May 24, 2025 a 02:03 pm

PFG: Trend and Support & Resistance Analysis - Principal Financial Group, Inc.

The recent analysis of Principal Financial Group, Inc. (PFG) shows a varied market performance over the past few months. With a focus on retirement, asset management, and insurance products, PFG is a versatile company in a competitive financial landscape. The company's stock has experienced fluctuations, presenting both opportunities and risks for investors. This detailed analysis will explore the dominant trend, along with support and resistance levels to provide a clear outlook on potential price movements.

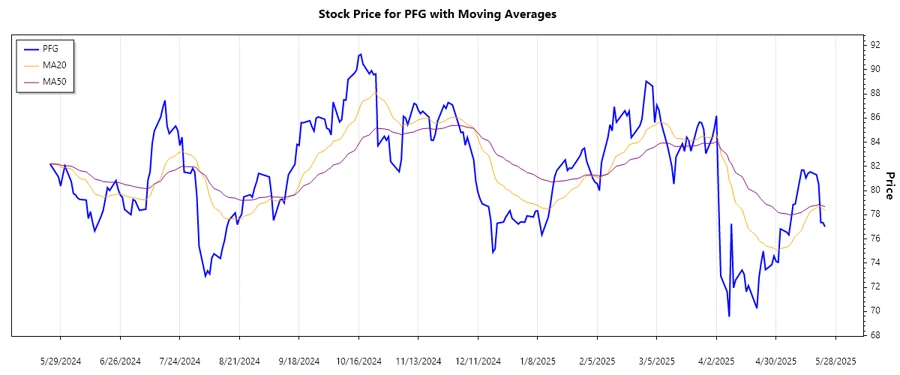

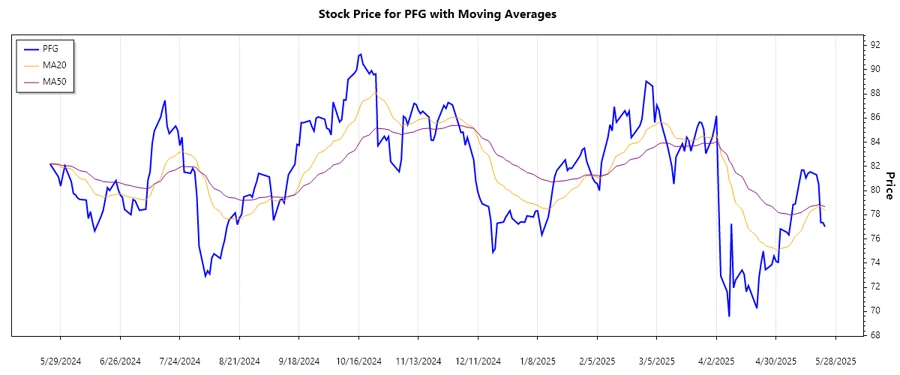

Trend Analysis

Analyzing the historical data of PFG shows a complex price movement with recent declines followed by periods of recovery. In the latest period, the 20-day EMA (Exponential Moving Average) is lower than the 50-day EMA, indicating an overall downward trend. This is further corroborated by the price action, showing potential risk for investors if the downtrend continues.

| Date | Close Price | Trend |

|---|---|---|

| 2025-05-23 | $77.01 | ▼ |

| 2025-05-22 | $77.35 | ▼ |

| 2025-05-21 | $77.36 | ▼ |

| 2025-05-20 | $80.53 | ▼ |

| 2025-05-19 | $81.30 | ▼ |

| 2025-05-16 | $81.55 | ▼ |

| 2025-05-15 | $81.42 | ▼ |

The current downward trend indicates caution for investors as prices are finding lower highs. Continued monitoring of the EMAs is suggested to identify any potential shifts in trend direction.

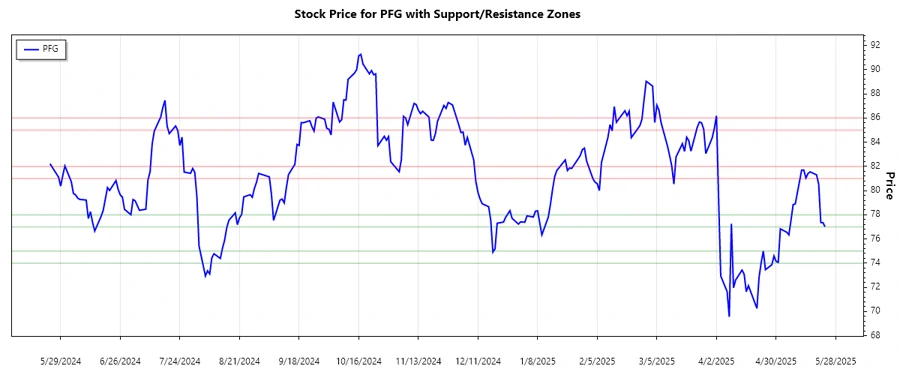

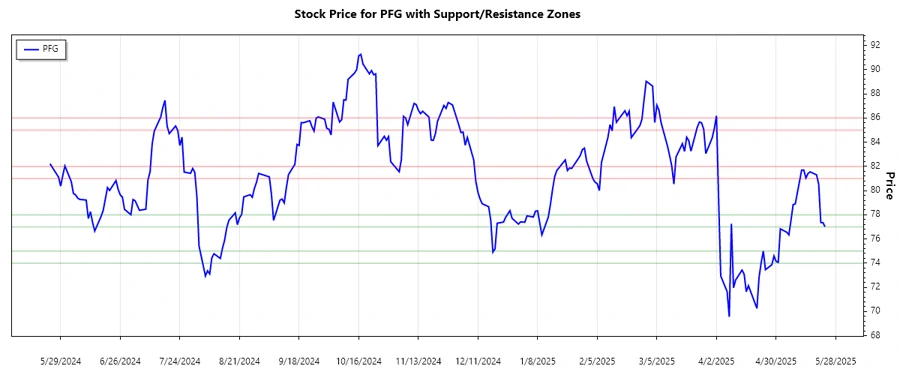

Support and Resistance

After analyzing the price data, key support and resistance levels have been identified. The recent dip suggests that prices are approaching critical support zones.

| Zone | From | To |

|---|---|---|

| Support 1 | $77.00 | $78.00 |

| Support 2 | $74.00 | $75.00 |

| Resistance 1 | $81.00 | $82.00 |

| Resistance 2 | $85.00 | $86.00 |

The current price of $77.01 is within the Support 1 zone, suggesting a possible stabilization or reversal point. Investors should observe these levels to make informed decisions on entering or exiting positions.

Conclusion

The analysis of Principal Financial Group, Inc. indicates a prevailing downward trend that investors should carefully consider alongside the identified support and resistance levels. The current position within a support zone may offer potential buying opportunities if a reversal occurs. However, given the downward trajectory of the EMAs, risk management strategies should be prioritized. The financial services sector remains competitive, and PFG's diverse portfolio positions it well for long-term resilience, provided it can navigate short-term market volatility effectively.