June 01, 2025 a 04:44 pm

TPL: Fibonacci Analysis - Texas Pacific Land Corporation

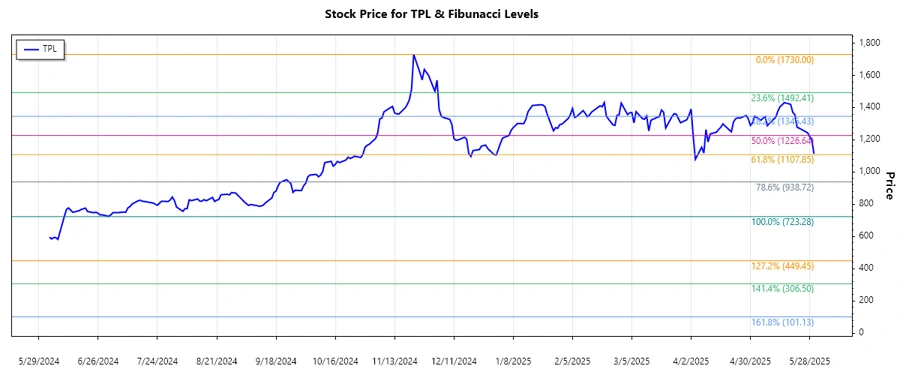

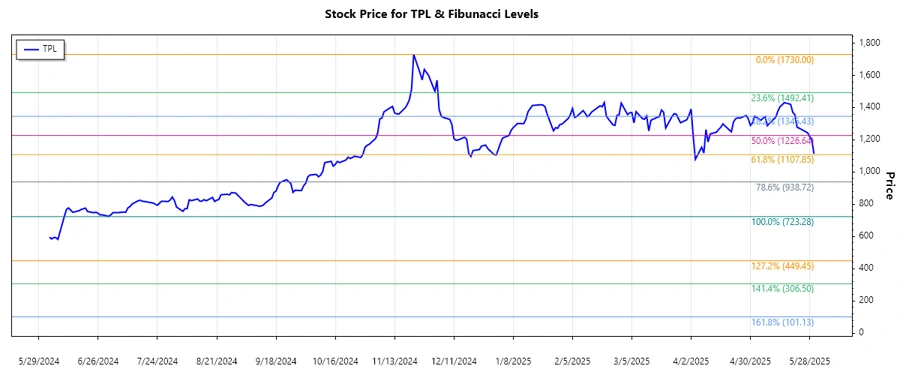

Texas Pacific Land Corporation (TPL) has recently experienced significant fluctuations in its stock price. The company, with its diverse operations in land and resource management as well as water services, remains a strong player in the market. Its performance in recent months reflects both opportunities for growth and the inherent volatility of its industry. A detailed technical analysis can provide insights into potential future movements.

Fibonacci Analysis

| Detail | Information |

|---|---|

| Trend Start Date | 2024-12-02 |

| Trend End Date | 2024-11-22 |

| High Price | $1730 (2024-11-22) |

| Low Price | $723.28 (2024-06-10) |

| Fibonacci Levels |

|

| Current Price in Retracement Zone | Yes, 0.618 |

| Interpretation | The current price level suggests a potential support area at the 0.618 retracement, indicating stabilization or reversal may be on the horizon. |

Conclusion

The technical analysis of Texas Pacific Land Corporation (TPL) reveals an intriguing phase as the stock currently sits within a significant Fibonacci retracement zone. While the recent high and low suggest a substantial range, the current price may benefit from support at the 0.618 level, potentially providing a base for recovery. Analysts should carefully monitor the stock for signs of either stabilization or further volatility. As the company navigates the complexities of its industry, the stock’s movements could reflect broader market sentiments as well as specific operational outcomes. Opportunities for growth exist, but investors should be wary of inherent risks due to market dynamics and sector-specific challenges.