December 10, 2025 a 06:44 am

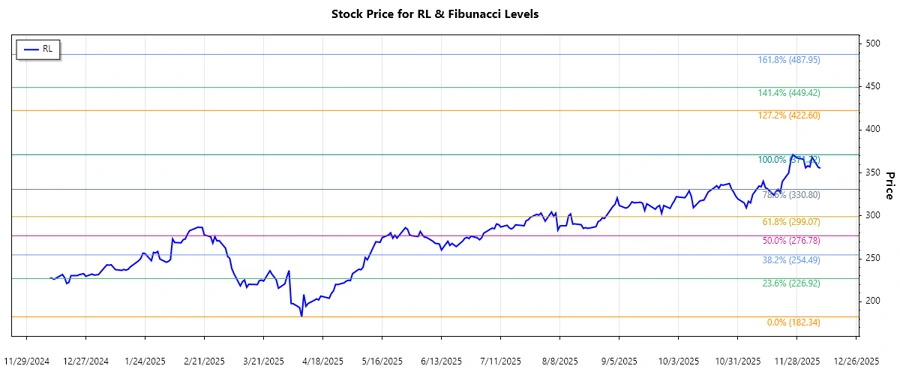

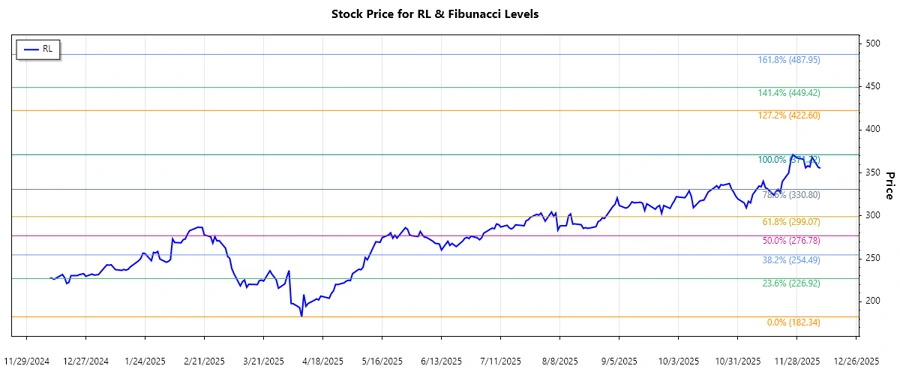

RL: Fibonacci Analysis - Ralph Lauren Corporation

The Ralph Lauren Corporation (Ticker: RL) showcases a strong historical performance across diversified lifestyle products. Its expansive reach globally provides a buffer against regional market fluctuations. In recent trading sessions, the stock has demonstrated resilient trends, offering potential strategic entry points for investors, depending on broader economic conditions and market sentiment.

Fibonacci Analysis

| Parameter | Details |

|---|---|

| Trend Analysis Period | 2025-04-08 to 2025-12-09 |

| High Price | $371.22 on 2025-11-26 |

| Low Price | $182.34 on 2025-04-08 |

Fibonacci Retracement Levels

| Level | Price |

|---|---|

| 23.6% | $288.24 |

| 38.2% | $312.09 |

| 50.0% | $326.78 |

| 61.8% | $341.46 |

| 78.6% | $360.52 |

The current stock price of $355.53 lies in the 78.6% retracement zone. This price level may serve as a technical resistance, suggesting a potential reversal or continuation based on further market catalysts.

Conclusion

The upward trend observed from April to December 2025 for Ralph Lauren Corporation presents opportunities for investors, although attention should be given to the resistances around the 78.6% Fibonacci level. A sustained break above this level could indicate continued bullish momentum, while failure to breach might lead to consolidation or correction. As a fashion and lifestyle leader, the company can capitalize on global expansion; however, it remains sensitive to economic downturns and consumer spending shifts.