September 24, 2025 a 10:16 am

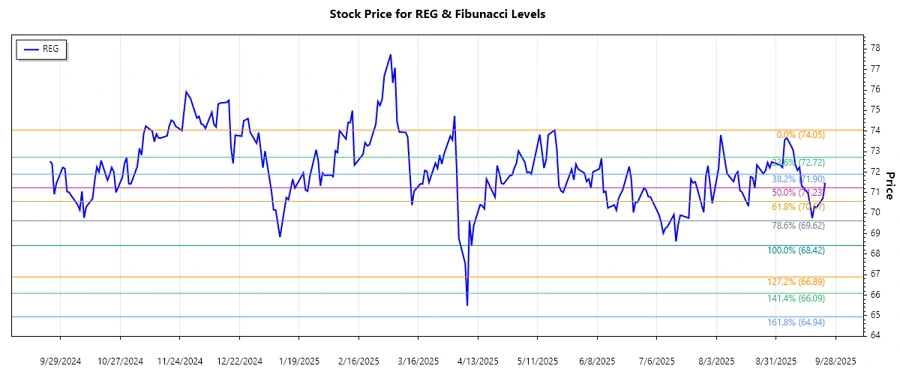

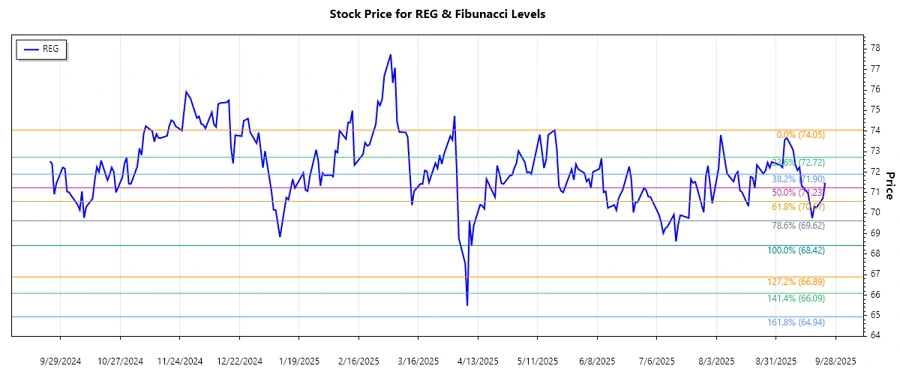

REG: Fibonacci Analysis - Regency Centers Corporation

The Regency Centers Corporation has demonstrated a steady performance in the real estate investment trust (REIT) sector, focusing on affluent shopping centers. With a diversified portfolio of thriving properties and a presence in high-demand trade areas, it continues to leverage its position as a key player in retail real estate. Notably, its strategic alignments with productive grocers and best-in-class retailers are indicative of sustainable long-term growth.

Fibonacci Analysis

| Parameter | Details |

|---|---|

| Trend Start Date | 2025-05-19 |

| Trend End Date | 2025-09-23 |

| High Point Price & Date | $74.05 on 2025-05-19 |

| Low Point Price & Date | $68.42 on 2025-04-10 |

| Fibonacci Level 0.236 | $72.75 |

| Fibonacci Level 0.382 | $72.08 |

| Fibonacci Level 0.5 | $71.23 |

| Fibonacci Level 0.618 | $70.38 |

| Fibonacci Level 0.786 | $69.28 |

| Current Retracement Zone | 0.5 (around $71.23) |

| Technical Interpretation | Current price suggests a potential support in the 0.5 retracement level, indicating a possible bullish reversal if maintained above this point. |

Conclusion

In conclusion, Regency Centers Corporation, while facing some downward pressure recently, remains poised at a critical support level suggested by the Fibonacci retracement analysis. This might offer an attractive entry point for investors looking at technical indicators. However, analysts should remain aware of broader market conditions and potential changes in consumer behavior affecting retail properties. The continued strength of strategic retailer partnerships can serve as a buffer against market volatility. Investors are advised to watch for any deviations from this technical level, as they might signal a more significant trend change.