May 11, 2025 a 03:11 pm

Retail Stocks - Performance Analysis

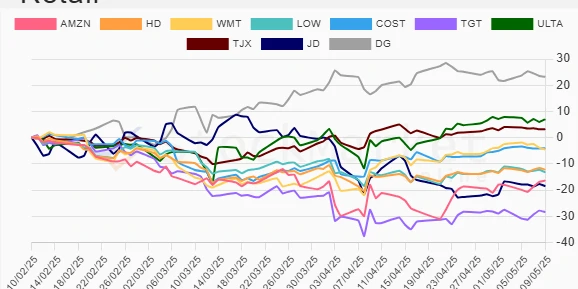

In recent months, the retail sector has exhibited diverse performance metrics across various timeframes. While certain stocks have showcased resilience, others have been significantly impacted by ongoing market dynamics. This analysis delves into the performance of key retail stocks over the past week, month, and three months, highlighting trends and providing a comprehensive overview.

📊 Retail Stocks Performance One Week

Over the past week, the retail sector experienced mixed results. Amongst the top performers, Amazon (AMZN) exhibited positive momentum with a 1.67% increase. Conversely, stocks like Lowe's (LOW) and Walmart (WMT) showed declines, suggesting potential short-term volatility.

| Stock | Performance (%) | Performance |

|---|---|---|

| AMZN | 1.67% | |

| DG | 1.54% |

📊 Retail Stocks Performance One Month

The one-month analysis reveals a more optimistic picture for the retail sector, led by Ulta (ULTA) with a notable rise of 8.42%. This increase highlights substantial investor interest and potential robust consumer demand in the beauty segment.

| Stock | Performance (%) | Performance |

|---|---|---|

| ULTA | 8.42% | |

| AMZN | 4.77% |

📊 Retail Stocks Performance Three Months

Over the three-month span, the retail sector displayed varied outcomes. Dollar General (DG) emerged as a prominent winner, achieving a remarkable 23.19% increase, reflecting potential gains from cost-conscious consumers. In contrast, Target (TGT) suffered significant declines, raising concerns about its strategic positioning and operational headwinds.

| Stock | Performance (%) | Performance |

|---|---|---|

| DG | 23.19% | |

| ULTA | 6.99% |

🔍 Summary

In conclusion, the retail sector's performance has been heterogeneous across the observed periods. The data identifies a promising outlook for select stocks, underpinned by consumer trends and specific strategic moves. However, ongoing market uncertainties require cautious optimism while exploring the sector for investment opportunities. Stocks that managed robust three-month gains, like Dollar General and Ulta, suggest potential avenues for strategic portfolio augmentation.