August 22, 2025 a 09:16 am

Technology Stocks - Performance Analysis

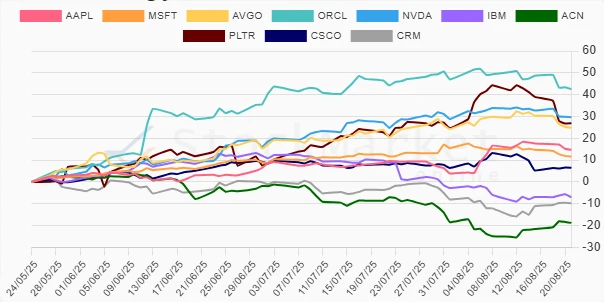

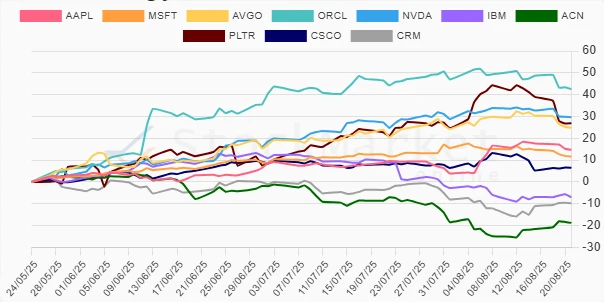

📊 The technology sector has shown mixed performance with significant variances in short and long-term periods. Notable volatility has been observed, suggesting both risk and opportunity for investors. The analysis outlines the weekly, monthly, and quarterly performances of leading tech stocks, highlighting key trends and potential strategies.

Technology Stocks Performance One Week

🔍 In the past week, tech stocks have largely underperformed, with a few exceptions. ACN and CRM showed positive returns while PLTR experienced the most significant decline. This period highlights the challenges faced by the broader tech market amidst varying market conditions.

| Stock | Performance (%) | Performance |

|---|---|---|

| ACN | 2.83% | |

| CRM | 1.39% | |

| CSCO | 1.24% | |

| IBM | -0.12% | |

| AAPL | -2.90% | |

| NVDA | -3.02% | |

| MSFT | -3.09% | |

| AVGO | -5.55% | |

| ORCL | -6.10% | |

| PLTR | -12.11% |

Technology Stocks Performance One Month

📈 Over the last month, AAPL emerged as a top performer with a significant increase, while IBM faced substantial declines. Notably, this period underscores the heightened sensitivity of tech stocks to both market conditions and company-specific news.

| Stock | Performance (%) | Performance |

|---|---|---|

| AAPL | 5.27% | |

| NVDA | 2.66% | |

| AVGO | 2.41% | |

| PLTR | 2.16% | |

| MSFT | -0.15% | |

| CSCO | -2.07% | |

| ORCL | -3.21% | |

| CRM | -8.00% | |

| ACN | -11.45% | |

| IBM | -15.85% |

Technology Stocks Performance Three Months

📈 Over the last three months, ORCL and PLTR have shown extraordinary resilience, outperforming other tech giants significantly. Conversely, ACN and CRM witnessed notable declines. This period reflects sustained growth momentum for certain stocks amidst sector rotation and macroeconomic influences.

| Stock | Performance (%) | Performance |

|---|---|---|

| ORCL | 42.60% | |

| PLTR | 26.89% | |

| AVGO | 24.78% | |

| NVDA | 29.66% | |

| AAPL | 14.70% | |

| MSFT | 11.65% | |

| CSCO | 6.50% | |

| IBM | -6.99% | |

| CRM | -9.76% | |

| ACN | -18.76% |

Summary

✅ In summary, the tech sector has demonstrated differential growth trajectories across different time frames. Investors should take note of the robust performance by stocks like ORCL, PLTR, and NVDA over longer periods, while remaining cautious about stocks like IBM and ACN, which have shown consistent underperformance. Portfolio diversification and a strategic approach can leverage these insights to harness sectoral advantages while mitigating risk.