August 16, 2025 a 08:38 pm

STZ: Analysts Ratings - Constellation Brands, Inc.

Constellation Brands, Inc., a major player in the beverage industry, exhibits resilience despite market volatilities. Currently, the stock enjoys strong buy and buy ratings primarily, reflecting optimism. The company's diverse portfolio ranging from beer to spirits supports this positive sentiment. However, it’s essential to monitor sentiment shifts to gauge long-term investment potential.

Historical Stock Grades

| Rating | Count | Score Bar |

|---|---|---|

| Strong Buy | 3 | |

| Buy | 13 | |

| Hold | 9 | |

| Sell | 0 | |

| Strong Sell | 0 |

Sentiment Development

Over recent months, total ratings have varied slightly. The count for "Strong Buy" ratings has dropped from 7 in June to 3 in August, indicating decreasing conviction. On the other hand, "Hold" ratings have increased, suggesting a cautious approach by analysts. The consistent absence of "Sell" or "Strong Sell" ratings underscores confidence in the stock's performance, despite the cautious stance.

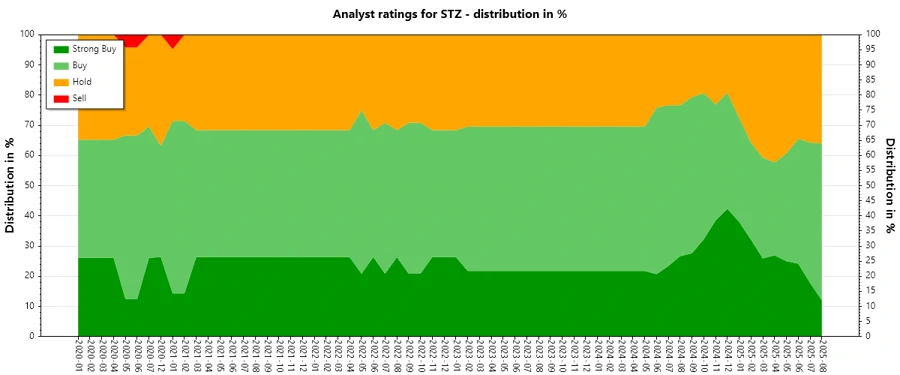

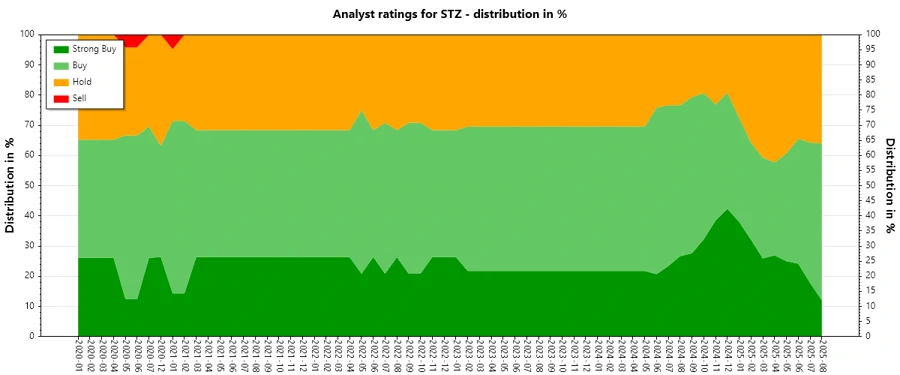

Percentage Trends

Analysts' willingness to recommend the stock strongly has waned. "Strong Buy" recommendations decreased from 26% in January 2025 to 10% in August 2025. In contrast, "Hold" ratings saw an increment, climbing from 19% to 29%. Despite fewer "Strong Buy" ratings, the stock retains substantial "Buy" support, demonstrating steady confidence.

Latest Analyst Recommendations

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-07-07 | Buy | Hold | Jefferies |

| 2025-07-03 | Buy | Buy | Needham |

| 2025-07-03 | Neutral | Neutral | B of A Securities |

| 2025-07-03 | Neutral | Neutral | JP Morgan |

| 2025-07-03 | Neutral | Neutral | Citigroup |

Analyst Recommendations with Change of Opinion

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-07-07 | Buy | Hold | Jefferies |

| 2025-03-20 | Neutral | Buy | Citigroup |

| 2025-02-27 | Equal Weight | Overweight | Morgan Stanley |

| 2025-02-03 | Neutral | Overweight | Piper Sandler |

| 2025-01-13 | Neutral | Overweight | JP Morgan |

Interpretation

The analyst sentiment for Constellation Brands indicates a mixed outlook with a predominant tilt towards cautious optimism. The stable number of "Buy" ratings suggests confident market performance, although the rise in "Hold" ratings may denote slight uncertainty or market overvaluation concerns. While analyst stability appears present, the shifts in strong buys imply a nuanced approach reflecting industry changes or broader market conditions.

Conclusion

Constellation Brands maintains solid analyst support, predominantly in the "Buy" category. However, the rise in "Hold" ratings might suggest challenges within its business environment or market positioning uncertainty. Maintaining a reputation for resilient performance, the company continues to draw positive market sentiment. Nevertheless, the emerging caution hints at potential assessment adjustments amid macroeconomic factors. Investors should discern risks carefully, as analyst confidence, while reassuring, reflects evolving market dynamics.