September 25, 2025 a 07:43 am

WM: Fundamental Ratio Analysis - Waste Management, Inc.

Waste Management, Inc. provides comprehensive waste management services across North America, making it a key player in the Industrials sector. Despite a solid operational presence, its current fundamentals suggest a moderate investment outlook. Investors are advised to consider long-term growth potential versus immediate financial metrics.

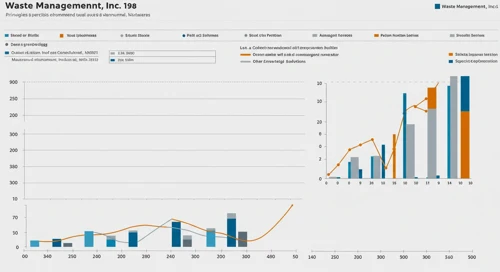

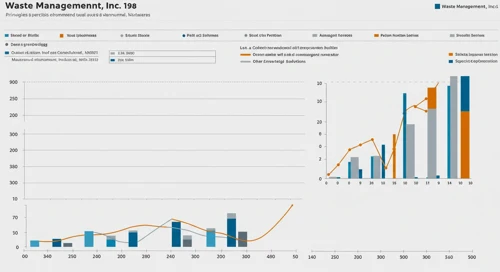

Fundamental Rating

The current fundamentals of Waste Management, Inc. indicate a stable yet modest performance across key metrics, reflecting a balanced approach in managing its financials.

| Category | Score | Visualization |

|---|---|---|

| Discounted Cash Flow (DCF) | 4 | |

| Return on Equity (ROE) | 5 | |

| Return on Assets (ROA) | 4 | |

| Debt to Equity | 1 | |

| Price to Earnings | 2 | |

| Price to Book | 1 |

Historical Rating

There have been minor changes in the ratings over time, reflecting the company's stable yet cautious growth approach.

| Date | Overall | DCF | ROE | ROA | Debt to Equity | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-09-24 | 3 | 4 | 5 | 4 | 1 | 2 | 1 |

| N/A | 0 | 4 | 5 | 4 | 1 | 2 | 1 |

Analyst Price Targets

Analysts' price targets suggest moderate upside potential, with a consensus towards holding the stock for steady returns.

| High | Low | Median | Consensus |

|---|---|---|---|

| $250 | $152 | $213.5 | $201.5 |

Analyst Sentiment

The general sentiment among analysts is neutral, with a majority leaning towards holding the stock due to its steady performance.

| Recommendation | Count | Visualization |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 15 | |

| Hold | 18 | |

| Sell | 0 | |

| Strong Sell | 0 |

Conclusion

Waste Management, Inc. presents a stable investment opportunity with a solid operational foundation. The fundamentals show room for improvement, especially in debt management and valuation metrics. The company's strategic expansions and service diversifications may offer long-term value creation. Analysts are cautiously optimistic, maintaining a hold recommendation. Overall, it stands as a reliable income play in a dynamic sector.