November 15, 2025 a 08:15 am

UPS: Trend and Support & Resistance Analysis - United Parcel Service, Inc.

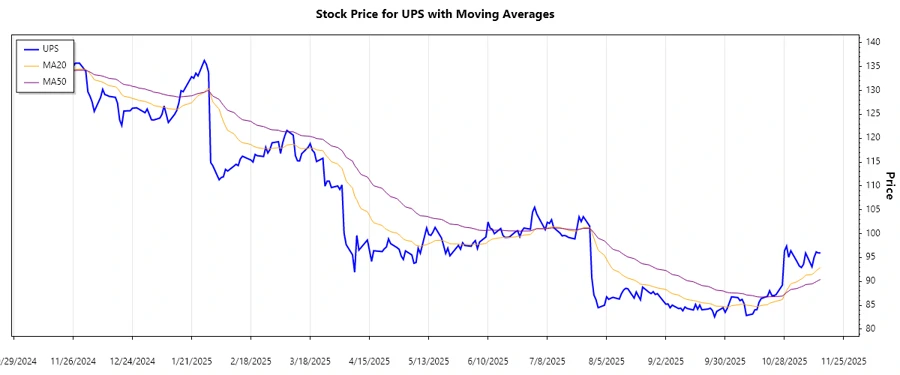

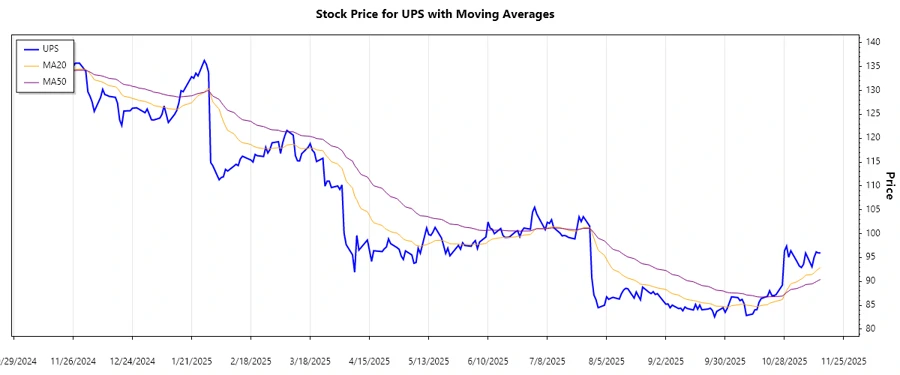

United Parcel Service, Inc. (UPS) has shown a diverse range of price movements over the past months. It serves both domestic and international markets, providing reliable delivery and logistics services across the globe. Given the recent fluctuations in the stock price, finding strong support and resistance levels is crucial for potential investors. The technical indicators also suggest varying trends that provide insights into future price movements. As the market dynamics continue to evolve, understanding these trends will be essential for making informed financial decisions.

Trend Analysis

Analyzing the historical price data of UPS stock, we computed the EMA20 and EMA50 to identify the prevailing trend. The latest data suggest that the stock is currently experiencing an uptrend as the EMA20 is greater than the EMA50.

| Date | Close Price | Trend |

|---|---|---|

| 2025-11-14 | $95.98 | ▲ Uptrend |

| 2025-11-13 | $95.97 | ▲ Uptrend |

| 2025-11-12 | $96.18 | ▲ Uptrend |

| 2025-11-11 | $95.03 | ▲ Uptrend |

| 2025-11-10 | $93.06 | ▲ Uptrend |

| 2025-11-07 | $95.95 | ▼ Downtrend |

| 2025-11-06 | $93.60 | ▼ Downtrend |

This trend analysis indicates a recent shift in market sentiment, favoring an uptrend. However, investors should remain vigilant as market conditions can change quickly.

Support- and Resistance

Based on the technical analysis, two key support and resistance zones have been identified. These zones could play critical roles in future price movements as indicators of potential buying or selling pressures.

| Zone Type | From | To |

|---|---|---|

| Support 1 | $87.00 | $89.00 |

| Support 2 | $93.00 | $95.00 |

| Resistance 1 | $97.00 | $99.00 |

| Resistance 2 | $101.00 | $103.00 |

Currently, the stock price is approaching a resistance zone, suggesting potential resistance to upwards price movement. Technical factors indicate that breaking past this zone could lead to further price increases.

Conclusion

The UPS stock currently exhibits an uptrend with significant support and resistance levels identified. This suggests potential for upward movement, although resistance zones may pose challenges. Essential for analysts is monitoring these zones, as breaking through could lead to renewed upward momentum. Conversely, failure to do so could result in retracement and consolidation. Therefore, investors should remain informed and agile to capitalize on market opportunities while managing risks effectively.