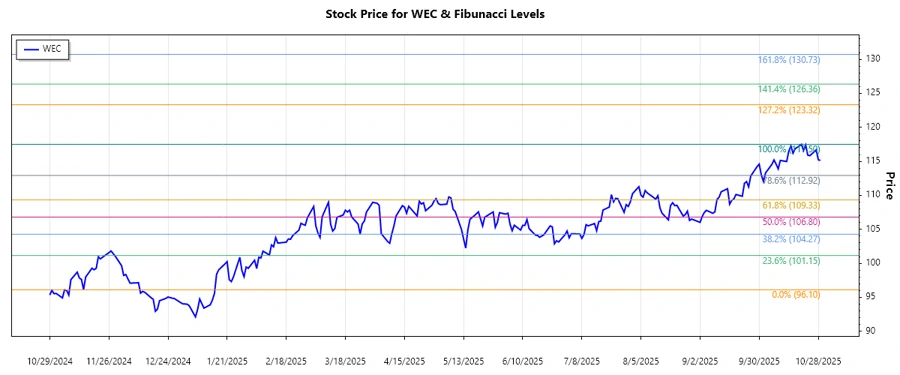

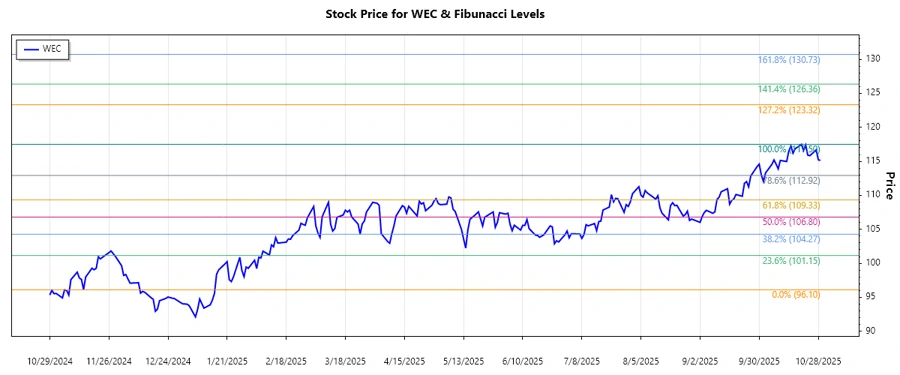

October 29, 2025 a 04:44 pm### WEC: Fibonacci Analysis - WEC Energy Group, Inc.

### Fibonacci Analysis

#### Trend Details

### Fibonacci Analysis

#### Trend Details

#### Fibonacci Retracement Levels:

- **0.236 Level:** $101.89

- **0.382 Level:** $106.13

- **0.5 Level:** $106.8

- **0.618 Level:** $107.47

- **0.786 Level:** $108.42

### Conclusion

WEC Energy Group, Inc. demonstrates potential for continued growth given its recent upward trajectory. With current levels above the Fibonacci retracement zones, this depicts robust investor interest and potential bullish continuance. However, analysts should be cautious of potential retracements to Fibonacci levels, which could act as support. Investors are advised to monitor economic and regulatory developments that could impact WEC's trajectory. Overall, the company's diversified energy portfolio positions it strongly against sector-specific risks while offering stable growth prospects.

### Conclusion

WEC Energy Group, Inc. demonstrates potential for continued growth given its recent upward trajectory. With current levels above the Fibonacci retracement zones, this depicts robust investor interest and potential bullish continuance. However, analysts should be cautious of potential retracements to Fibonacci levels, which could act as support. Investors are advised to monitor economic and regulatory developments that could impact WEC's trajectory. Overall, the company's diversified energy portfolio positions it strongly against sector-specific risks while offering stable growth prospects.

WEC Energy Group, Inc. has demonstrated steady growth with a recent upward trend. The stock has reached new highs, indicating strong investor confidence. Given its consistent performance, the company's diversified energy resources showcase stability and potential for long-term value. However, external factors like energy regulations may influence future performance.

| Detail | Date | Price |

|---|---|---|

| Start Date | 2024-11-05 | 96.1 |

| End Date | 2025-10-29 | 115.14 |

| High Point | 2025-10-20 | 117.5 |

| Low Point | 2024-11-05 | 96.1 |

| Level | Price |

|---|---|

| 0.236 | 101.89 |

| 0.382 | 106.13 |

| 0.5 | 106.8 |

| 0.618 | 107.47 |

| 0.786 | 108.42 |

As of the latest data (Oct 29, 2025), the current price is $115.14. This indicates the stock is above the highest Fibonacci level (0.786). It could signify strong upward momentum with potential supports forming at these retracement levels.

### Conclusion

WEC Energy Group, Inc. demonstrates potential for continued growth given its recent upward trajectory. With current levels above the Fibonacci retracement zones, this depicts robust investor interest and potential bullish continuance. However, analysts should be cautious of potential retracements to Fibonacci levels, which could act as support. Investors are advised to monitor economic and regulatory developments that could impact WEC's trajectory. Overall, the company's diversified energy portfolio positions it strongly against sector-specific risks while offering stable growth prospects.

### Conclusion

WEC Energy Group, Inc. demonstrates potential for continued growth given its recent upward trajectory. With current levels above the Fibonacci retracement zones, this depicts robust investor interest and potential bullish continuance. However, analysts should be cautious of potential retracements to Fibonacci levels, which could act as support. Investors are advised to monitor economic and regulatory developments that could impact WEC's trajectory. Overall, the company's diversified energy portfolio positions it strongly against sector-specific risks while offering stable growth prospects.