May 31, 2025 a 01:00 pm

WELL: Analysts Ratings - Welltower Inc.

Welltower Inc. has established itself as a leading entity in the healthcare infrastructure sector. As a real estate investment trust (REIT), the company is well-positioned to capitalize on the growing demand for senior housing and healthcare facilities across major markets in North America and the United Kingdom. The current sentiment among analysts suggests a predominantly positive outlook with a strong emphasis on Buy recommendations, indicating a stable potential for growth. Investors should consider market dynamics, such as demographic trends and healthcare needs, when evaluating WELL's stock performance.

Historical Stock Grades

The latest analyst ratings as of May 2025 indicate a strong confidence in Welltower Inc.'s stock performance, with a substantial number of Strong Buy and Buy ratings. This aligns with the company's consistent performance in the healthcare REIT sector.

| Recommendation | Count | Score |

|---|---|---|

| Strong Buy | 6 | |

| Buy | 10 | |

| Hold | 4 | |

| Sell | 0 | |

| Strong Sell | 0 |

Sentiment Development

Recent analysis of the sentiment trend for Welltower Inc. exhibits stability in Strong Buy and Buy recommendations, with minor fluctuations in Hold positions. The overall number of analyst ratings has seen a gradual increase, reflecting heightened interest and confidence in the stock.

- The Strong Buy ratings remained consistent around 5-6 reviews over recent months.

- Buy positions slightly increased, suggesting a marginally improved confidence level.

- Hold ratings experienced a minor rise, possibly indicating some caution despite the positive sentiment.

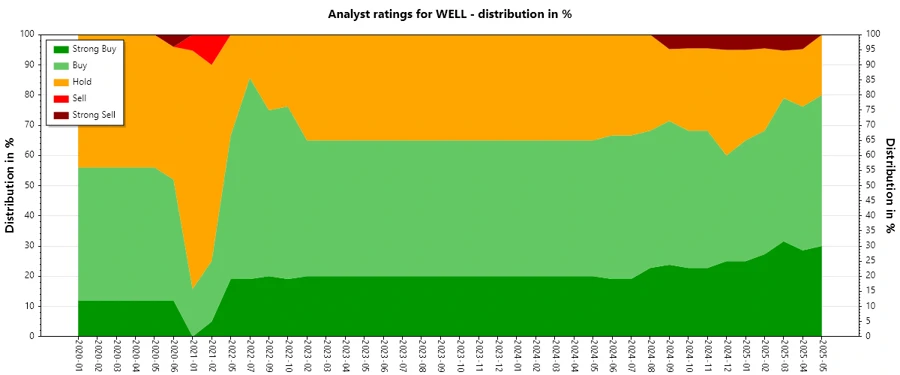

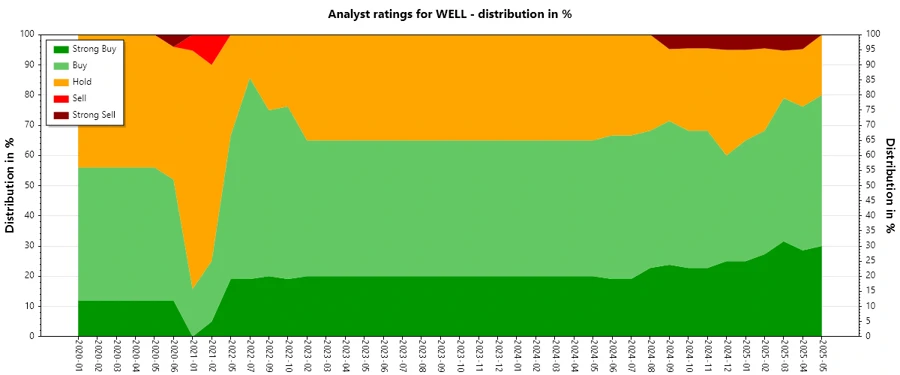

Percentage Trends

The percentage distribution of analyst ratings reflects a solid conviction in Welltower Inc.’s continued positive performance. Notably, there has been a slight shift with reduced Buy proportions yet stable Strong Buy figures. This indicates an incremental conservative outlook despite a dominant optimistic perspective.

- Recent months have shown a consistent 60%+ weight of positive recommendations (Strong Buy + Buy).

- A slight uptick in Hold ratings suggests some evaluators are taking a more cautious stance.

- The absence of Sell or Strong Sell tones reflects confidence in the stock's prospects.

Latest Analyst Recommendations

The latest analyst recommendations highlight a trend of maintained ratings, with occasional adjustments reflecting minor shifts in perception or strategy adjustments.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2024-10-01 | Equal Weight | Overweight | Wells Fargo |

| 2024-09-23 | Sector Outperform | Sector Outperform | Scotiabank |

| 2024-09-16 | In Line | In Line | Evercore ISI Group |

| 2024-08-28 | In Line | In Line | Evercore ISI Group |

| 2024-08-21 | Buy | Buy | Deutsche Bank |

Analyst Recommendations with Change of Opinion

In recent evaluations, some analysts have adjusted their stance on Welltower Inc., reflecting shifts in market perceptions or strategic moves in the company’s portfolio.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2024-10-01 | Equal Weight | Overweight | Wells Fargo |

| 2023-12-18 | Overweight | Neutral | JP Morgan |

| 2023-11-28 | Sector Perform | Outperform | RBC Capital |

| 2023-11-09 | Strong Buy | Outperform | Raymond James |

| 2023-10-12 | Neutral | Overweight | JP Morgan |

Interpretation

Analyzing the current market view of Welltower Inc., a solid analyst consensus supports the potential for growth, especially due to emerging trends in healthcare infrastructure investments. While some caution is exhibited in the transition from Strong Buy to Buy and Hold recommendations, positive sentiments dominate, suggesting a robust outlook. Notably, the limited number of Sell ratings highlights continued investor confidence in the company's resilience.

Conclusion

In conclusion, Welltower Inc.'s stock is often viewed favorably by analysts, attributed to its strategic positioning in the rapidly growing healthcare infrastructure sector. The mix of stability and incremental upgrades in ratings reflects optimistic yet measured expectations. Investors should remain mindful of potential market fluctuations and the dynamic needs of the healthcare industry which could impact Welltower’s valuation.