into the company's efficiency in utilizing resources and generating profit.

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Return on Equity | 10.07 % | 11.08 % | -1.23 % |

| Return on Assets | 3.18 % | 3.63 % | -0.35 % |

| Net Margin | 11.38 % | 11.13 % | -0.99 % |

| EBIT Margin | 14.79 % | 15.97 % | 3.70 % |

| EBITDA Margin | 21.18 % | 21.29 % | 8.29 % |

| Gross Margin | 40.83 % | 43.65 % | 44.59 % |

| R&D to Revenue | 0 % | 0 % | 0 % |

Profitability margins show resilience with slight fluctuations. However, recent declines in ROE and ROA in 2024 suggest challenges in sustaining operational efficiency.

📈 Price Development

📋 Dividend Scoring System

| Category | Rating | Score |

|---|---|---|

| Dividend Yield | 3 | |

| Dividend Stability | 4 | |

| Dividend Growth | 3 | |

| Payout Ratio | 2 | |

| Financial Stability | 3 | |

| Dividend Continuity | 4 | |

| Cashflow Coverage | 3 | |

| Balance Sheet Quality | 3 |

Overall Score: 25/40

🏆 Rating

Willis Towers Watson maintains a moderate yet reliable position among dividend payers, particularly for investors prioritizing stability over aggressive growth. Their consistent dividend payment history and moderate growth rate provide a reasonable investment prospect. Recommended for conservative income portfolios.