October 29, 2025 a 11:44 am

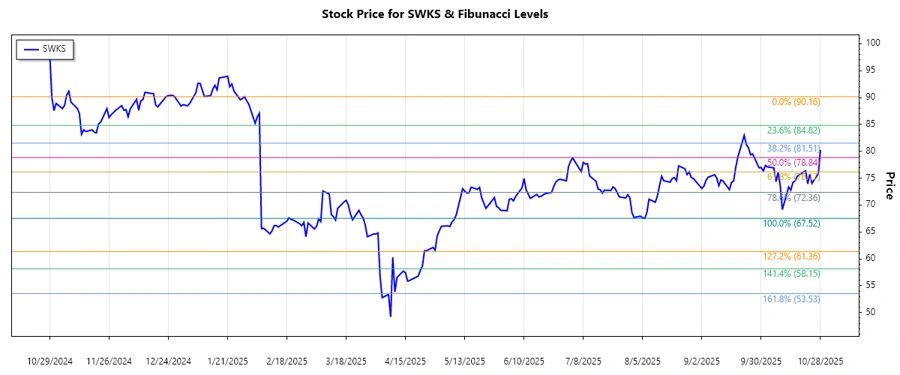

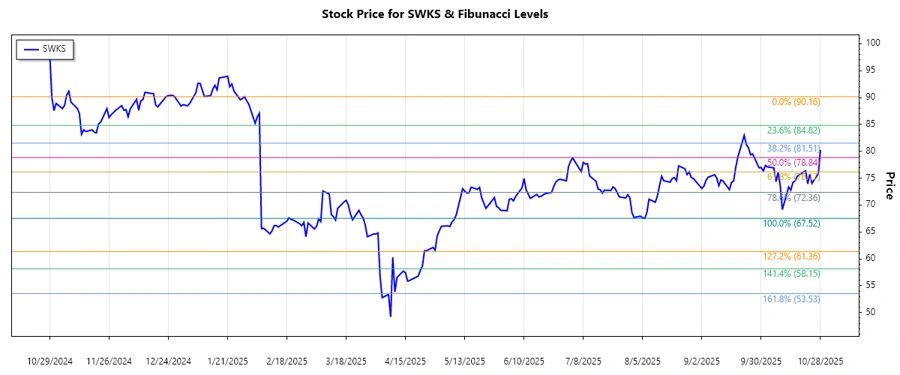

SWKS: Fibonacci Analysis - Skyworks Solutions, Inc.

The recent data for Skyworks Solutions, Inc. (SWKS) presents a bearish trend over the past few months. With a wide range of semiconductor products, Skyworks serves multiple high-growth industries like aerospace and automotive. Despite the recent decline, the stock has a history of recovery, driven by innovation and industry demand. Investors may find potential entry points as the technical landscape evolves. Fibonacci retracement levels help in identifying possible support areas.

Fibonacci Analysis

| Details | Information |

|---|---|

| Trend Duration | 2025-01-29 to 2025-10-28 |

| High Point | 90.16 on 2025-01-29 |

| Low Point | 67.52 on 2025-08-06 |

| Fibonacci Level | Price Level |

|---|---|

| 0.236 | 83.161 |

| 0.382 | 79.950 |

| 0.5 | 78.840 |

| 0.618 | 77.730 |

| 0.786 | 76.318 |

Current analysis indicates the stock is within the 0.382 retracement level. This suggests potential mid-term resistance around the current price.

Conclusion

Skyworks Solutions' stock shows a downward trend over the recent months, which corresponds to broader market adjustments. The calculated Fibonacci levels highlight key price levels where investors might find support or resistance. While the stock is experiencing a pullback, it might present opportunities at lower levels for investors looking for long-term gains. Monitoring these technical levels is crucial for making informed investment decisions. Market volatility remains a factor, and potential economic shifts could influence future trends. Remaining vigilant about industry developments can offer guidance on timing market entry.