October 14, 2025 a 09:31 am

Real Estate Stocks - Performance Analysis 📊

The real estate sector has recently demonstrated varied performance with noticeable divergences across different timeframes. Recent metrics reveal that some major stocks have rebounded, while others continue to experience setbacks. This analysis dives into these dynamics, highlighting key outliers and performance trends essential for strategic investment insights.

Real Estate Stocks Performance One Week 📊

In the last week, the real estate sector has shown mixed results. EQIX emerged as the leader, gaining 2.44%, while WELL recorded the largest drop at -3.59%. This period marked a stark contrast with notable underperformers facing downward market pressures, possibly indicating short-term market volatility dynamics.

| Stock | Performance (%) | Performance |

|---|---|---|

| EQIX | 2.44 | |

| PSA | 2.08 | |

| CCI | 1.03 | |

| CBRE | 0.19 | |

| SPG | -1.35 | |

| DLR | -1.98 | |

| WY | -1.99 | |

| AMT | -2.02 | |

| PLD | -2.78 | |

| WELL | -3.59 |

Real Estate Stocks Performance One Month 📊

The monthly performance gives a broader perspective where PSA leads the gainers with a 2.58% rise, while CBRE suffered the most with a -6.80% decrease. This suggests stronger mid-term growth potential for some stocks despite ongoing headwinds affecting others.

| Stock | Performance (%) | Performance |

|---|---|---|

| PSA | 2.58 | |

| EQIX | 2.32 | |

| CCI | 0.85 | |

| DLR | -0.95 | |

| WELL | -1.18 | |

| PLD | -2.17 | |

| SPG | -3.20 | |

| WY | -3.84 | |

| AMT | -6.16 | |

| CBRE | -6.80 |

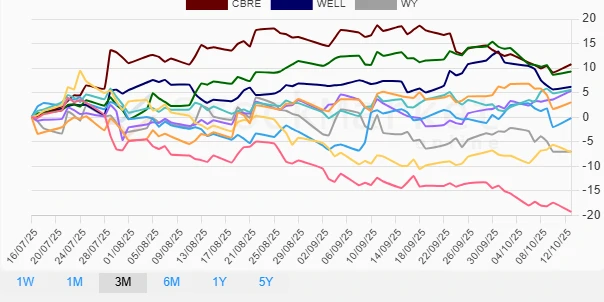

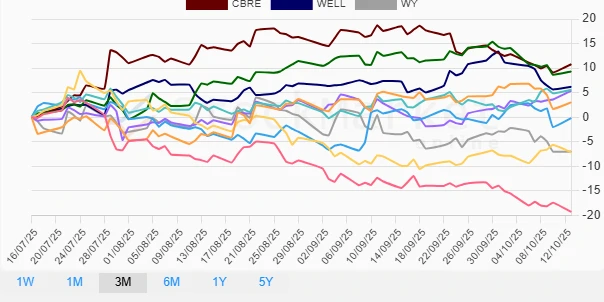

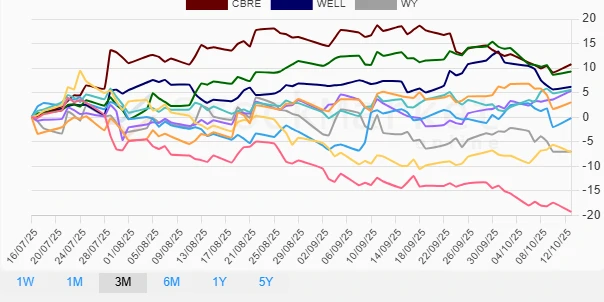

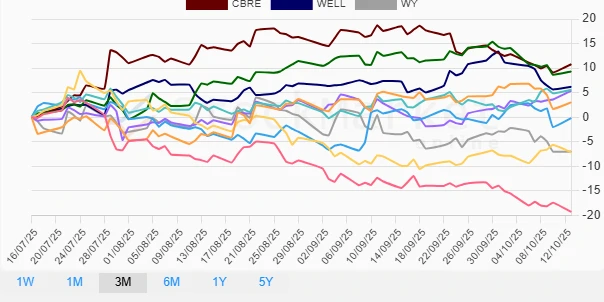

Real Estate Stocks Performance Three Months 📊

Over three months, CBRE has shown the most significant improvement with a 10.78% increase, whereas AMT suffered a -19.26% decline. This highlights a diverse trajectory in the real estate sector where certain stocks exhibit resilience and capital growth potential, while others continue to grapple with headwinds.

| Stock | Performance (%) | Performance |

|---|---|---|

| CBRE | 10.78 | |

| SPG | 9.31 | |

| WELL | 6.19 | |

| EQIX | 5.57 | |

| PSA | 5.38 | |

| PLD | 3.03 | |

| DLR | -0.20 | |

| WY | -7.00 | |

| CCI | -7.14 | |

| AMT | -19.26 |

Summary 📈

The analysis shows a fluctuating landscape in the real estate sector, with clear discrepancies in performance across major stocks. Over the short to medium term, select stocks like CBRE and SPG have exhibited potential for growth, likely offering viable investment opportunities. Conversely, stocks like AMT have faced challenges, indicating potential risks that warrant cautious monitoring. It's essential for investors to conduct further due diligence and align their strategies with market trends for optimal positioning.