September 25, 2025 a 05:01 pm

SPGI: Analysts Ratings - S&P Global Inc.

S&P Global Inc. holds a strategic position within the global financial landscape, providing indispensable services such as credit ratings and market analytics. Current analyst sentiment around SPGI reflects a predominantly positive outlook, with the majority suggesting a 'Buy' or 'Strong Buy'. While there are minimal 'Hold' recommendations, the absence of 'Sell' or 'Strong Sell' insights underlines confidence in the stock's stability and future potential.

Historical Stock Grades

| Recommendation | Quantity | Score |

|---|---|---|

| Strong Buy | 6 | |

| Buy | 18 | |

| Hold | 2 | |

| Sell | 0 | |

| Strong Sell | 0 |

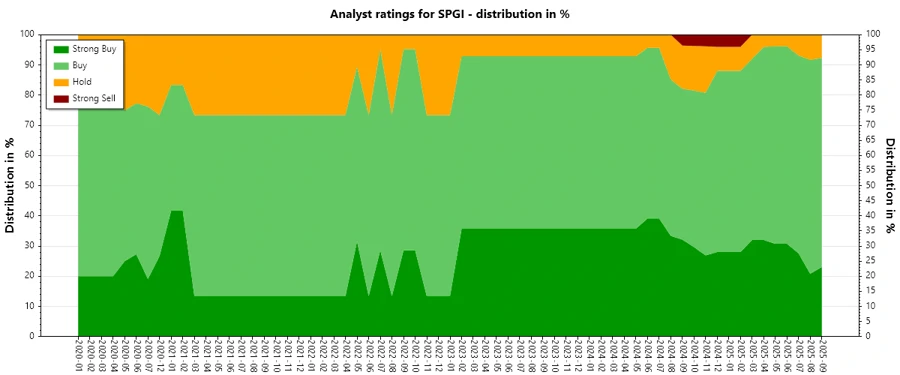

Sentiment Development

Over recent months, SPGI has maintained a positive sentiment, with consistently high 'Buy' recommendations. Notably, 'Strong Buy' ratings fluctuated slightly, showing a peak in July 2025 and contracting slightly in subsequent months. There has been a stable 'Hold' count, and notably, no analysts have recommended 'Sell' or 'Strong Sell'.

- Strong Buy peaked in July 2025 with 8 recommendations, slightly declining thereafter.

- Buy ratings remained consistently high, peaking at 19 in July 2025.

- The 'Hold' ratings remain minimal and unchanged.

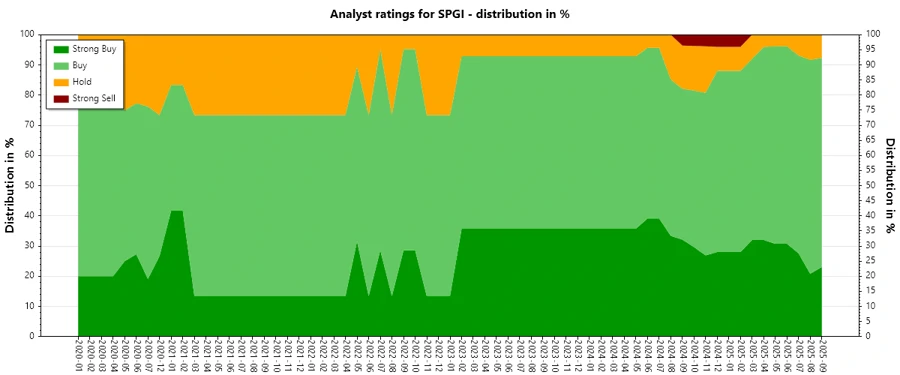

Percentage Trends

The recommendation landscape for SPGI indicates a strong preference for bullish outlooks, with Buy and Strong Buy dominating. Over the months, there was a slight relative increase in 'Buy' at the expense of 'Strong Buy', suggesting cautious optimism. The stability in the 'Hold' category denotes persistent confidence, refraining from moves to Sell.

- Strong Buy ratings decreased from 9 in mid-2024 to around 6-8 in 2025.

- Buy ratings showed an upward trend, gradually increasing through 2025.

- No presence of Sell recommendations highlights overall market confidence.

Latest Analyst Recommendations

Recent recommendations feature sustained convictions in SPGI's market promise, with multiple firms reiterating previous positive assessments. No downgrades signal enduring trust, aligning with broader market sentiment towards stability and growth.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-09-19 | Overweight | Overweight | Wells Fargo |

| 2025-09-15 | Buy | Buy | Citigroup |

| 2025-08-01 | Overweight | Overweight | Wells Fargo |

| 2025-08-01 | Outperform | Outperform | BMO Capital |

| 2025-08-01 | Overweight | Overweight | Morgan Stanley |

Analyst Recommendations with Change of Opinion

Over the past years, there have been notable changes in opinions among analysts, illustrating shifts in market sentiment due to evolving macro and micro-economic factors. Observations show movements from bullish positions towards more neutral stances, likely reflecting strategic cautions.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2024-09-23 | Market Perform | Outperform | Raymond James |

| 2024-04-03 | Hold | Buy | Erste Group |

| 2022-11-07 | Overweight | Neutral | Atlantic Equities |

| 2022-11-06 | Overweight | Neutral | Atlantic Equities |

| 2021-04-01 | Outperform | Market Perform | Raymond James |

Interpretation

The analytical narrative for SPGI suggests a robust market confidence backed by relevant expert insights and historical performance. Analyst sentiment aligns with market consensus, highlighting a predominance of 'Buy' and 'Strong Buy' designations. Despite a few shifts towards neutral ratings, no significant downgrades manifest market concerns. The absence of 'Sell' recommendations reinforces the confidence and resilience perceived. Overall, the sentiment appears stable, further supporting strategic investor decisions.

Conclusion

In summary, S&P Global Inc.'s potential reflects a positive investment opportunity marked by consistent 'Buy' recommendations and minimal instances of Hold. The analyses indicate an environment of trust bolstered by favourable market conditions across its operating sectors. Despite minor strategic downgrading, the overarching interpretation points towards continued investor interest. This stability fortifies SPGI's role as a pivotal entity in the financial markets, promising returns given its comprehensive market solutions and strong global presence.