February 13, 2026 a 02:47 am

RF: Dividend Analysis - Regions Financial Corporation

Regions Financial Corporation offers a consistent dividend profile with a 3.51% yield, supported by decades of stable dividend histories and prudent financial management. Its low payout ratios suggest a sustainable dividend, while historical growth highlights a commitment to returning capital to shareholders. Despite lower recent dividend growth, the company's robust capital position warrants attention.

📊 Overview

The Regions Financial Corporation operates in a dynamic sector, influenced by macroeconomic shifts. Its attractive dividend yield of 3.51% and a substantial 41 years of dividend payment record underline a stable shareholder return approach.

| Data | Value |

|---|---|

| Sector | Financial Services |

| Dividend yield | 3.51% |

| Current dividend per share | 1.03 USD |

| Dividend history | 41 years |

| Last cut or suspension | None |

🗓️ Dividend History

A prolonged dividend-paying track record is crucial for income-focused investors. The historical payment data signals financial resilience even through market volatility.

| Year | Dividend per Share (USD) |

|---|---|

| 2026 | 0.265 |

| 2025 | 1.03 |

| 2024 | 0.98 |

| 2023 | 0.88 |

| 2022 | 0.74 |

📈 Dividend Growth

Analyzing the growth pattern offers insight into the management's future outlook and capacity for enhancing shareholder value. A consistent increase reflects operational strength and growth intent.

| Time | Growth |

|---|---|

| 3 years | 11.65% |

| 5 years | 10.69% |

The average dividend growth is 10.69% over 5 years. This shows moderate but steady dividend growth.

💼 Payout Ratio

The payout ratio helps assess dividend sustainability by comparing earnings against payments. A lower ratio often suggests a cushion for future payments or reinvestment.

| Key figure | Ratio |

|---|---|

| EPS-based | 41.80% |

| Free cash flow-based | 40.25% |

With a 41.80% payout from EPS and 40.25% from free cash flow, the ratios portray a balanced approach, indicating room for either dividend consistency or future expansion.

🔍 Cashflow & Capital Efficiency

Effective cash flow management sustains operational excellence and investor confidence. Analyzing efficiency ratios reveals how astutely resources are utilized.

| Metric | 2025 | 2024 | 2023 |

|---|---|---|---|

| Free Cash Flow Yield | - | 6.74% | 11.86% |

| Earnings Yield | 9.09% | 8.79% | 11.43% |

| CAPEX to Operating Cash Flow | - | 9.14% | 6.80% |

| Stock-based Compensation to Revenue | 0.00% | 0.00% | 0.00% |

| Free Cash Flow / Operating Cash Flow Ratio | 0% | 90.86% | 93.20% |

Cash flow metrics, especially the stability of free cash flow yield, affirm the firm's efficient capital allocation and robust financial posture.

📉 Balance Sheet & Leverage Analysis

Assessing debt metrics and liquidity ratios provides insights into the company’s solvency and risk management framework.

| Metric | 2025 | 2024 | 2023 |

|---|---|---|---|

| Debt-to-Equity | 0.26 | 0.36 | 0.13 |

| Debt-to-Assets | 0.03 | 0.04 | 0.02 |

| Debt-to-Capital | 0.20 | 0.27 | 0.12 |

| Net Debt to EBITDA | -2.15 | -1.69 | -1.57 |

| Current Ratio | 0.30 | - | - |

| Quick Ratio | 0.30 | 0.27 | 0.28 |

| Financial Leverage | 8.38 | 8.80 | 8.73 |

The low debt levels and healthy leverage ratios suggest a well-managed capital structure with ample capacity for meeting obligations and potential growth.

✅ Fundamental Strength & Profitability

Profitability metrics highlight the firm’s efficiency in converting revenue to profit, crucial for assessing operational effectiveness.

| Metric | 2025 | 2024 | 2023 |

|---|---|---|---|

| Return on Equity | 11.32% | 10.59% | 11.90% |

| Return on Assets | 1.35% | 1.20% | 1.36% |

| Margins: Net | 22.4% | 20.2% | 22.7% |

| EBIT | 28.5% | 25.1% | 28.5% |

| EBITDA | 29.2% | 26.6% | 31.1% |

| Gross | 74.6% | 70.4% | 76.7% |

| Research & Development to Revenue | 0% | 0% | 0% |

Stable profitability metrics, particularly the return on equity and various margins, accentuate the strategic competence and operational efficacy of Regions Financial Corporation.

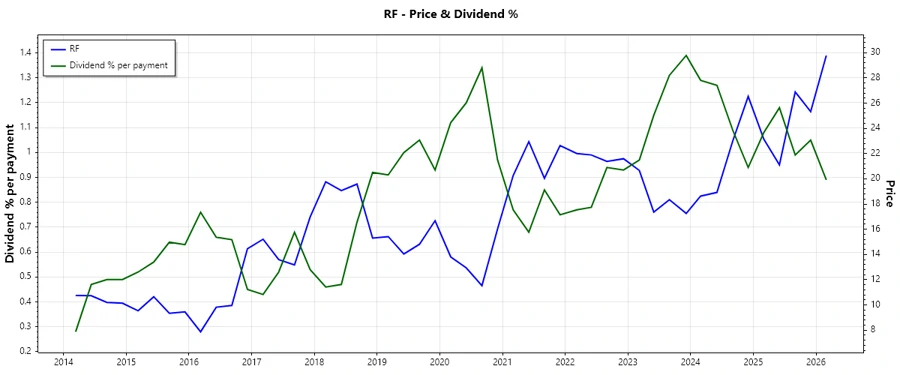

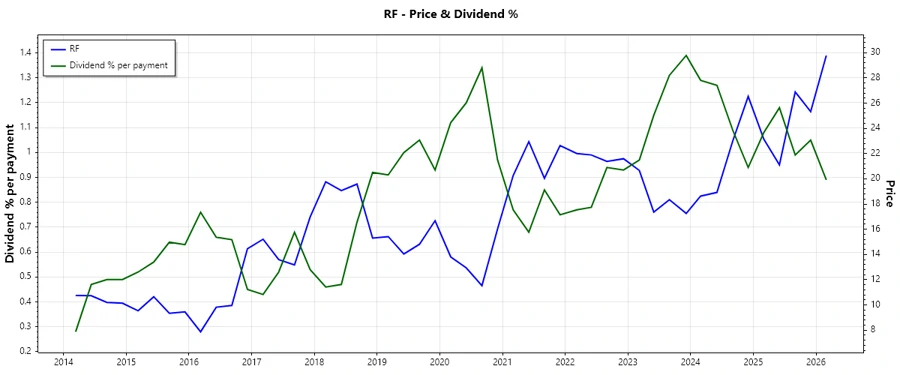

📊 Price Development

🔍 Dividend Scoring System

| Criteria | Score | Score Bar |

|---|---|---|

| Dividend yield | 4 | |

| Dividend Stability | 5 | |

| Dividend growth | 3 | |

| Payout ratio | 4 | |

| Financial stability | 5 | |

| Dividend continuity | 5 | |

| Cashflow Coverage | 4 | |

| Balance Sheet Quality | 5 |

Total Score: 35/40

📋 Rating

The comprehensive dividend and financial analysis of Regions Financial Corporation underlines its robust dividend approach and operational effectiveness. The company emerges as a strong dividend player with commendable financial stability, offering moderate growth prospects but ensuring consistent returns. This positions RF as a favorable option for income-seeking investors.