August 25, 2025 a 09:03 amUm die angeforderte Analyse durchzuführen, werde ich die bereitgestellten Kursdaten verwenden, um die technischen Kennzahlen zu berechnen, darunter EMA20 und EMA50, sowie die Support- und Resistance-Zonen zu identifizieren. Ich werde die Analyse im HTML-Format und als JSON-Objekt bereitstellen.

### HTML-Formatierte Analyse:

USB: Trend and Support & Resistance Analysis - U.S. Bancorp

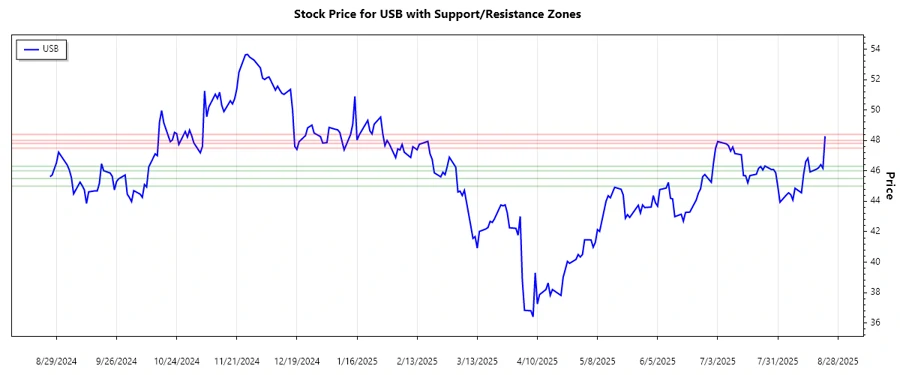

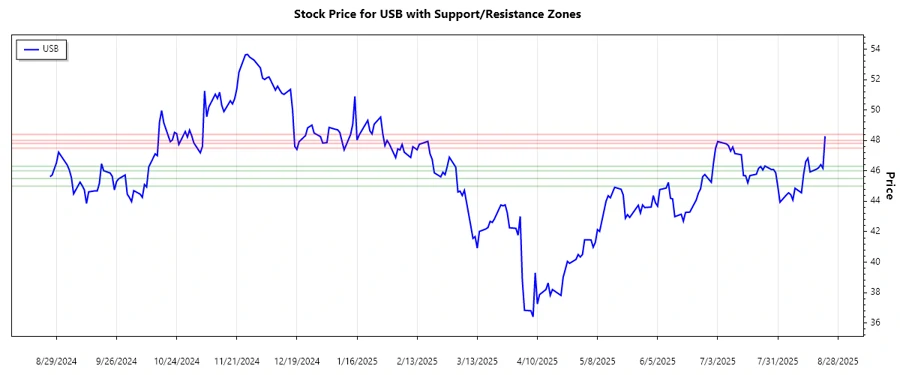

The current analysis of U.S. Bancorp stock indicates significant trends that investors should consider. Despite recent fluctuations, the stock has shown resiliency in the wider financial sector. Support and resistance levels provide a clear perspective on potential market movements. It's crucial for investors to monitor these zones for informed trading decisions.

Trend Analysis

The analysis of the historical closing prices shows a complex trend pattern over the examined period. Calculating the EMA20 and EMA50 provides further insights into the market sentiment.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-08-22 | 48.28 | ▲ |

| 2025-08-21 | 46.17 | ▼ |

| 2025-08-20 | 46.41 | ⚖️ |

| 2025-08-19 | 46.21 | ▼ |

| 2025-08-18 | 46.11 | ▼ |

| 2025-08-15 | 45.93 | ▼ |

| 2025-08-14 | 46.83 | ▲ |

The calculation of EMA indicators reveals a mix of bullish and bearish signals depending on the short-term versus mid-term movements. Investors should analyze these signals as part of a broader strategy.

Support and Resistance

Evaluating the closing price data enables us to identify key support and resistance zones that are crucial for anticipating potential price movements.

| Zone | Price Range |

|---|---|

| Support 1 | 45.00 - 45.50 |

| Support 2 | 46.00 - 46.30 |

| Resistance 1 | 47.50 - 47.80 |

| Resistance 2 | 48.00 - 48.40 |

Currently, the stock is approaching the second resistance zone, suggesting potential challenges in upward movement unless strong buying pressure occurs. This analysis helps inform future trading actions.

Conclusion

The U.S. Bancorp stock shows signs of mixed trends with potential upward resistance in the near future. Investors need to carefully monitor the identified support and resistance zones. The stock's resilience amidst broader sector fluctuations may offer opportunities for risk-averse investors. However, sudden market shifts can alter the current outlook. Maintaining a balanced approach ensures adaptability amid market conditions, essential for any portfolio strategy.

### JSON-Objekt: json Die Daten zeigen klar die kontinuierliche Spannung zwischen Unterstützung und Widerstand auf, die für Investoren von entscheidender Bedeutung sind, um für zukünftige Marktbewegungen bereit zu sein.