August 28, 2025 a 04:39 pm

TJX: Analysts Ratings - The TJX Companies, Inc.

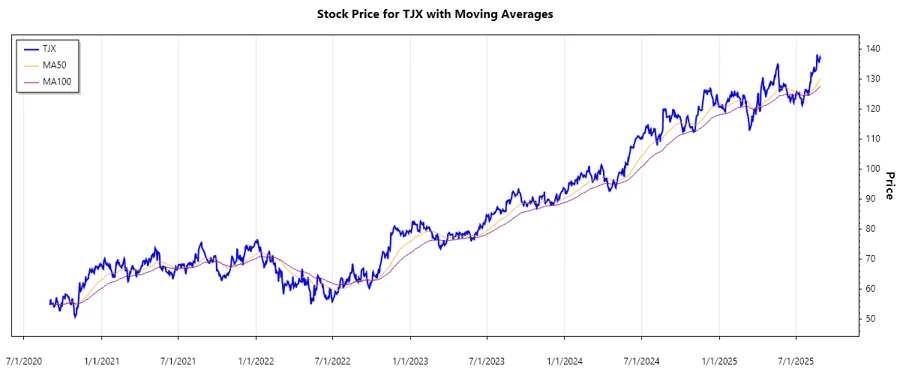

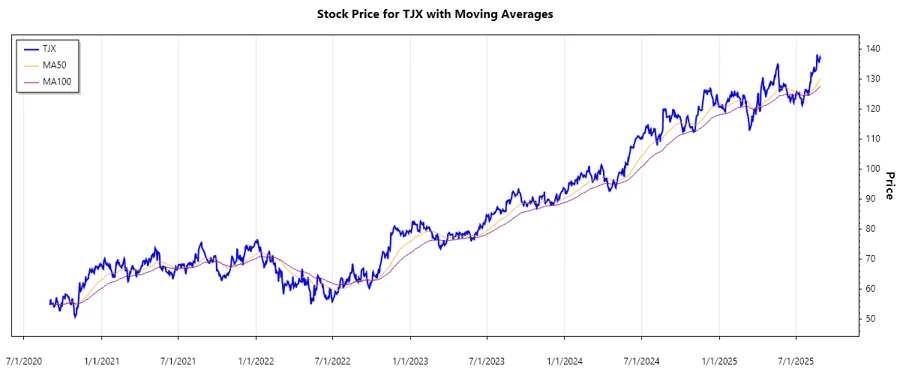

TJX Companies, Inc., as a leading off-price apparel and home fashions retailer, continues to hold a promising position in the market. Despite market fluctuations, analyst sentiment overall remains favorable with an array of Buy and Strong Buy recommendations. This reflects a continuous trust in TJX's business model and its ability to perform in diverse market conditions, supported by its expansive store network and product diversity.

Historical Stock Grades

An analysis of the latest analyst ratings of TJX shows a robust confidence in the company's future outlook. As of August 2025, the ratings reveal a strong inclination towards Buy recommendations with minimal dispositions towards Sell. This positive sentiment is indicative of market trust in TJX's strategic direction and execution.

| Recommendation | Count | Score Representation |

|---|---|---|

| Strong Buy | 4 | |

| Buy | 15 | |

| Hold | 1 | |

| Sell | 1 | |

| Strong Sell | 0 |

Sentiment Development

The trend over the past months indicates a consistently strong belief in TJX's potential, reflecting a stable recommendation pattern with minor variations in Hold and Buy ratings. Analysts display caution with minimal Sell ratings, signaling confidence in resilience. Key observations include:

- August saw a consolidation in Buy ratings, with Strong Buy holding at 4 recommendations.

- The gradual decrease in Strong Buy from earlier months suggests a tempered but positive outlook.

- Minor fluctuations in Hold and Sell ratings, maintaining overall bullish sentiment.

Percentage Trends

Examining the percentage distribution of ratings, a stable investor confidence emerges. Buy recommendations dominate the analyst landscape, indicating a robust expectation of future performance. Notable developments include:

- Strong Buy declarations dropped from 23% in April to 17% in August, reflecting a cautiously optimistic market.

- Buy ratings consistently perform around the 65-75% mark, solidifying TJX's favored status.

- Hold and Sell ratings jointly remaining under 10% convey stable strategic confidence.

- The gradual adjustment in recommendation percentages points towards a shift in risk appraisal.

Latest Analyst Recommendations

The latest analyst recommendations for TJX predominantly maintain existing positive outlooks, reinforcing the established perception of stability. Despite minor adjustments, the overall investment sentiment remains strong and encouraging. Recent unchanged recommendations illustrate this point:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-21 | Overweight | Overweight | JP Morgan |

| 2025-08-21 | Outperform | Outperform | Baird |

| 2025-08-21 | Outperform | Outperform | Evercore ISI Group |

| 2025-08-21 | Buy | Buy | UBS |

| 2025-08-21 | Overweight | Overweight | Barclays |

Analyst Recommendations with Change of Opinion

Analysis of opinion changes among analysts reveals a dynamic but stable trust in the stock. Upgrades and downgrades are not uncommon, yet reflect specific tactical adjustments rather than sweeping sentiment changes. Recent recommendation changes include:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-04-03 | Buy | Neutral | Citigroup |

| 2024-08-22 | Neutral | Buy | Citigroup |

| 2024-05-02 | Buy | Neutral | UBS |

| 2024-04-25 | Buy | Neutral | Goldman Sachs |

| 2024-02-05 | Neutral | Buy | Redburn Atlantic |

Interpretation

Overall, analyst sentiment towards TJX reflects enduring confidence in its market position, but tempered by a more cautious appraisal of risks. The consistency in Buy and Strong Buy recommendations, combined with minimal Sell explorations, signals steady trust. An inclination towards more stable assessments suggests that while there is confidence, it is balanced with prudent caution, indicating a relatively stable opinion amidst market uncertainties.

Conclusion

In conclusion, TJX Companies, Inc. continues to enjoy robust confidence among analysts. While a slight moderation in Strong Buy ratings suggests cautious optimism, the dominant Buy recommendations uphold a positive outlook. This reflects both the strengths and uncertainties facing the company, amid macroeconomic factors. The balance of opinions suggests opportunities for growth; however, awareness of underlying market risks remains vital. As TJX navigates these dynamics, its future strategies will likely play a crucial role in sustaining analyst confidence.