August 16, 2025 a 04:45 pm

WAB: Fibunacci Analysis - Westinghouse Air Brake Technologies Corporation

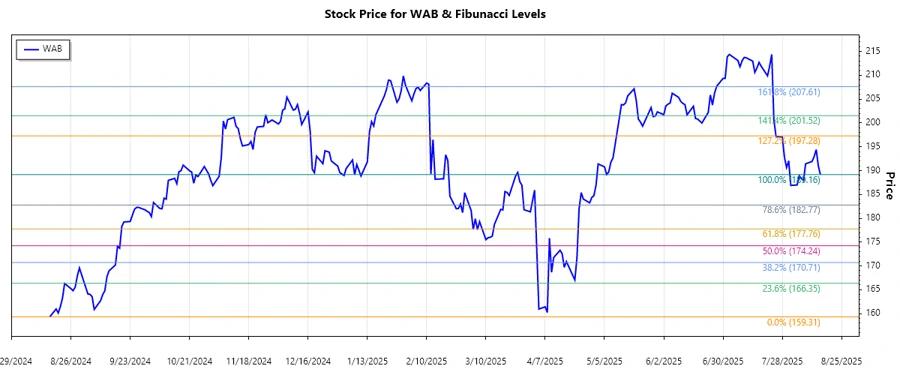

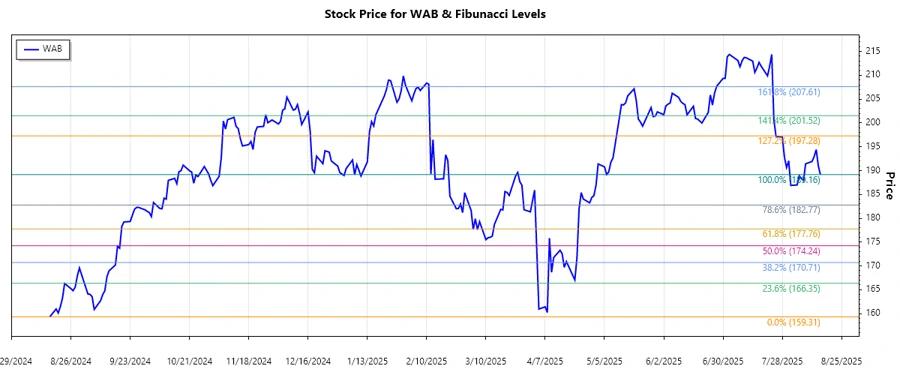

The Westinghouse Air Brake Technologies Corporation (WAB) has shown resilience in its stock performance, particularly within the freight and transit sectors. Over the most recent months, the company's strategic operations and technological innovations in the rail and transit industries have been significant. Analyzing the stock patterns, a dominant downtrend was observed, which offers insights for potential retracements and reversals from a technical analysis perspective.

Fibunacci Analysis

| Element | Detail | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Trend Type | Downtrend | ||||||||||||

| Start Date | 2024-08-16 | ||||||||||||

| End Date | 2025-08-15 | ||||||||||||

| High Point (Date) | 2024-08-16 | ||||||||||||

| High Price | 159.31 | ||||||||||||

| Low Point (Date) | 2025-08-15 | ||||||||||||

| Low Price | 189.16 | ||||||||||||

| Fibonacci Levels |

|

||||||||||||

| Current Price Level | In the 0.236 retracement zone | ||||||||||||

| Technical Interpretation | The current price level suggests potential support or reversal, indicating traders may observe buying pressure entering the market in this zone. |

Conclusion

WAB's current position denotes an intriguing opportunity for technical analysis enthusiasts and investors observing potential market movements. While the downtrend identifies weaker moments in stock performance, the presence in retracement zones hints at probable support levels. Attention to support at Fibonacci levels may provide a gateway to trade breakouts or continuation. Technically, if the price holds within significant retracement levels, it could frame a future upward momentum, albeit mindful of prevailing market conditions which could introduce volatility or unforeseen risks in the short term.