September 27, 2025 a 09:01 pm

TPL: Analysts Ratings - Texas Pacific Land Corporation

Texas Pacific Land Corporation, known for its vast land and resource management in Texas, holds potential but faces varied analyst sentiments. With its unique business model, encompassing both land management and water services in the Permian Basin, TPL's performance is intertwined with the broader oil and gas markets. In recent months, the analyst sentiment shows a cautious optimism with most ratings tending towards a "Buy".

Historical Stock Grades

The analyst ratings for Texas Pacific Land Corporation for September 2025 reflect a sole "Buy" recommendation. Despite the lack of stronger buy signals, the stability in ratings suggests a consolidated view of moderate growth potential.

| Rating | Count | Score |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 1 | |

| Hold | 0 | |

| Sell | 0 | |

| Strong Sell | 0 |

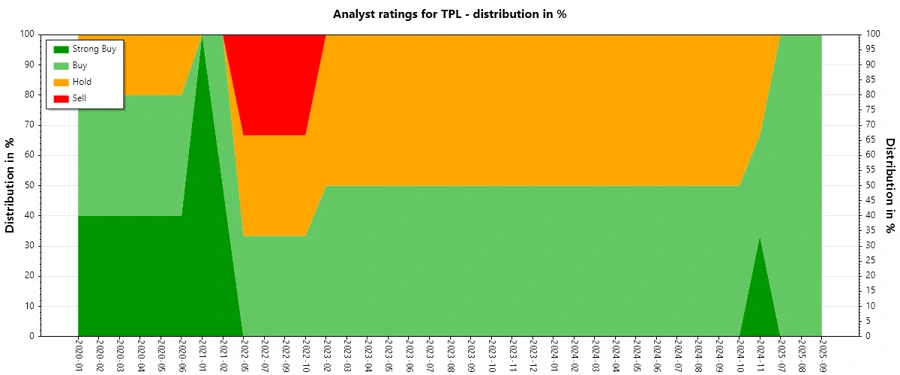

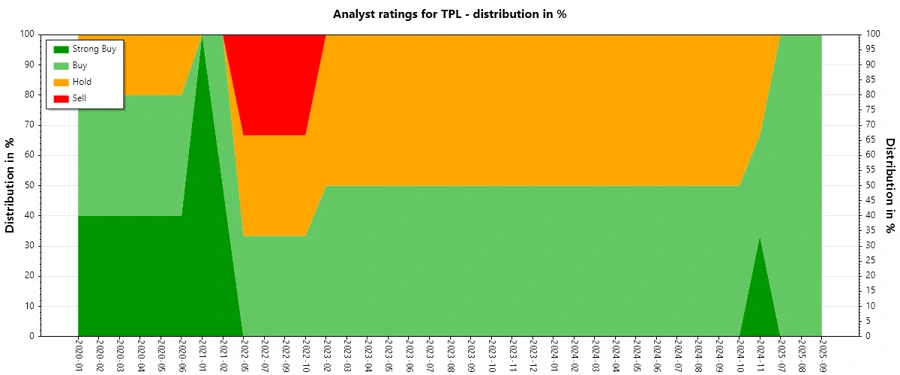

Analyst Ratings History

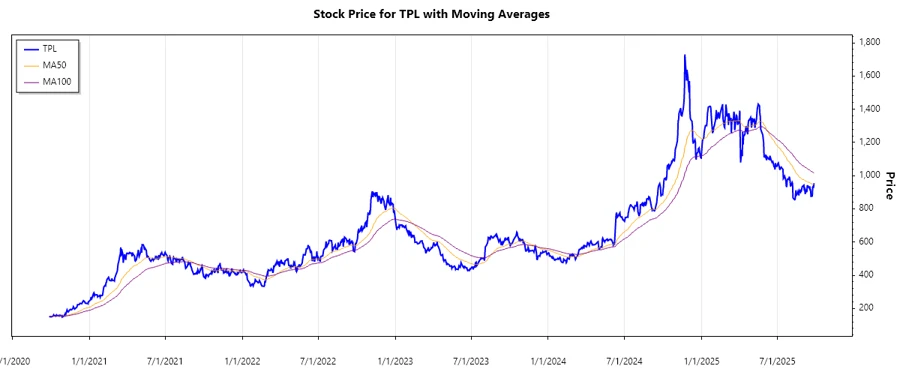

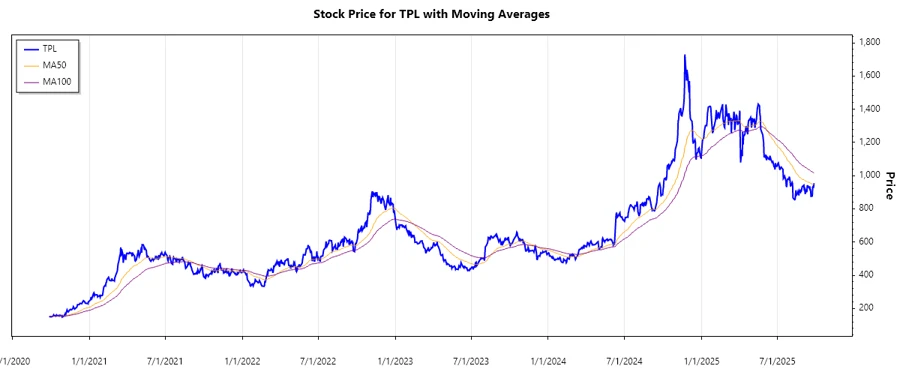

Stock Performance Chart

Sentiment Development

The TPL sentiment over recent months shows a marked decrease in diverse analyst activity. Most ratings have consistently hovered around "Buy," barring occasional "Hold" recommendations.

- The total number of ratings has remained largely steady at one per month.

- "Strong Buy" ratings have been absent, indicating moderate enthusiasm.

- There is a persistent lack of negative sentiment (i.e., "Sell" or "Strong Sell").

Percentage Trends

Over the past year, the percentage of "Buy" ratings has dominated with little competition from other categories.

- The transition from varied ratings in 2024 to uniform "Buy" in 2025 signifies reduced divergence among analyst opinions.

- The percentage of "Hold" recommendations saw a decline post-2024, with no resurgence in 2025.

- Analyst caution is expressed through consistent "Buy" ratings without upgrading to "Strong Buy".

Latest Analyst Recommendations

Recent analyst recommendations reveal a tendency to maintain previous ratings. This consistent approach reflects limited shifts in market perception.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2024-08-12 | Buy | Buy | BWS Financial |

| 2024-05-10 | Buy | Buy | BWS Financial |

| 2024-04-02 | Buy | Buy | BWS Financial |

| 2024-01-23 | Hold | Hold | Stifel |

| 2023-11-30 | Hold | Hold | Stifel |

Analyst Recommendations with Change of Opinion

The rare instances of changed recommendations suggest conservative shifts in analyst sentiment. This observation implies a general consensus on TPL's current market position.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2021-04-01 | Hold | Buy | Stifel |

| 2021-03-31 | Hold | Buy | Stifel |

Interpretation

The consistent "Buy" recommendations over recent months suggest a cautiously optimistic outlook. Analysts appear to see sustainable, moderate potential without significant immediate catalysts for dramatic price changes. The absence of "Strong Buy" or "Sell" recommendations indicates a stable, albeit conservative, analyst perception of TPL’s market position. There is little evidence of uncertainty, reflecting steady confidence but without strong enthusiasm.

Conclusion

Texas Pacific Land Corporation continues to be regarded with a sense of cautious optimism, as demonstrated by consistent "Buy" ratings without significant shifts to stronger buy signals or sell recommendations. The company’s unique position with land and water rights in Texas underpins its steady performance outlook. However, without more dynamic recommendations like "Strong Buy," opportunities for substantial growth appear limited. The stability in analyst sentiment suggests predictability but also points to potential risks if market conditions change unexpectedly.