October 12, 2025 a 07:31 am

TPR: Dividend Analysis - Tapestry, Inc.

Tapestry, Inc., a prominent player in the consumer discretionary sector, showcases a balanced dividend profile with a yield of 1.39%. With a steadfast dividend history spanning 17 years and recent increases, it remains a stable choice for income-focused investors. However, a payout ratio of over 156% against EPS raises sustainability concerns.

📊 Overview

Tapestry, Inc. operates within the consumer discretionary sector, exhibiting a noteworthy dividend yield of 1.39%. It has maintained its dividend history for 17 years. The absence of recent dividend cuts or suspensions indicates a commitment to shareholder returns. Here is a snapshot of their current position:

| Detail | Value |

|---|---|

| Sector | Consumer Discretionary |

| Dividend yield | 1.39% |

| Current dividend per share | 1.38 USD |

| Dividend history | 17 years |

| Last cut or suspension | None |

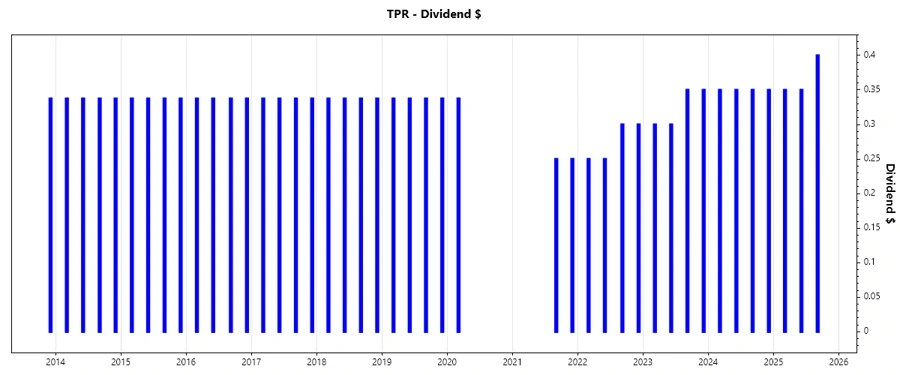

🗣️ Dividend History

The dividend history of a company serves as a vital indicator of its commitment to returning capital to shareholders. A consistent and growing dividend record suggests stable cash generation and financial health.

| Year | Dividend per Share (USD) |

|---|---|

| 2025 | 1.10 |

| 2024 | 1.40 |

| 2023 | 1.30 |

| 2022 | 1.10 |

| 2021 | 0.50 |

📈 Dividend Growth

The dividend growth rate reflects the company's potential for increasing payout amounts over time, indicating a positive trend for dividend enthusiasts.

| Time | Growth |

|---|---|

| 3 years | 0.41% |

| 5 years | 0.73% |

The average dividend growth is 0.73% over 5 years. This shows moderate but steady dividend growth.

📉 Payout Ratio

Payout ratios are a cornerstone for assessing the sustainability of dividend payments. A very high payout ratio may limit future dividend growth and increase cut risk.

| Key figure | Ratio |

|---|---|

| EPS-based | 156.59% |

| Free cash flow-based | 26.27% |

The EPS payout ratio of 156.59% is considerably high, suggesting that the company may not generate enough earnings to cover its dividend payments sustainably. In contrast, a more comfortable 26.27% ratio based on free cash flow indicates better coverage.

✅ Cashflow & Capital Efficiency

Strong cash flows and efficient capital use are crucial for sustaining dividend payouts and driving shareholder value.

| Metric | 2023 | 2024 | 2025 |

|---|---|---|---|

| Free Cash Flow Yield | 7.82% | 11.69% | 5.79% |

| Earnings Yield | 9.25% | 8.32% | 0.97% |

| CAPEX to Operating Cash Flow | 18.88% | 8.67% | 10.09% |

| Stock-based Compensation to Revenue | 1.18% | 1.29% | 1.25% |

| Free Cash Flow / Operating Cash Flow Ratio | 81.11% | 91.33% | 89.91% |

Consistent free cash flow generation and low CAPEX to operating cash flow ratios indicate robust cash flow management, facilitating ongoing dividend support.

⚠️ Balance Sheet & Leverage Analysis

A healthy balance sheet and appropriate leverage are critical for financial resilience and delivering long-term shareholder value.

| Metric | 2023 | 2024 | 2025 |

|---|---|---|---|

| Debt-to-Equity | 1.45 | 3.03 | 4.55 |

| Debt-to-Assets | 46.26% | 65.42% | 59.25% |

| Debt-to-Capital | 59.10% | 75.16% | 81.97% |

| Net Debt to EBITDA | 1.84 | 1.92 | 5.32 |

| Current Ratio | 1.84 | 5.14 | 1.87 |

| Quick Ratio | 1.12 | 4.66 | 1.31 |

| Financial Leverage | 3.12 | 4.62 | 7.67 |

A rising debt-to-equity ratio coupled with high financial leverage suggests increased financial risk. However, strong liquidity ratios indicate short-term stability.

📊 Fundamental Strength & Profitability

Profitability ratios reveal insights into a company’s efficiency in generating profits and sustaining earnings growth.

| Metric | 2023 | 2024 | 2025 |

|---|---|---|---|

| Return on Equity | 41.09% | 28.17% | 21.36% |

| Return on Assets | 13.15% | 6.09% | 2.78% |

| Net Margin | 14.05% | 12.23% | 2.61% |

| EBIT Margin | 17.58% | 17.04% | 4.30% |

| EBITDA Margin | 20.94% | 20.47% | 7.51% |

| Gross Margin | 70.78% | 73.29% | 75.44% |

| R&D to Revenue | 0% | 0% | 0% |

While RoE and net margin deterioration indicate potential challenges, strong gross margins reflect operational efficiency.

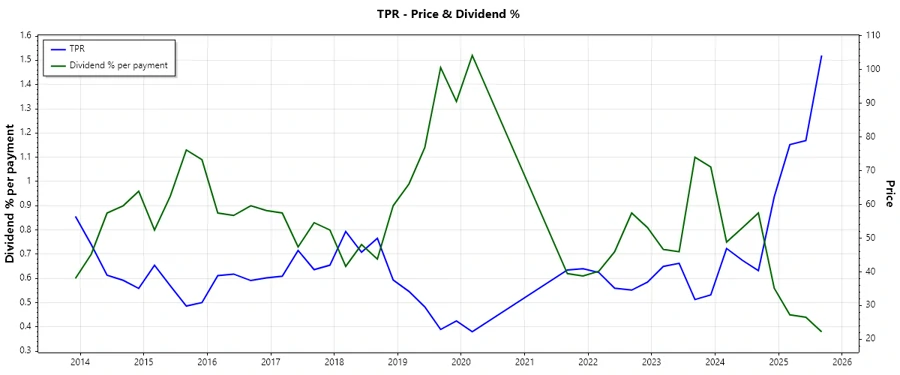

📈 Price Development

Dividend Scoring System

| Category | Score | Indicator |

|---|---|---|

| Dividend yield | 3 | |

| Dividend Stability | 4 | |

| Dividend growth | 2 | |

| Payout ratio | 2 | |

| Financial stability | 3 | |

| Dividend continuity | 4 | |

| Cashflow Coverage | 4 | |

| Balance Sheet Quality | 2 |

Overall Score: 24/40

Rating

In summation, Tapestry, Inc. maintains a respectable position in the dividend landscape with consistent past payouts but faces challenges with sustainability indicated by a high EPS payout ratio. Prudent investors should weigh the firm's strong historical trend with its financial ratios for a holistic investment decision.