October 28, 2025 a 02:03 pm

TROW: Trend and Support & Resistance Analysis - T. Rowe Price Group, Inc.

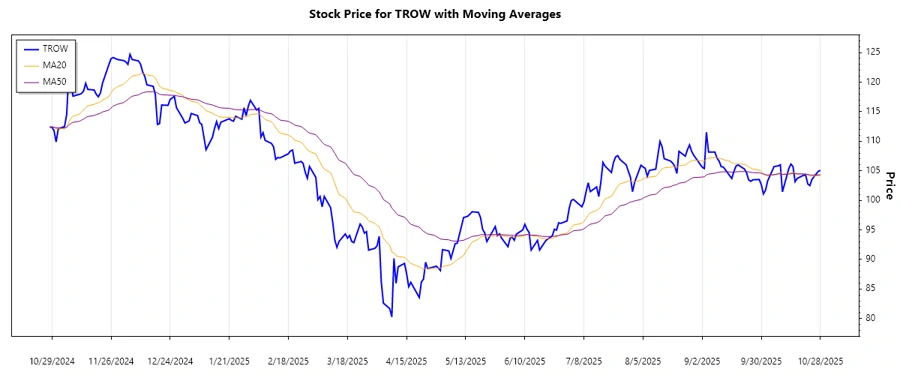

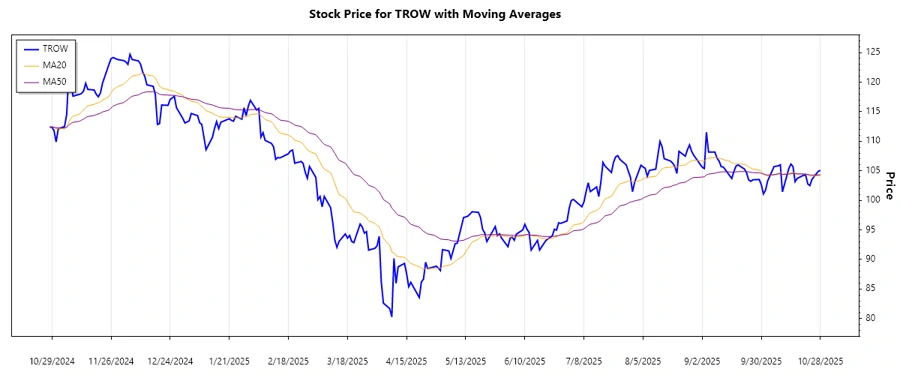

T. Rowe Price Group, Inc., a prominent investment manager, has experienced variable performance over the analyzed period. The recent data suggests an oscillation between minor upswings and downturns, reflecting fluctuating investor confidence and market conditions. The company's diversified portfolio and commitment to socially responsible investing may offer resilience against macroeconomic volatilities, but potential investors should remain cautious of the trading environment's inherent uncertainties.

Trend Analysis

The trend analysis utilizing the Exponential Moving Averages (EMA) indicates fluctuating short-term sentiment. As of the most recent data, the calculated EMA20 is below EMA50, denoting a prevailing ▼ Abwärtstrend.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-10-28 | 105.08 | ▼ |

| 2025-10-27 | 104.91 | ▼ |

| 2025-10-24 | 103.55 | ▼ |

| 2025-10-23 | 102.49 | ▼ |

| 2025-10-22 | 102.76 | ▼ |

| 2025-10-21 | 104.25 | ▼ |

| 2025-10-20 | 104.24 | ▼ |

In summary, the downward trend suggests caution, as it may point to depreciation in stock value. Maintaining vigilance for potential reversal signals is advisable.

Support and Resistance

The support and resistance levels have been evaluated to identify key trading thresholds. Current analysis highlights two major support and resistance zones.

| Zone Type | From | To |

|---|---|---|

| Resistance ▲ | 106.50 | 108.00 |

| Resistance ▲ | 110.00 | 112.00 |

| Support ▼ | 102.00 | 104.00 |

| Support ▼ | 100.00 | 102.00 |

Currently, the stock is positioned near a support zone, which could act as a cushion against further losses. Traders should monitor these levels closely.

Conclusion

T. Rowe Price Group, Inc. demonstrates a technical picture characteristic of potential value decline. The current downward trend and proximity to support levels require close monitoring. While the firm benefits from a robust investment approach and global market participation, sensitivity to broader economic conditions and market sentiment is evident. Strategies centered around both defensive investment and seizing potential reversal opportunities may be prudent.