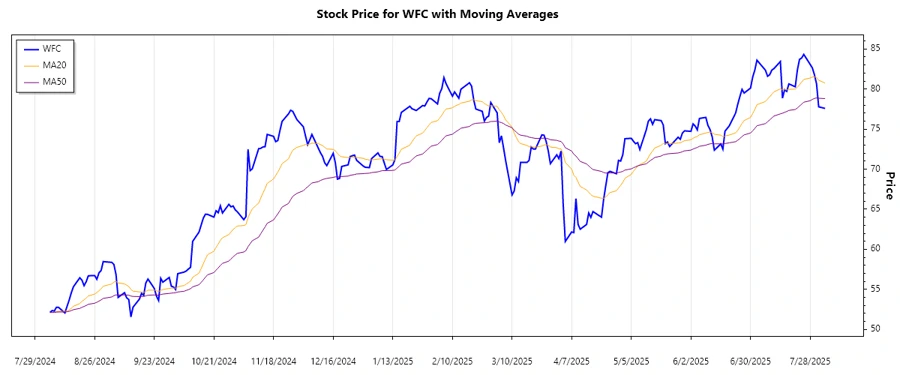

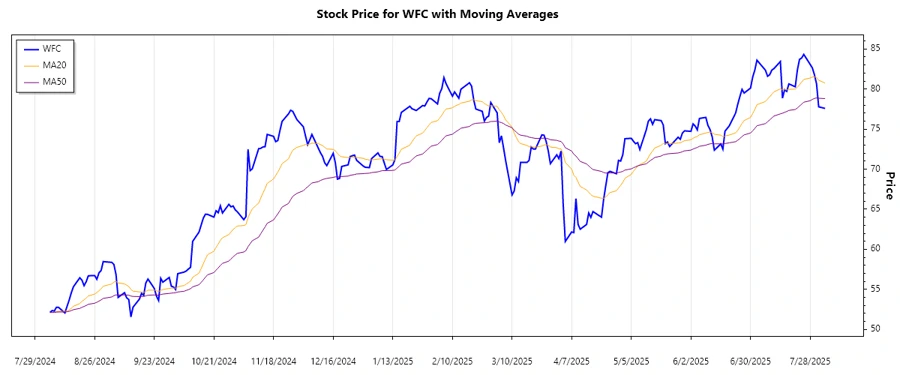

August 05, 2025 a 08:15 amHere is a technical analysis based on your provided data for Wells Fargo & Company (WFC):

WFC: Trend and Support & Resistance Analysis - Wells Fargo & Company

Wells Fargo & Company's stock has shown varied financial performance, somewhat reflective of broader market conditions and the company's strategic initiatives across its segments. Given its dominance in consumer and commercial finance, any potential fluctuations in federal interest rates and economic policies could significantly impact its operations. Recently, the stock illustrates signs of stabilization, and potential investors should carefully consider the indicated support and resistance levels while analyzing longer-term trends.

Trend Analysis

| Date | Close Price | Trend |

|---|---|---|

| 2025-08-04 | 77.58 | ▼ |

| 2025-08-01 | 77.78 | ▼ |

| 2025-07-31 | 80.63 | ▼ |

| 2025-07-30 | 81.78 | ▼ |

| 2025-07-29 | 82.65 | ▲ |

| 2025-07-28 | 83.07 | ▲ |

| 2025-07-25 | 84.32 | ▲ |

The current data shows a predominantly bearish trend despite the previous uptrend. The recent EMA20 < EMA50 suggests a downtrend, accompanied by recent closing prices falling below significant support levels. Technical indicators point towards a cautious approach, possibly indicating further corrections.

Support- and Resistance

| Zone Type | From | To |

|---|---|---|

| Support | 74.50 | 75.30 |

| Support | 77.00 | 77.80 |

| Resistance | 82.00 | 83.00 |

| Resistance | 84.00 | 85.00 |

The stock is currently trading just above the nearest support zone, suggesting potential resilience at current levels. However, should it breach this zone, a move towards the next support level could ensue. Resistance levels are clearly defined and would need to be crossed for a trend reversal.

Conclusion

The recent trend analysis identifies a short-term bearish indicator for Wells Fargo & Company, with the stock sitting close to key support zones. Breaking these levels could lead to a continuation of the downtrend. However, the long-term support and resistance zones suggest potential stabilization, offering a strategic entry or exit point for investors. Given the current economic environment and Wells Fargo's broad sector involvement, market participants should remain vigilant about macroeconomic shifts that may impact the financial sector as a whole and this stock in particular.

json The analysis reflects the stock's short-term technical outlook and evaluates its potential future moves based on current market conditions and historical price data.