October 03, 2025 a 09:01 am

STZ: Analysts Ratings - Constellation Brands, Inc.

The analysis of Constellation Brands, Inc. suggests a mature and established presence in the alcoholic beverages industry. Offering products across beer, wine, and spirits, the company benefits from a diverse portfolio that includes popular brands such as Corona, Modelo, and Robert Mondavi. Analyst ratings reflect a generally positive outlook, with a strong inclination toward 'Buy' recommendations, indicating confidence in the company's growth strategy and market position.

Historical Stock Grades

| Recommendation | Count | Score |

|---|---|---|

| Strong Buy | 2 | |

| Buy | 13 | |

| Hold | 8 | |

| Sell | 0 | |

| Strong Sell | 2 |

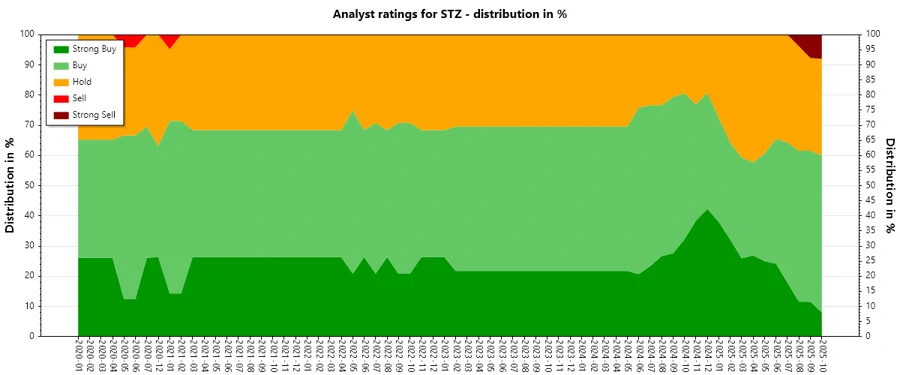

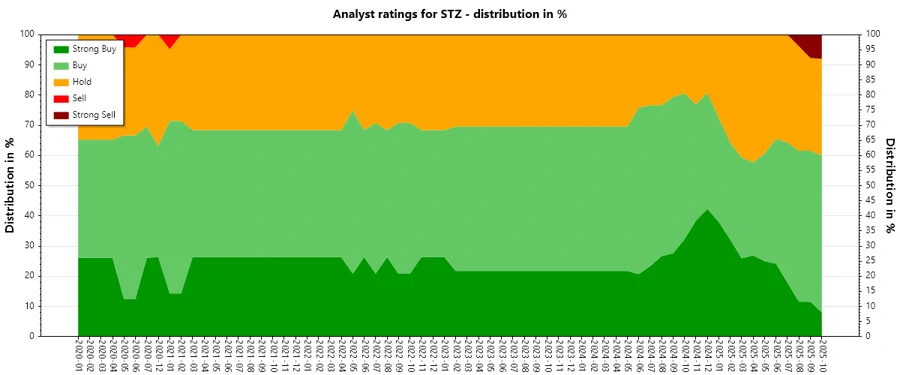

Sentiment Development

Over recent months, there has been a noteworthy trend change in analyst sentiment toward Constellation Brands. The number of Strong Buy ratings has decreased, while Hold ratings exhibit an increasing trend. Overall, recommendations reflect a stable but slightly cautious outlook among analysts:

- The total number of ratings has remained relatively stable.

- A noticeable decline in Strong Buy recommendations from 9 in February to 2 in October.

- Hold ratings increased, indicating a cautious sentiment in the market.

Percentage Trends

The distribution of ratings for Constellation Brands in recent months suggests a noteworthy shift in sentiment. While Buy recommendations maintain robustness, there is a gradual incline towards Hold:

- Strong Buy ratings decreased from constituting 33% in January to 9% in October.

- Buy ratings remained consistent, approximately 39%, marking sustained market confidence.

- Hold ratings rose from 24% in January to 36% in October.

- The increased percentage in Hold ratings signals analyst caution possibly due to market conditions or company-specific factors.

Latest Analyst Recommendations

Recent analyst recommendations provide insights into current sentiment and factors influencing decisions. Although there is stability in some ratings, minor adjustments indicate shifting outlooks:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-10-02 | Buy | Buy | Goldman Sachs |

| 2025-09-25 | Overweight | Overweight | Wells Fargo |

| 2025-09-23 | Neutral | Neutral | Citigroup |

| 2025-09-12 | Equal Weight | Overweight | Barclays |

| 2025-09-04 | Outperform | Outperform | Bernstein |

Analyst Recommendations with Change of Opinion

The adjustments in analyst recommendations indicate evolving sentiments in the market, reflecting either improved or lowered expectations:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-09-12 | Equal Weight | Overweight | Barclays |

| 2025-07-07 | Buy | Hold | Jefferies |

| 2025-03-20 | Neutral | Buy | Citigroup |

| 2025-02-27 | Equal Weight | Overweight | Morgan Stanley |

| 2025-02-03 | Neutral | Overweight | Piper Sandler |

Interpretation

The analysis of current and previous analyst recommendations reveals a cautious optimism centered around Constellation Brands. While Buy ratings still signify confidence, the uptick in Hold ratings suggests a growing sense of prudence among market analysts. This sentiment may reflect market uncertainties or potential risks impacting the stock. Though some ratings demonstrate stability, others show transitions toward neutrality, highlighting a dynamic market outlook. Collectively, analyst opinions suggest a mixture of confidence and caution, emphasizing the need to closely monitor future developments in the company's performance and market conditions.

Conclusion

Constellation Brands presents a robust yet cautiously optimistic investment opportunity. Analysts recognize its strong market presence and product diversity, reflected in sustained Buy ratings. However, recent trends showing a rise in Hold ratings underscore caution possibly due to market volatility or changes in consumer behavior. Investors should weigh these factors while understanding that the company's broad portfolio and strategic growth initiatives retain significant potential. Continued market monitoring is recommended to navigate risks and leverage opportunities effectively.