July 18, 2025 a 03:15 pm

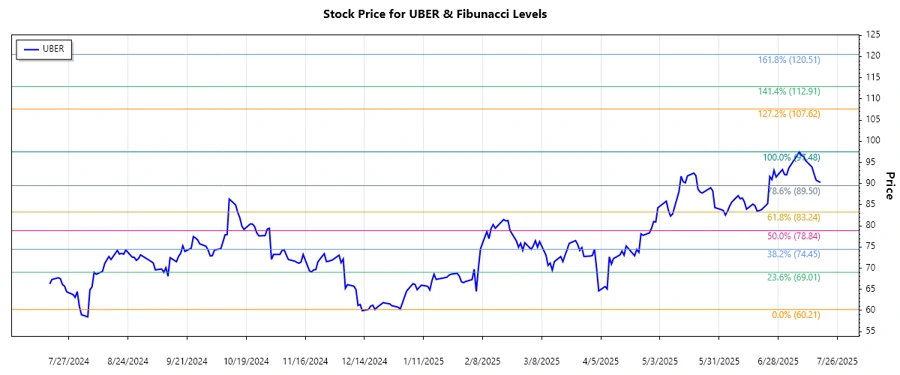

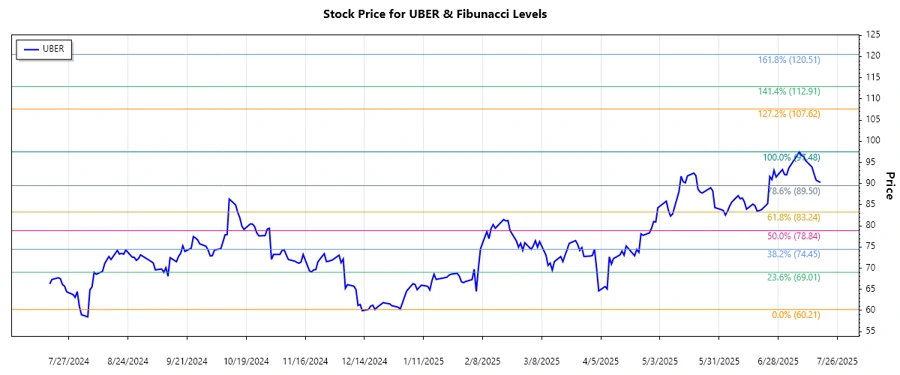

UBER: Fibonacci Analysis - Uber Technologies, Inc.

Uber Technologies, Inc. has shown a robust uptrend over the past months with varying degrees of price movement influenced by their diverse business operations. As a tech giant in the ride-sharing and delivery sectors, Uber continues to expand its market presence globally, posing great potential for investors. Recent price changes reflect market optimism around Uber's strategic initiatives and revenue growth, making it a stock to watch in the tech industry.

Fibonacci Analysis

| Trend Dates | Price Info |

|---|---|

| Start Date | 2024-12-30 |

| End Date | 2025-07-14 |

| High Point | $97.48 on 2025-07-08 |

| Low Point | $60.21 on 2024-12-19 |

| Fibonacci Levels | |

| 0.236 | $73.93 |

| 0.382 | $79.95 |

| 0.5 | $83.85 |

| 0.618 | $87.75 |

| 0.786 | $92.04 |

The current price of $90.26 is in the retracement zone of 0.5 to 0.618. This is an indication of a potential support level where prices may stabilize or renew upward momentum.

From a technical perspective, this retracement range could act as a significant support zone, suggesting that the uptrend might resume from these levels unless further downtrend signals emerge.

Conclusion

Uber Technologies, Inc. has shown powerful upside potential. The current prices suggest a consolidation phase within the Fibonacci levels of 0.5 and 0.618. Investor sentiment backed by strategic company initiatives could lead to continued price appreciation. Risks exist primarily from market volatility and operational changes, especially in global markets. Analysts view this as a critical support area that can result in renewed upward momentum. Continuous monitoring of market conditions and company news will be essential to gauge Uber's stock trajectory moving forward.