September 29, 2025 a 10:15 am

VRSK: Fibonacci Analysis - Verisk Analytics, Inc.

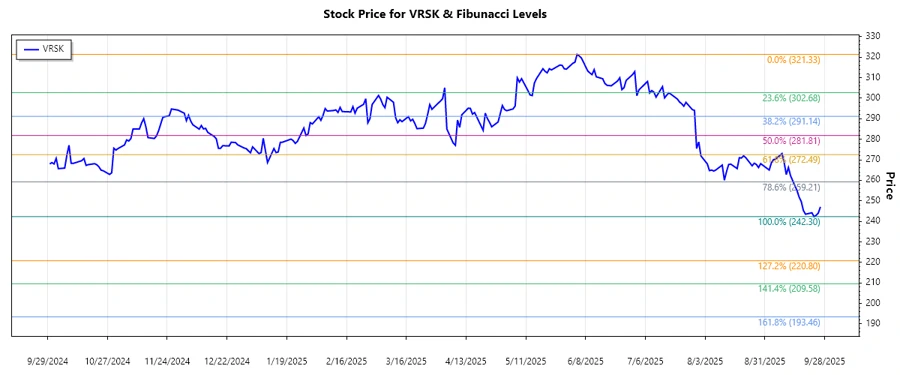

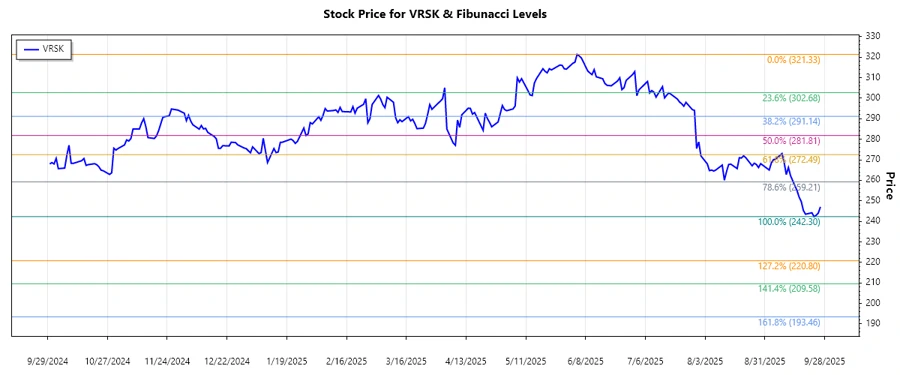

Verisk Analytics, Inc. has shown a recent downtrend from June to September 2025. Despite its strong foundation in data analytics solutions, recent market conditions have impacted its stock value. Understanding Fibonacci retracement levels could provide insights into potential support or resistance levels for future price movements.

Fibonacci Analysis

This analysis focuses on the downtrend identified from June 2025 to September 2025. The Fibonacci retracement levels offer vital insights into potential support levels.

| Parameter | Value |

|---|---|

| Trend Start Date | 2025-06-04 |

| Trend End Date | 2025-09-26 |

| High Point | $321.33 (2025-06-04) |

| Low Point | $242.30 (2025-09-23) |

Fibonacci Retracement Levels

| Level | Price |

|---|---|

| 0.236 | $262.44 |

| 0.382 | $276.18 |

| 0.5 | $281.82 |

| 0.618 | $287.46 |

| 0.786 | $295.08 |

The current price is approximately $247.07. It currently lies below the $262.44 (0.236) retracement level, indicating potential bearish momentum.

Technical analysis suggests a possible support level around $242.30, with a chance of testing lower Fibonacci levels as resistance. A rise above $262.44 could signal a reversal.

Conclusion

The analyzed data depicts a significant downtrend from June to September 2025, with a recent test of low points. Short-term opportunities may arise if the price rebounds above crucial Fibonacci levels. However, current trends suggest caution, as the stock remains vulnerable to further declines until positive confirmation of a support base. Analysts should watch for sustained movement above $262.44 as an indicator of trend reversal potential, balancing the promising innovation in Verisk's offerings against market dynamics impacting its valuation.