May 30, 2025 a 08:00 am

TPR: Fundamental Ratio Analysis - Tapestry, Inc.

Tapestry, Inc. has established a strong presence in the luxury goods market with a diverse portfolio of products and segments. The company's strategic expansion and brand strength contribute to its competitive positioning. Investors looking for exposure in the consumer cyclical sector might find this stock attractive.

Fundamental Rating

The following are the scores that outline the company's fundamental health across various financial metrics.

| Category | Score | Visualization |

|---|---|---|

| Overall | 3 | |

| Discounted Cash Flow | 3 | |

| Return on Equity | 5 | |

| Return on Assets | 5 | |

| Debt to Equity | 1 | |

| Price to Earnings | 3 | |

| Price to Book | 1 |

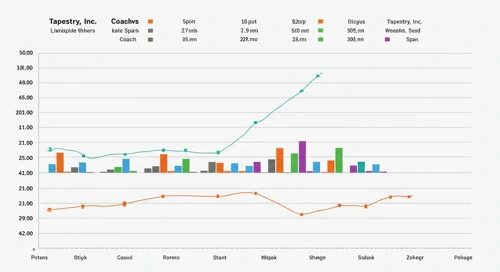

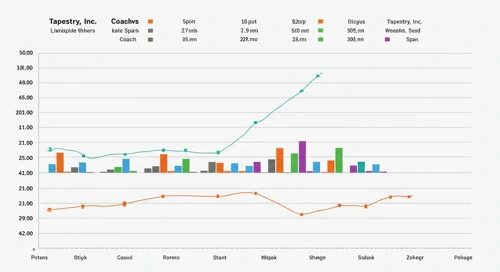

Historical Rating

Comparison of historical and current scores gives insight into the company's financial trend.

| Date | Overall | DCF | ROE | ROA | Debt/Equity | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-05-29 | 3 | 3 | 5 | 5 | 1 | 3 | 1 |

| Previous | 0 | 3 | 5 | 5 | 1 | 3 | 1 |

Analysts' Price Targets

The projections provide a spectrum of possible outcomes for Tapestry, Inc.'s future stock value.

| High | Low | Median | Consensus |

|---|---|---|---|

| 84 | 70 | 80 | 79 |

Analysts' Sentiment

Market sentiment from analysts reflects optimism or caution regarding Tapestry, Inc.'s prospects.

| Rating | Count | Distribution |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 31 | |

| Hold | 7 | |

| Sell | 0 | |

| Strong Sell | 0 |

Conclusion

Tapestry, Inc. shows a solid fundamental standing with strong performance indicators like ROE and ROA. The stock presents a favorable risk-reward ratio as per the analysts' consensus of 'Buy'. However, investors should note the lower scores in debt management and market volatility. The bullish price targets suggest potential upside, but it's crucial to consider macroeconomic factors affecting the luxury goods sector.