October 23, 2025 a 07:46 am

RSG: Dividend Analysis - Republic Services, Inc.

With a long-standing history in dividend distributions, Republic Services, Inc. exemplifies a stable dividend investment. Despite modest growth rates, the company's consistency appeals to income-focused investors. However, recent dividend cuts indicate caution amidst external economic pressures.

📊 Overview

Republic Services, Inc., operating in the waste management sector, presents itself as a reliable dividend payer. Despite a relatively low dividend yield of 1.06%, the company's consistency over 23 years underscores its commitment to returning value to shareholders. However, the 2024 suspension marks a critical turn in their cash flow management strategy.

| Metric | Value |

|---|---|

| Sector | Waste Management |

| Dividend yield | 1.06% |

| Current dividend per share | 2.19 USD |

| Dividend history | 23 years |

| Last cut or suspension | 2024 |

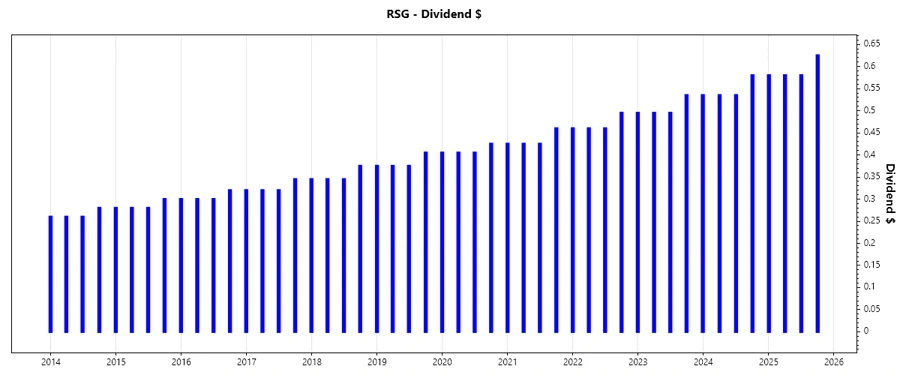

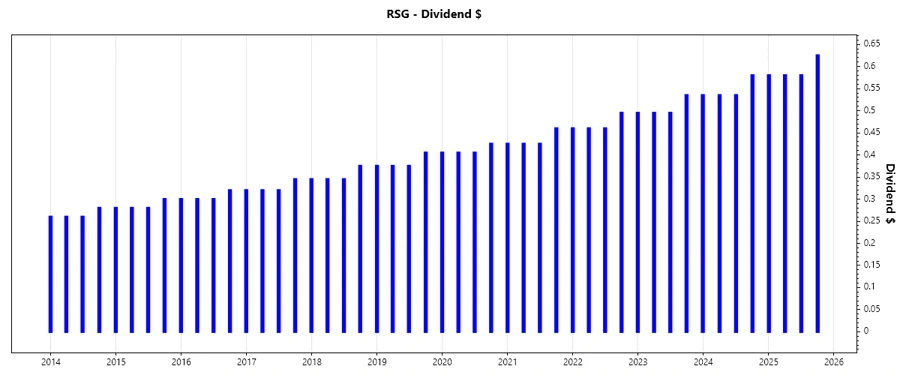

🗣️ Dividend History

The recent dividend payment history of Republic Services indicates a fluctuating yet gradually increasing trend. Maintaining and growing dividends for over two decades emphasizes their prioritization of shareholder returns amidst varying market challenges.

| Year | Dividend Per Share (USD) |

|---|---|

| 2025 | 2.365 |

| 2024 | 1.650 |

| 2023 | 2.060 |

| 2022 | 1.910 |

| 2021 | 1.770 |

📈 Dividend Growth

Dividend growth is a crucial indicator of financial health and future potential returns for investors. Republic Services exhibits a very slight growth over both the three and five-year periods, which suggests stability but perhaps limits on aggressive expansion.

| Time | Growth |

|---|---|

| 3 years | -2.31% |

| 5 years | 1.13% |

The average dividend growth is 1.13% over 5 years. This shows moderate but steady dividend growth.

✅ Payout Ratio

Monitoring payout ratios can provide insights into a company's ability to sustain its dividend payouts. The EPS-based payout ratio of 32.23% and the FCF-based ratio of 28.95% suggest a prudent dividend policy that balances shareholder returns with reinvestment needs.

| Key figure | Ratio |

|---|---|

| EPS-based | 32.23% |

| Free cash flow-based | 28.95% |

The current payout ratios reflect a disciplined approach to dividend distribution, ensuring sustainability even amidst changing market conditions.

Cashflow & Capital Efficiency

Effective capital and cash flow management is central to sustaining dividend capabilities. Republic Services demonstrates strong performance metrics that support its operational efficiency.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Free Cash Flow Yield | 3.29% | 3.81% | 4.25% |

| Earnings Yield | 3.23% | 3.32% | 3.64% |

| CAPEX to Operating Cash Flow | 43.35% | 45.09% | 45.58% |

| Stock-based Compensation to Revenue | 0.26% | 0.27% | 0.29% |

| Free Cash Flow / Operating Cash Flow Ratio | 52.87% | 54.91% | 54.42% |

| Return on Invested Capital | 9.18% | 7.97% | 7.48% |

The cash flow and capital efficiency metrics indicate a solid and consistent capacity to generate sufficient cash, supporting growth initiatives and dividend payments.

Balance Sheet & Leverage Analysis

An examination of leverage ratios reveals the financial flexibility of Republic Services. The company's calculated leverage indicates a balanced approach to capital management.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Debt-to-Equity | 1.14 | 1.24 | 1.25 |

| Debt-to-Assets | 39.99% | 41.61% | 41.58% |

| Debt-to-Capital | 53.19% | 55.35% | 55.50% |

| Net Debt to EBITDA | 2.62 | 2.99 | 3.26 |

| Current Ratio | 0.66 | 0.56 | 0.70 |

| Quick Ratio | 0.56 | 0.54 | 0.67 |

| Financial Leverage | 2.84 | 2.98 | 3.00 |

The leverage ratios reflect a well-managed debt structure, maintaining the company’s liquidity and operational capabilities.

Fundamental Strength & Profitability

Profitability metrics showcase Republic Services' ability to deliver consistent earnings. Strong returns on equity and assets reflect management efficiency.

| Metric | 2024 | 2023 | 2022 |

|---|---|---|---|

| Return on Equity | 18.31% | 16.42% | 15.36% |

| Return on Assets | 6.36% | 5.51% | 5.12% |

| Net Margin | 12.74% | 11.57% | 11.01% |

| EBIT Margin | 18.60% | 18.18% | 16.42% |

| EBITDA Margin | 29.71% | 28.87% | 27.08% |

| Gross Margin | 30.55% | 29.56% | 28.61% |

| Research & Development to Revenue | 0% | 0% | 0% |

The data reflects consistent profitability, with margins indicating effective cost management and strategic investments, ensuring robust earnings across cycles.

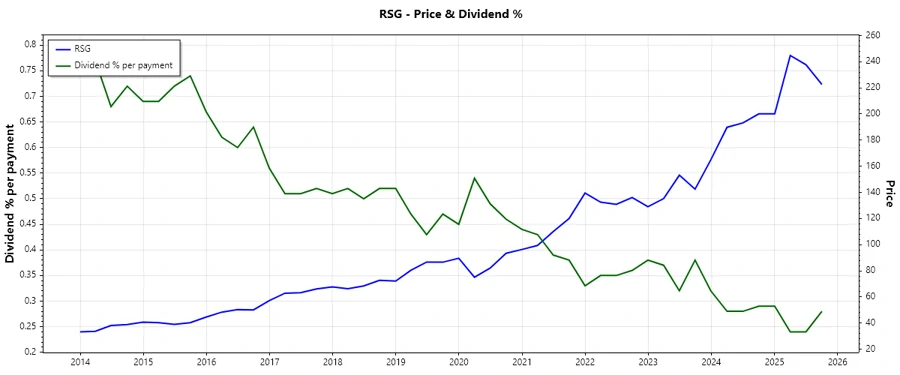

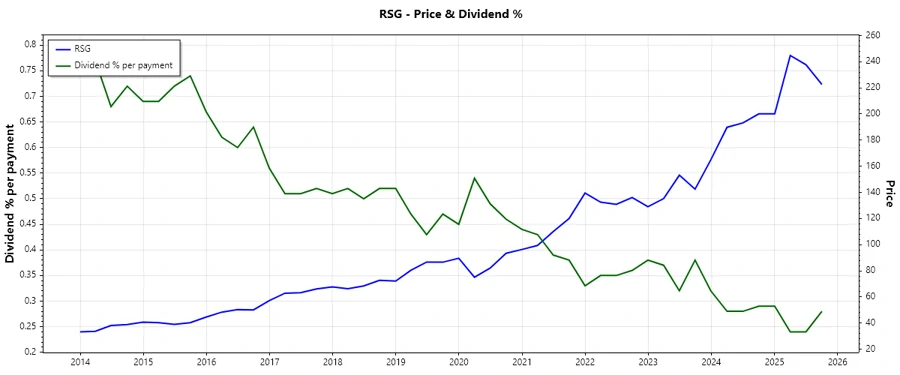

📈 Price Development

Dividend Scoring System

An evaluation of key dividend criteria reveals the current standings of Republic Services in maintaining shareholder value.

| Category | Score | |

|---|---|---|

| Dividend yield | 2 | |

| Dividend Stability | 4 | |

| Dividend growth | 2 | |

| Payout ratio | 3 | |

| Financial stability | 3 | |

| Dividend continuity | 2 | |

| Cashflow Coverage | 4 | |

| Balance Sheet Quality | 4 |

Total Score: 24/40

Rating

Republic Services, Inc. offers a stable but ultimately subdued dividend spectrum. While the company maintains strong financial metrics to underpin distributions, a cautious approach is advisable given recent cuts. Consideration for inclusion in income-focused portfolios remains, contingent on risk appetite and market conditions.