November 21, 2025 a 09:16 am

Technology Stocks - Performance Analysis

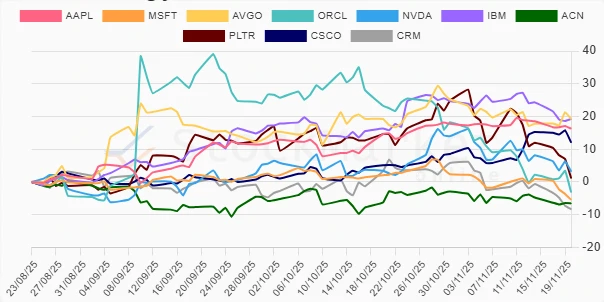

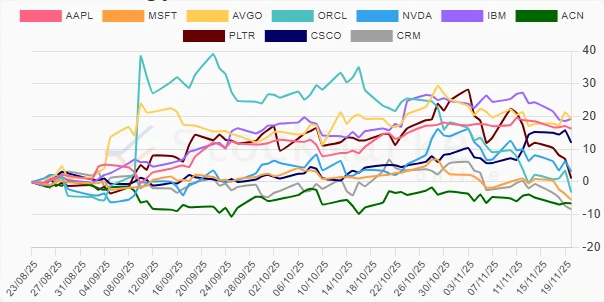

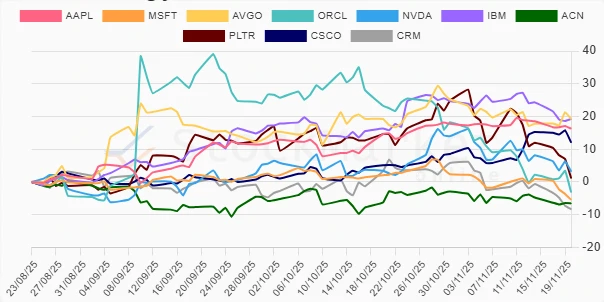

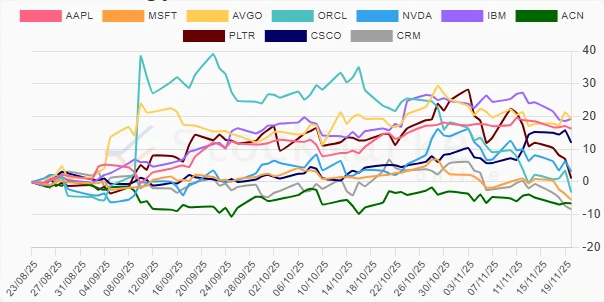

📊 Technology stocks have shown varied performances across different timeframes. The sector witnessed a significant fluctuation with some stocks exhibiting a strong recovery while others faced severe downturns. The contrasting performances highlight the underlying volatility and the influence of market dynamics on these equities. Understanding these shifts provides crucial insights into potential strategic adjustments and investment opportunities.

Technology Stocks Performance One Week

🔍 The short-term analysis of technology stocks over the past week highlights significant volatility. 📉 Notably, PLTR experienced a significant decline of -10.87%, positioning it as the week's largest underperformer. Conversely, AVGO managed to achieve a positive return of 1.38%, outshining its peers.

| Stock | Performance (%) | Performance |

|---|---|---|

| AVGO | 1.38 | |

| ACN | -1.80 | |

| AAPL | -2.27 | |

| CSCO | -3.25 | |

| NVDA | -4.99 | |

| IBM | -5.06 | |

| ORCL | -5.34 | |

| MSFT | -6.36 | |

| CRM | -7.72 | |

| PLTR | -10.87 |

Technology Stocks Performance One Month

🔍 Over the one-month period, technology stocks have shown mixed performance. 📈 CSCO led with a notable increase of 6.93%, while ORCL encountered a significant drop of -24.81%, the most substantial within this period.

| Stock | Performance (%) | Performance |

|---|---|---|

| CSCO | 6.93 | |

| AAPL | 3.06 | |

| AVGO | 2.50 | |

| IBM | 1.55 | |

| NVDA | 1.08 | |

| ACN | -3.19 | |

| PLTR | -10.12 | |

| CRM | -12.65 | |

| MSFT | -8.22 | |

| ORCL | -24.81 |

Technology Stocks Performance Three Months

🔍 The quarterly evaluation of technology stocks shows strong performance among several equities. 📈 Leading the gains, IBM and AVGO both approached a remarkable rise of above 19%, while CRM experienced the largest drawdown at -8.35%.

| Stock | Performance (%) | Performance |

|---|---|---|

| IBM | 19.26 | |

| AVGO | 19.18 | |

| AAPL | 16.26 | |

| CSCO | 12.02 | |

| NVDA | 3.20 | |

| PLTR | 1.13 | |

| ORCL | -3.17 | |

| MSFT | -5.45 | |

| ACN | -6.57 | |

| CRM | -8.35 |

Summary

💡 In summary, technology stocks have been on a rollercoaster, reflecting a diverse blend of gains and declines over the reviewed periods. The pronounced quarterly returns of IBM and AVGO suggest strong positions in the current market climate. However, notable losses such as those incurred by ORCL and CRM present cautionary signals for stakeholders. Proactive market observation and strategic diversification are recommended to navigate the volatility and seize long-term opportunities.