September 21, 2025 a 11:44 am

TMO: Fibonacci Analysis - Thermo Fisher Scientific Inc.

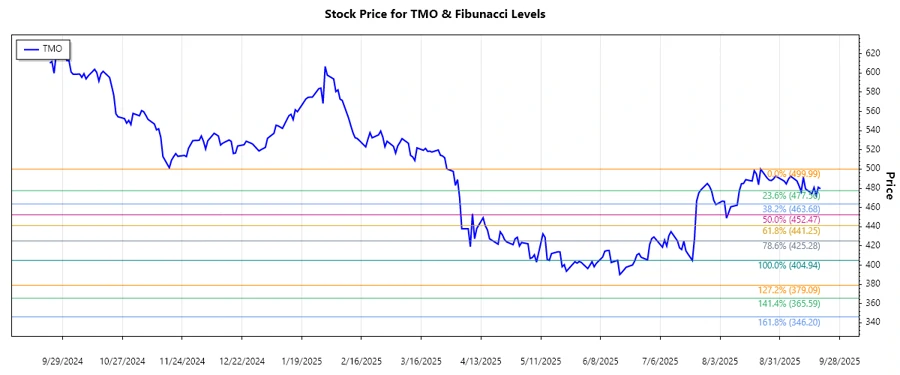

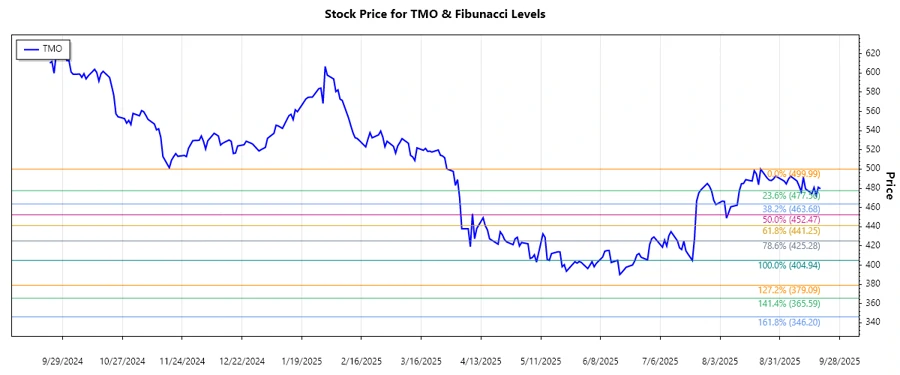

Thermo Fisher Scientific Inc. has demonstrated a resilient business model in the life sciences sector, with a diverse product range catering to both research and industrial applications worldwide. Despite recent market fluctuations, TMO has maintained a steady growth rate, positioning itself as a leader in its field. This analysis focuses on the technical aspects of TMO's stock performance over the past months.

Fibonacci Analysis

This analysis identifies a recent downward trend in TMO stock from July 21, 2025, to August 22, 2025. The price peaked at $499.99 on August 22, 2025. The lowest point was $404.94 on July 21, 2025. Here are the calculated Fibonacci retracement levels based on these points:

| Level | Price |

|---|---|

| 0.236 | 427.94 |

| 0.382 | 451.82 |

| 0.5 | 452.47 |

| 0.618 | 425.13 |

| 0.786 | 460.98 |

The current price of TMO is $479.58, which suggests it is within the 0.382 retracement level. This level may act as a potential support, suggesting a potential reversal or continuation of the trend.

Conclusion

In conclusion, Thermo Fisher Scientific Inc. has experienced a notable decline, yet its robust business model offers a solid foundation for potential recovery. The technical analysis indicates a current position within a key retracement level, highlighting potential support zones. Investors should monitor these levels closely for signs of reversal or continuation. While potential market risk persists, the company's diverse offerings and market leadership underscore its resilience. This analysis represents an essential perspective for analysts considering future price movements and investment opportunities.