November 29, 2025 a 12:46 pm

PWR: Dividend Analysis - Quanta Services, Inc.

Quanta Services, Inc. (PWR) exhibits a consistently stable dividend history with moderate growth. The company's robust payout ratios and strong financial stability position it as a reliable investment for dividend-seeking investors. Potential investors should consider the strategic sector presence and growth factors.

📊 Overview

Quanta Services, Inc., operating in a strategic sector, provides a competitive dividend yield of 0.09%, with a current dividend per share of 0.37 USD. Maintaining a dividend history for 9 years, the company nonetheless witnessed a dividend cut or suspension in 2026.

| Metric | Value |

|---|---|

| Sector | Engineering & Construction Services |

| Dividend yield | 0.09% |

| Current dividend per share | 0.37 USD |

| Dividend history | 9 years |

| Last cut or suspension | 2026 |

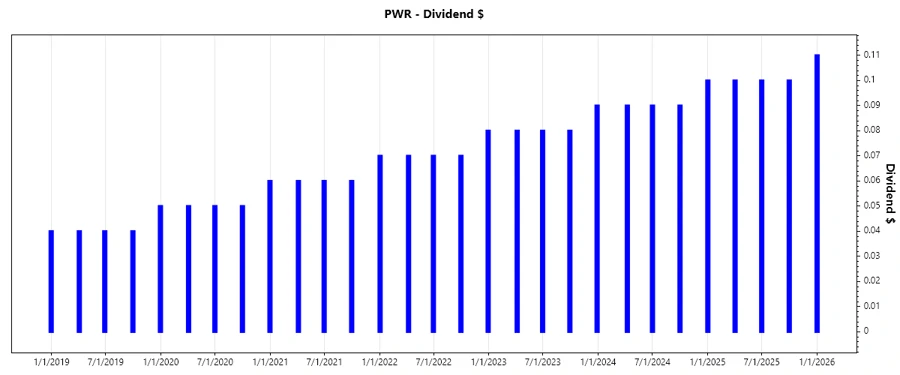

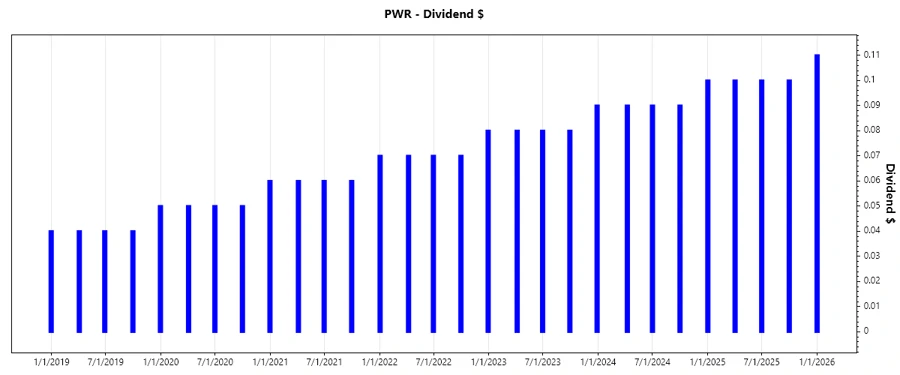

🗣️ Dividend History

The importance of a company’s dividend history cannot be overemphasized as it indicates the company's commitment to returning value to shareholders. Consistency in dividend payments may also reflect stable financial health and profit growth.

| Year | Dividend per Share (USD) |

|---|---|

| 2026 | 0.11 |

| 2025 | 0.40 |

| 2024 | 0.27 |

| 2023 | 0.33 |

| 2022 | 0.36 |

📈 Dividend Growth

Analyzing the dividend growth of a company helps investors understand how the company’s distributions are expanding over time. Steady and consistent growth often reflects positively on the company’s future outlook.

| Time | Growth |

|---|---|

| 3 years | 14.47% |

| 5 years | 9.69% |

The average dividend growth is 9.69% over 5 years. This shows moderate but steady dividend growth.

✅ Payout Ratio

The payout ratio is a critical metric in assessing how much of a company’s earnings are distributed as dividends, which helps in evaluating the sustainability of the dividends.

| Key Figure | Ratio |

|---|---|

| EPS-based | 5.40% |

| Free cash flow-based | 4.37% |

The EPS-based payout ratio of 5.40% and FCF-based payout ratio of 4.37% indicate a sufficiently covered dividend, showcasing good financial health.

🧮 Cashflow & Capital Efficiency

Understanding the cashflow and capital efficiency ratios helps assess a company's financial stability and the effective use of its resources.

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Free Cash Flow Yield | 3.43% | 3.64% | 3.18% |

| Earnings Yield | 2.40% | 2.38% | 1.95% |

| CAPEX to Operating Cash Flow | 37.93% | 27.59% | 29.03% |

| Stock-based Compensation to Revenue | 0.62% | 0.61% | 0.64% |

| Free Cash Flow / Operating Cash Flow Ratio | 62.07% | 72.41% | 70.97% |

The metrics highlight robust cashflow management and efficient capital allocation, indicating sound financial footing.

⚖️ Balance Sheet & Leverage Analysis

Evaluating the balance sheet and leverage ratios elucidates the company's financial stability, liquidity, and debt management practices.

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Debt-to-Equity | 0.74 | 0.71 | 0.61 |

| Debt-to-Assets | 0.30 | 0.27 | 0.24 |

| Debt-to-Capital | 0.42 | 0.42 | 0.38 |

| Net Debt to EBITDA | 2.41 | 1.79 | 1.73 |

| Current Ratio | 1.63 | 1.47 | 1.30 |

| Quick Ratio | 1.59 | 1.44 | 1.26 |

| Financial Leverage | 2.50 | 2.59 | 2.55 |

Notable leverage ratios and liquidity measures underscore the company’s solid financial structure and adept management of its financial obligations.

💡 Fundamental Strength & Profitability

Examining the fundamental strength and profitability ratios provides keen insights into the company's operational effectiveness and efficiency in value creation.

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Return on Equity (ROE) | 9.12% | 11.87% | 12.36% |

| Return on Assets (ROA) | 3.65% | 4.58% | 4.84% |

| Net Margin | 2.88% | 3.57% | 3.82% |

| EBIT Margin | 4.85% | 5.54% | 5.98% |

| EBITDA Margin | 8.63% | 8.48% | 9.11% |

| Gross Margin | 12.74% | 12.68% | 13.21% |

| Research & Development to Revenue | 0.00% | 0.00% | 0.00% |

The robust ROE and consistent margins convey effective strategic management, positioning Quanta Services favorably for continued growth and profitability.

📉 Price Development

🔍 Dividend Scoring System

| Category | Score | |

|---|---|---|

| Dividend yield | 2 | |

| Dividend Stability | 4 | |

| Dividend growth | 3 | |

| Payout ratio | 5 | |

| Financial stability | 4 | |

| Dividend continuity | 3 | |

| Cashflow Coverage | 4 | |

| Balance Sheet Quality | 5 |

Overall Score: 30/40

✅ Rating

Quanta Services, Inc. presents an attractive prospect for dividend investors due to its strong financial metrics, moderate dividend growth, and sound payout ratios. However, potential investors should remain cautious due to the recent dividend suspension. Overall, the company's fundamental stability and efficient capital management support a favorable long-term investment outlook.