October 07, 2025 a 08:39 pm

WSM: Analysts Ratings - Williams-Sonoma, Inc.

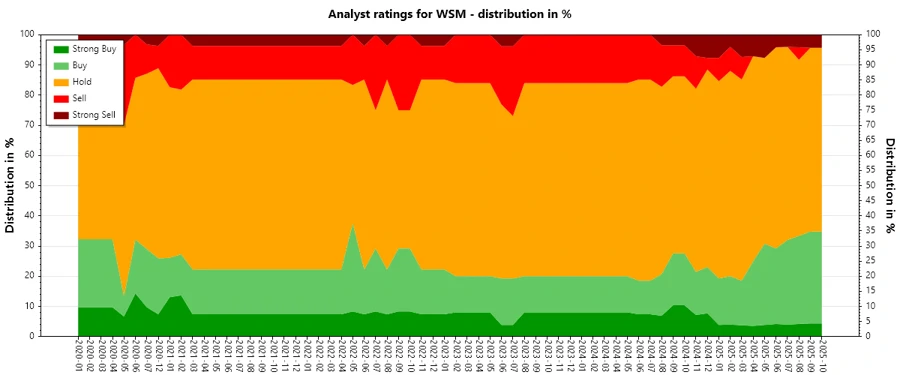

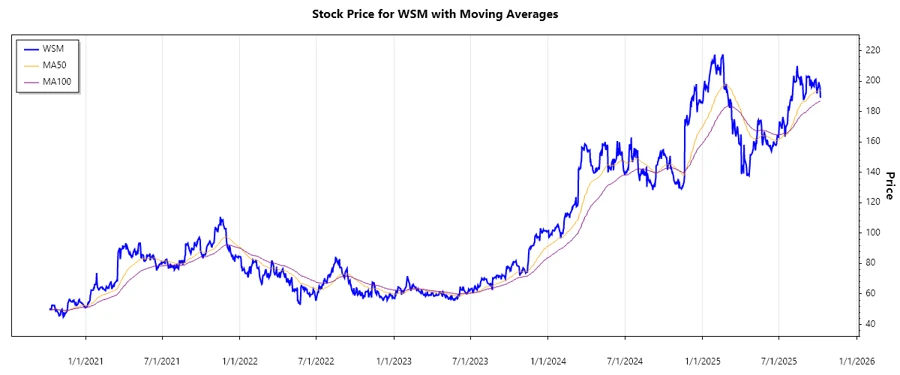

As a prominent omni-channel specialty retailer, Williams-Sonoma, Inc. has seen varied analyst sentiment. While the company continues to maintain a robust retail presence and emphasize e-commerce, there is evident caution among analysts. The shift towards increased 'Hold' ratings signifies a sentiment of uncertainty, possibly reflecting concerns about market saturation or economic factors affecting consumer spending on home goods.

Historical Stock Grades

Analyst sentiment for WSM as of October 2025 suggests a cautiously optimistic outlook with a notable increase in 'Hold' recommendations, indicating a balanced perspective amid market variables.

| Recommendation | Count | Score |

|---|---|---|

| Strong Buy | 1 | |

| Buy | 7 | |

| Hold | 14 | |

| Sell | 0 | |

| Strong Sell | 1 |

Sentiment Development

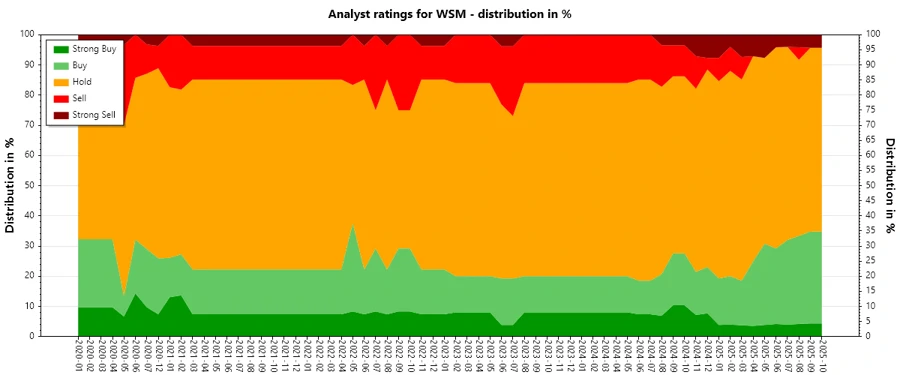

Over the past months, there has been a stabilization in the number of ratings, predominantly around the 'Hold' category. - A noticeable decrease in 'Strong Buy' from mid-2024 to late 2025. - Consistent 'Hold' ratings suggest a wait-and-see approach from analysts. - The decrease in 'Sell' categories may signal reduced negative sentiment.

Percentage Trends

The percentage distribution of recommendations shows a shift towards neutrality. - 'Strong Buy' recommendations have shrunk from 6% to 3% since 2024. - 'Buy' ratings have also slightly decreased, while 'Hold' ratings became prevalent. - Selling pressures hinted by 'Strong Sell' ratings remain minimal. - Over the past 12 months, the trend indicates a cautious stance amid consumer spending uncertainties.

Latest Analyst Recommendations

Recent months have shown stability in analyst opinions with no abrupt changes among major covering firms.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-28 | Outperform | Outperform | Telsey Advisory Group |

| 2025-08-28 | Neutral | Neutral | JP Morgan |

| 2025-08-28 | Equal Weight | Equal Weight | Morgan Stanley |

| 2025-08-28 | Outperform | Outperform | RBC Capital |

| 2025-08-28 | In Line | In Line | Evercore ISI Group |

Analyst Recommendations with Change of Opinion

There have been few upgrades and downgrades reflecting minor shifts in analyst expectations.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-07-23 | Buy | Hold | Gordon Haskett |

| 2025-05-19 | Equal Weight | Underweight | Barclays |

| 2025-04-25 | Overweight | Sector Weight | Keybanc |

| 2025-03-20 | Neutral | Sell | UBS |

| 2024-10-30 | Neutral | Outperform | Wedbush |

Interpretation

The overall market appraisal of Williams-Sonoma, Inc. exhibits cautious optimism with predominant 'Hold' recommendations. This suggests trust in the company's resilience but hesitation due to market variables. Rising 'Hold' trends indicate stability in opinions yet allude to investor caution regarding home goods discretionary spending. Analysts seem to await further market clarity which may dictate future recommendation shifts.

Conclusion

Williams-Sonoma Inc. presents a mixed investment opportunity with stable hold opinions offset by dwindling buy sentiments. The data underscores a wait-and-see attitude prevalent among analysts, possibly reflecting broader economic concerns. While the company demonstrates a strong market presence, reliance on discretionary spending could amplify risk. The strategic emphasis on e-commerce remains a positive indicator for long-term growth. As such, potential investors should be mindful of economic shifts impacting consumer behaviours and market conditions.