August 15, 2025 a 06:45 am

VICI: Fibonacci Analysis - VICI Properties Inc.

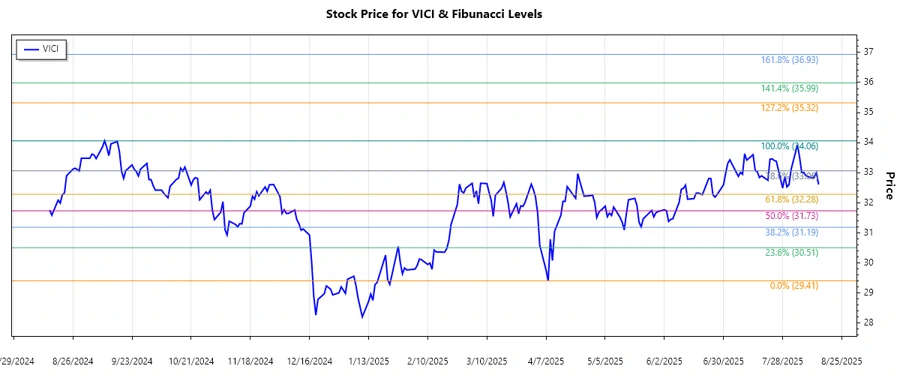

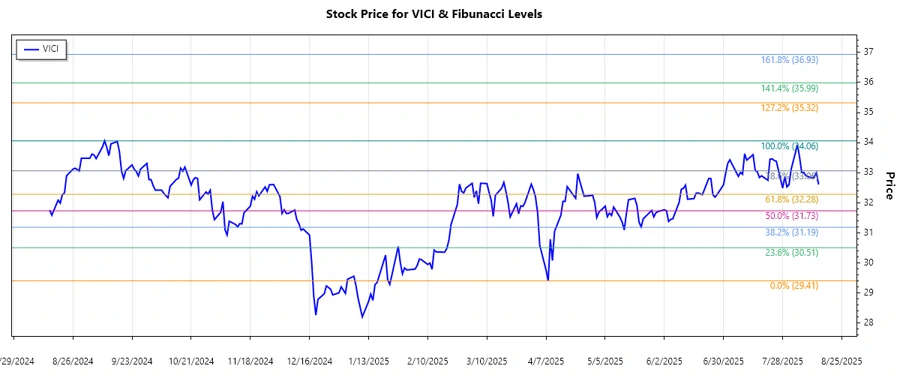

VICI Properties Inc. has exhibited a strong upward trend over the recent months, driven by consistent growth in its gaming and hospitality portfolio. The company's robust leasing agreements with industry leaders contribute to its resilient cash flow, making it an attractive investment for those seeking exposure to the experiential real estate market. However, investors should remain aware of market volatility and economic changes that could impact the sector.

Fibonacci Analysis

| Detail | Information |

|---|---|

| Trend Start Date | 2024-12-16 |

| Trend End Date | 2025-08-14 |

| High Point (Price & Date) | $34.06 on 2024-09-10 |

| Low Point (Price & Date) | $29.41 on 2025-04-08 |

Fibonacci Retracement Levels

| Level | Price |

|---|---|

| 0.236 | $30.64 |

| 0.382 | $31.23 |

| 0.5 | $31.74 |

| 0.618 | $32.26 |

| 0.786 | $32.94 |

Currently, the VICI stock price is within the 0.382 to 0.5 retracement zone, indicating potential short-term support.

Technically, this suggests that as long as the price maintains above the 0.5 level, there may be room for a rebound or continuation of the upward trend.

Conclusion

The overall upward trend of VICI Properties Inc. reflects its strong position in the experiential real estate market, anchored by its comprehensive portfolio and strategic partnerships. While current retracement levels show some consolidation, these may serve as a foundation for future gains, assuming broader market conditions remain favorable. Investors should consider VICI's potential for long-term growth against market volatility risks. For analysts, keeping a close watch on retracement and breakout levels is crucial for optimizing entry or exit strategies.