August 15, 2025 a 09:03 am

WEC: Trend and Support & Resistance Analysis - WEC Energy Group, Inc.

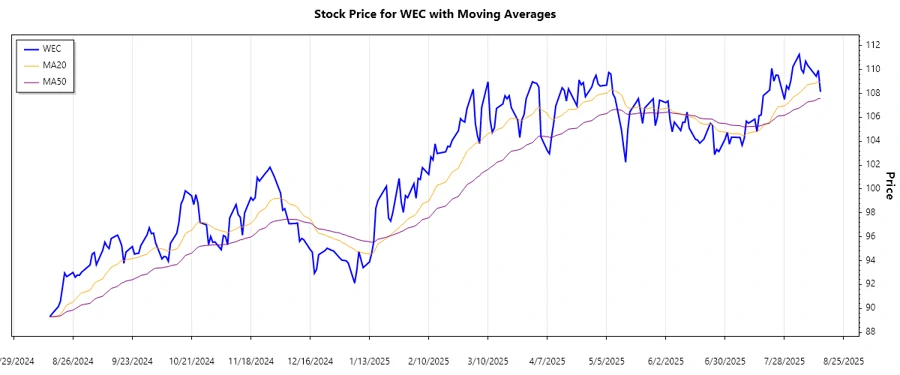

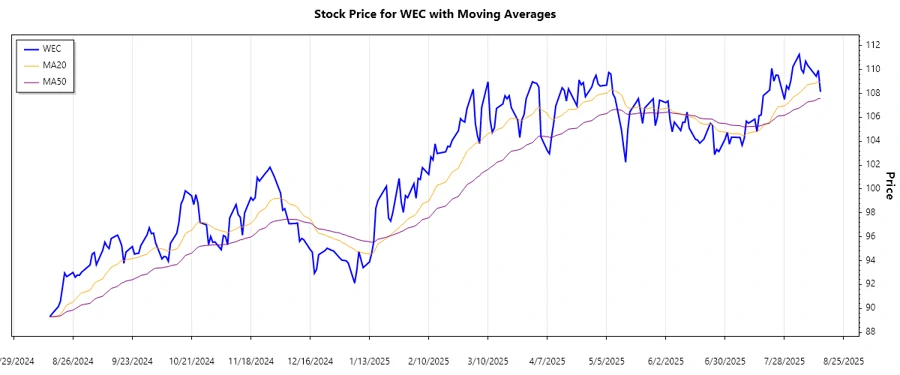

WEC Energy Group, Inc. has shown a steady performance with investment opportunities in the utility sector, reinforced by its diversified energy sources. The stock has shown resilience in energy market fluctuations. With continuous investments in renewable energy, WEC aims to maintain a sustainable growth trajectory. This analysis assesses the recent trends and key support and resistance levels based on historical data.

Trend Analysis

Analyzing the stock price over the past months, the trend has demonstrated a gradual upward trajectory, with recent data indicating stronger movements. By calculating the EMA20 and EMA50, the current state presents an upward trend as the EMA20 surpasses the EMA50. This signals a bullish sentiment in the near term.

| Date | Close Price | Trend |

|---|---|---|

| 2025-08-14 | $108.13 | ▲ |

| 2025-08-13 | $109.94 | ▲ |

| 2025-08-12 | $109.43 | ▲ |

| 2025-08-11 | $109.67 | ▲ |

| 2025-08-08 | $110.35 | ▲ |

| 2025-08-07 | $110.70 | ▲ |

| 2025-08-06 | $109.73 | ▲ |

The consistent upward trend in the last week aligns with the calculated EMAs supporting a bullish outlook for WEC.

Support and Resistance

The data signifies critical support and resistance zones that have formed within the given timeframe. Key support is identified around $104.22 and $106.2, while resistance is observed around $110.7 and $111.27. These levels provide pivotal markers for price movement anticipation.

| Zone | From | To |

|---|---|---|

| Support 1 | $104.22 | $106.2 |

| Support 2 | $107.82 | $109 |

| Resistance 1 | $110.70 | $111.27 |

| Resistance 2 | $112 | $113 |

The current price level is in the proximity of resistance zones, indicating potential barriers to further upward movement.

Conclusion

The analysis indicates a bullish trend for WEC Energy Group, underpinned by a robust upward trajectory. However, proximity to resistance levels might slow the momentum, requiring close monitoring. Investors should weigh the benefits of the stock's stability against possible corrections. The energy sector's inherent risks, including regulatory changes and energy price volatility, remain pivotal. Overall, WEC's strategic investments in renewable energy bolster its growth potential amidst utility sector challenges.