May 27, 2025 a 01:00 pm

SNPS: Analysts Ratings - Synopsys, Inc.

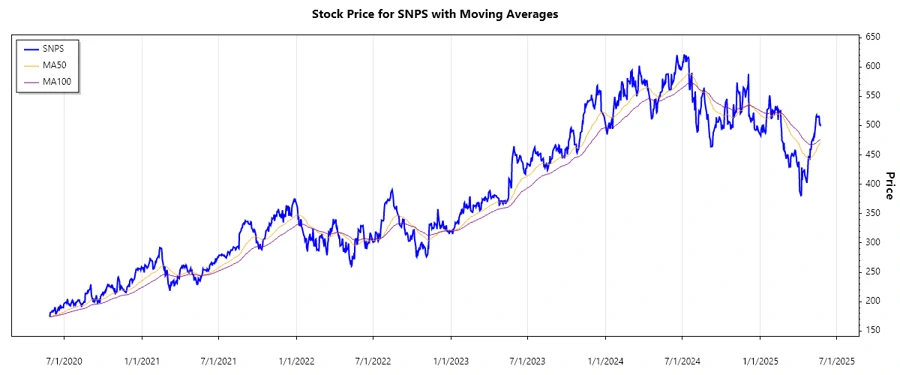

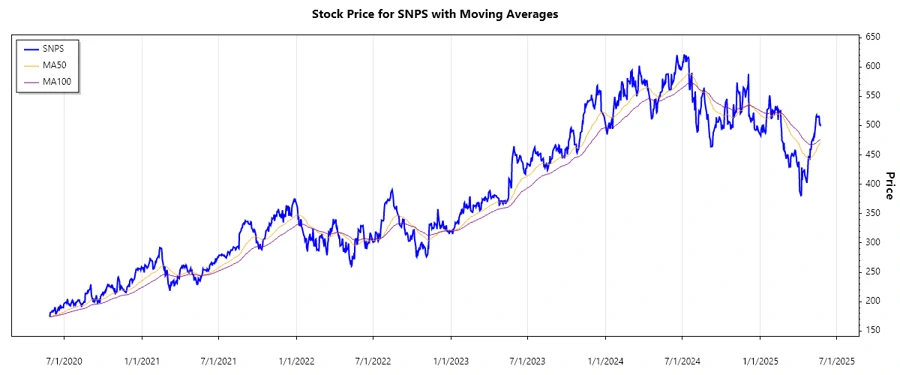

The current analyst ratings for Synopsys, Inc. demonstrate strong confidence in the company's performance, as indicated by a notable number of Strong Buy and Buy recommendations. The stability in the ratings suggests consistent optimism about the company’s growth prospects within its business landscape. An analysis of the trends and sentiment reveals a positive trajectory in investor sentiment toward Synopsys.

Historical Stock Grades

| Rating Type | Count | Score |

|---|---|---|

| Strong Buy | 5 | |

| Buy | 15 | |

| Hold | 3 | |

| Sell | 0 | |

| Strong Sell | 0 |

Sentiment Development

Over the past several months, Synopsys has experienced a consistent number of analyst ratings, with a trend towards maintaining or slightly increasing positive sentiment. The counts for Strong Buy recommendations have seen a modest increment, while Buy recommendations remain robust. A stable outlook is reflected in the marginal fluctuation of Hold ratings.

- Strong Buy ratings have been steady at 5, indicating continuous strong confidence.

- Buy ratings peaked, showcasing sustained market optimism.

- Hold ratings have fluctuated slightly, signaling cautious optimism.

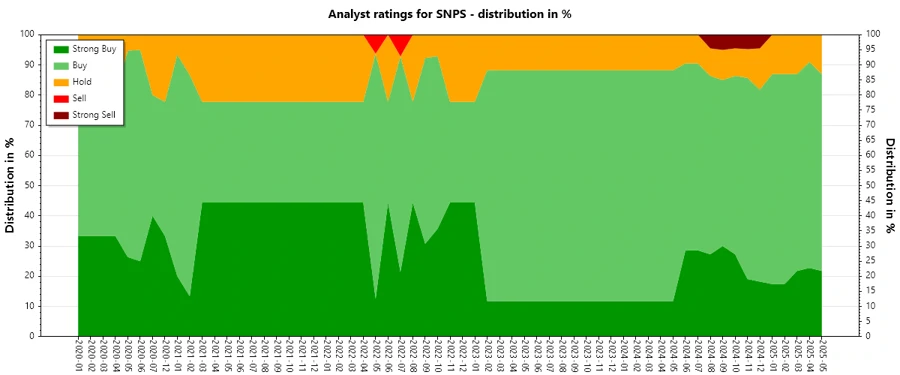

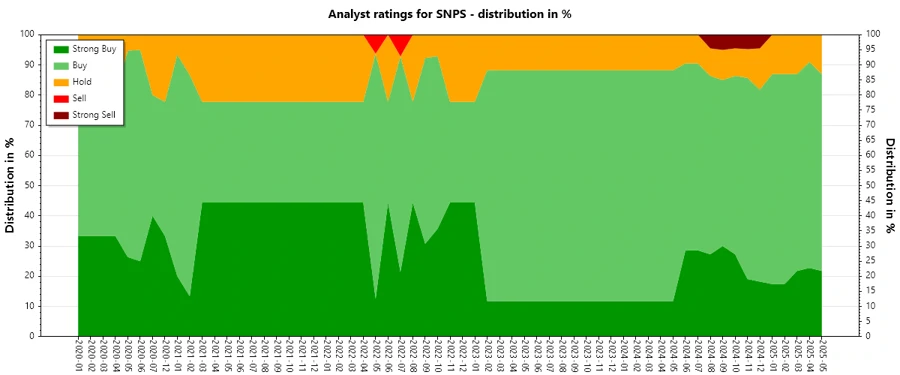

Percentage Trends

The percentage trends illustrate minor shifts in sentiment, with a predominant tilt towards bullish expectations. Notably, the percentage of Buy ratings accounts for the largest share, suggesting considerable confidence in the stock. The Share of Strong Buy ratings has incrementally grown, reflecting increasing enthusiasm among analysts, while Hold remains minimal.

- Strong Buy: From 20% to 25%, affirming strong endorsement.

- Buy: Maintaining between 65%-75%, indicating high market faith.

- Hold: Remaining under 15%, depicting a minority cautious stance.

Latest Analyst Recommendations

Recent analyst recommendations for Synopsys continue to demonstrate a robust Buy signal, with most firms maintaining their previous positive grades. The continuity in their recommendations signifies consistent market confidence in the company's prospects.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-05-20 | Overweight | Overweight | Keybanc |

| 2025-04-16 | Buy | Buy | B of A Securities |

| 2025-04-15 | Overweight | Overweight | Keybanc |

| 2025-04-15 | Outperform | Outperform | Mizuho |

| 2025-02-27 | Buy | Buy | Needham |

Analyst Recommendations with Change of Opinion

Shifts in analyst recommendations for Synopsys have been pivotal, indicating strategic reevaluation by analysts. Initially neutral, multiple analysts have upgraded their stance to Buy, a testament to perceived enhanced value or strategic improvements by the company.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2022-12-16 | Buy | Neutral | B of A Securities |

| 2022-12-15 | Buy | Neutral | B of A Securities |

| 2022-06-29 | Neutral | Underperform | B of A Securities |

| 2022-06-28 | Neutral | Underperform | B of A Securities |

| 2021-09-17 | Underperform | Neutral | B of A Securities |

Interpretation

The unwavering Buy sentiment signifies ongoing trust in Synopsys’ strategic direction and growth prospects. Analysts seem confident in the company's ability to navigate market challenges effectively. A consistent trend of maintaining positive ratings could indicate a consensus on the company's industry resilience. However, the absence of Sell recommendations should also be noted as a potential indication of market complacency.

Conclusion

In summary, Synopsys’ analyst ratings reflect strong confidence in the company’s market potential and strategic execution. While the persistent Buy and Strong Buy recommendations highlight growth prospects, the slight uptick in Hold ratings indicates a cautious awareness of possible sector volatility. Overall, Synopsys presents a compelling case for continued monitoring as both opportunities and risks are balanced through consistent positive sentiment in its stock performance.