September 21, 2025 a 06:44 am

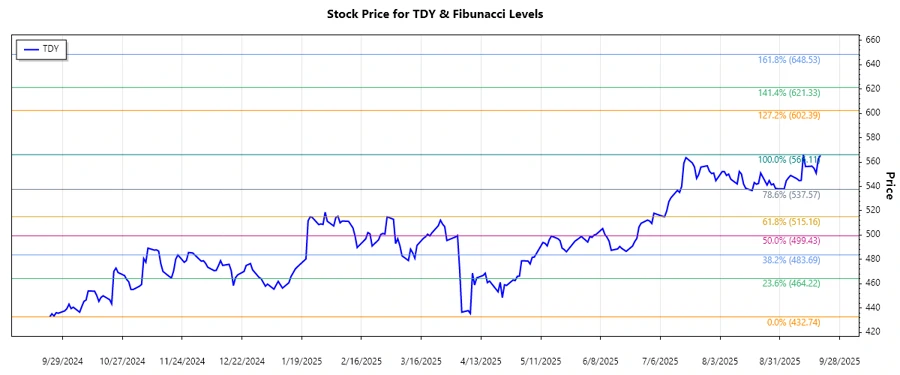

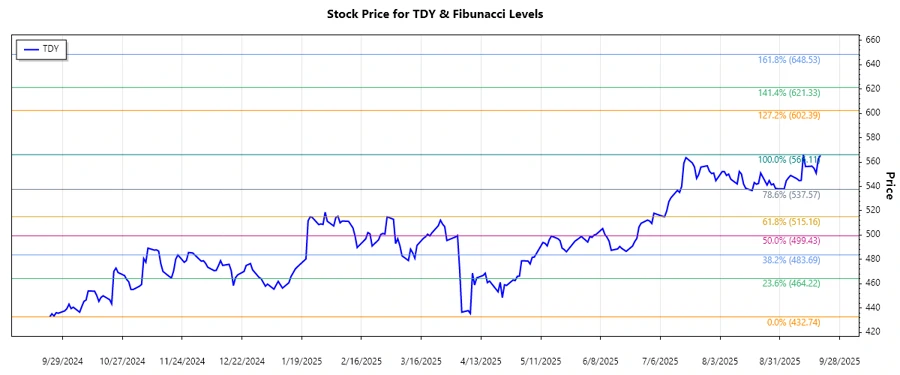

TDY: Fibonacci Analysis - Teledyne Technologies Incorporated

Teledyne Technologies Inc., with its diverse portfolio in digital imaging, aerospace and defense electronics, and engineered systems, has shown resilience in the face of industrial challenges. The stock has recently displayed a significant upward trend, suggesting renewed investor confidence. Given its presence in various technological sectors, both risks and opportunities abound in this dynamic market.

Fibonacci Analysis

| Detail | Information | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Start Date of Trend | 2024-09-23 | ||||||||||||

| End Date of Trend | 2025-09-11 | ||||||||||||

| High Point (Date & Price) | 2025-09-11, $566.11 | ||||||||||||

| Low Point (Date & Price) | 2024-09-23, $432.74 | ||||||||||||

| Retracement Levels |

|

||||||||||||

| Current Price Position | Currently not in a retracement area, above the 0.618 level. | ||||||||||||

| Technical Interpretation | The price soaring above the 0.618 Fibonacci level indicates strong bullish momentum, possibly finding new support around the $566 mark. |

Conclusion

Teledyne Technologies Inc. has exhibited a robust uptrend, confirming its efficacy in leveraging its technology-driven segments to capture market opportunities. The stock's move above the critical Fibonacci levels suggests strong investor sentiment and potential for further growth. However, analysts should be cautious of potential market volatilities and external economic factors that could impact the stock's future direction. The company's diverse industrial and geographical exposure offers both growth prospects and risk mitigations. Continued monitoring of sector trends and company performance will be essential for informed investment decisions.