September 19, 2025 a 08:00 am

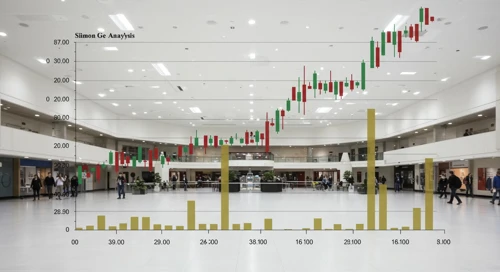

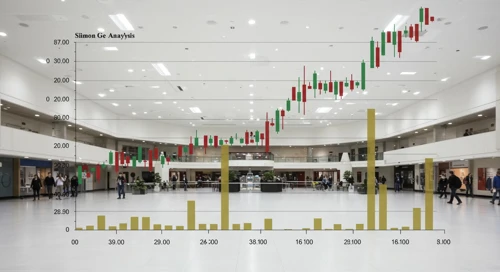

SPG: Fundamental Ratio Analysis - Simon Property Group, Inc.

Simon Property Group, Inc. (SPG) operates as a leading real estate investment trust specializing in premier shopping and mixed-use destinations. With properties spanning North America, Europe, and Asia, SPG facilitates community interactions and generates substantial annual sales. The stock presents intriguing opportunities and challenges for potential investors.

Fundamental Rating

SPG has maintained a strong standing in the market with commendable returns and a balanced financial position.

| Category | Score | Visual Indicator |

|---|---|---|

| Discounted Cash Flow (DCF) | 4 | |

| Return On Equity (ROE) | 5 | |

| Return On Assets (ROA) | 5 | |

| Debt To Equity | 1 | |

| Price To Earnings | 2 | |

| Price To Book | 1 |

Historical Rating

Comparing SPG's performance over recent periods reveals consistent scores with opportunities for improvement.

| Date | Overall | DCF | ROE | ROA | Debt/Equity | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-09-18 | 3 | 4 | 5 | 5 | 1 | 2 | 1 |

| Prior Date | 0 | 4 | 5 | 5 | 1 | 2 | 1 |

Analyst Price Targets

Analyst estimates show a positive outlook with room for upward momentum.

| High | Low | Median | Consensus |

|---|---|---|---|

| $210 | $169 | $176 | $182.75 |

Analyst Sentiment

The sentiment among analysts for SPG remains predominantly favorable with a 'Buy' consensus.

| Rating | Count | Percentage |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 18 | |

| Hold | 17 | |

| Sell | 2 | |

| Strong Sell | 0 |

Conclusion

Simon Property Group, Inc. offers a solid investment opportunity given its robust fundamentals and favorable analyst sentiment. The company has sustained a steady performance despite market challenges, with room for growth in its pricing and financial leverage metrics. Analysts remain mostly positive, indicating investor confidence in SPG's strategic positioning and growth potential. However, the high debt level remains a point of caution, suggesting a need for prudent risk management by the company. Overall, SPG stands as a strong contender in the real estate sector, suited for those with a risk-tolerant investment approach.