September 07, 2025 a 09:03 am

TYL: Trend and Support & Resistance Analysis - Tyler Technologies, Inc.

Tyler Technologies, Inc. has shown mixed performance in recent months with fluctuations around its moving averages. The ability to integrate information management solutions for the public sector positions it well for stability. Historically, the stock has demonstrated resilience, but recent price action suggests caution is necessary. For long-term investors, Tyler Technologies offers significant integration solutions, though short-term traders should monitor key levels closely due to potential volatility. The strategic collaboration with Amazon Web Services further provides a robust foundation for future growth, suggesting potential upward momentum despite recent market oscillations.

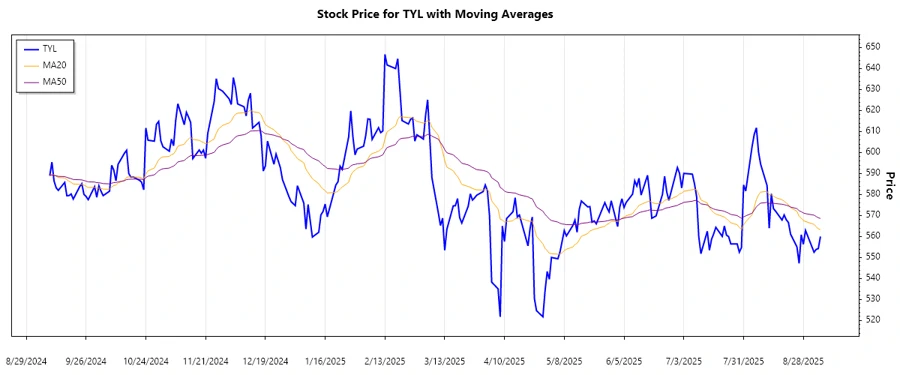

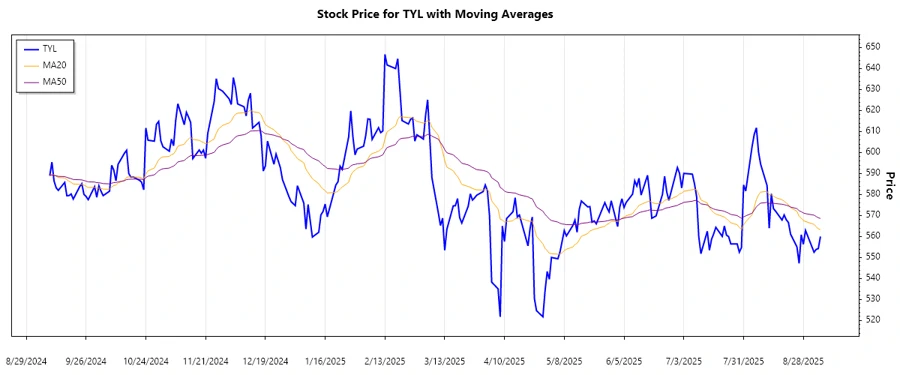

Trend Analysis

Over the analyzed period, Tyler Technologies, Inc. has exhibited a combination of upward momentum and occasional consolidation phases. Recent EMA values indicate the short-term moving average (EMA20) is slightly below the long-term moving average (EMA50), suggesting a downtrend. This reflects potential bearish pressure in the short-term outlook.

| Date | Close Price | Trend |

|---|---|---|

| 2025-09-05 | 559.96 | ▼ Downtrend |

| 2025-09-04 | 554.23 | ▼ Downtrend |

| 2025-09-03 | 553.83 | ▼ Downtrend |

| 2025-09-02 | 552.49 | ▼ Downtrend |

| 2025-08-29 | 562.88 | ▼ Downtrend |

| 2025-08-28 | 556.28 | ▼ Downtrend |

| 2025-08-27 | 560.81 | ▼ Downtrend |

This downtrend suggests potential bearish sentiment, implying traders might consider short positions or caution in current investments.

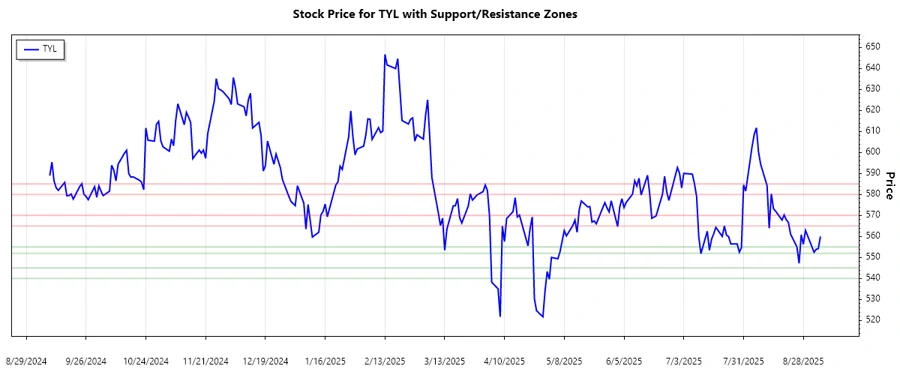

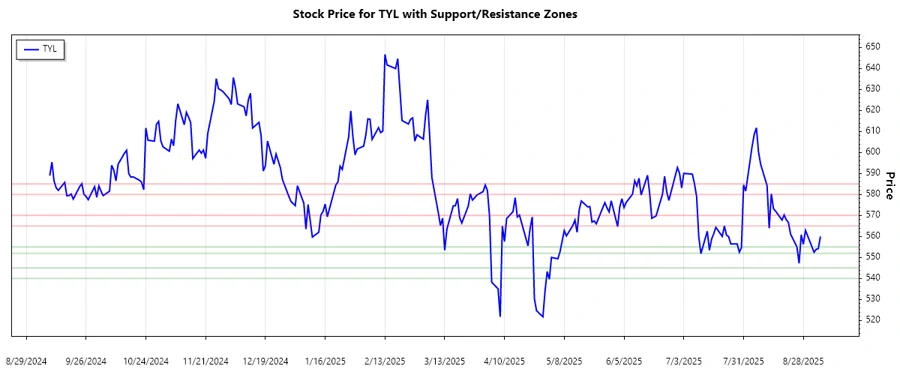

Support- and Resistance

Analyzing recent price movements, Tyler Technologies has critical support and resistance zones. These levels can act as psychological barriers where price action might stall or reverse.

| Zone Type | From | To |

|---|---|---|

| Support 1 | 552.00 | 555.00 |

| Support 2 | 540.00 | 545.00 |

| Resistance 1 | 565.00 | 570.00 |

| Resistance 2 | 580.00 | 585.00 |

Currently, the price is moving within the Support 1 zone, suggesting potential for a rebound if bullish momentum increases.

Conclusion

Tyler Technologies, Inc., while fundamentally strong, is experiencing short-term bearish pressures that have pushed prices into lower support zones. This serves as a cautionary sign for traders wary of downward continuations. However, the established support zones provide potential opportunities for bullish reversals. Analysts must balance short-term price action with long-term potential, highlighted by successful collaborations and service expansions. Investors should be vigilant of breakout opportunities beyond resistance levels, as these could signal sustained growth. The overall outlook is mixed, with significant weight on strategic market maneuvers and external partnerships.