August 13, 2025 a 03:15 am

ORCL: Trend and Support & Resistance Analysis - Oracle Corporation

Oracle Corporation has showcased significant momentum over the past months. The company remains a key player in the technology sector, with its extensive cloud services and enterprise solutions driving growth. Investors should consider the identified trends and support/resistance levels when evaluating trading opportunities in ORCL stock. With a strong business environment, Oracle continues to bring value through innovation and robust infrastructure solutions.

Trend Analysis

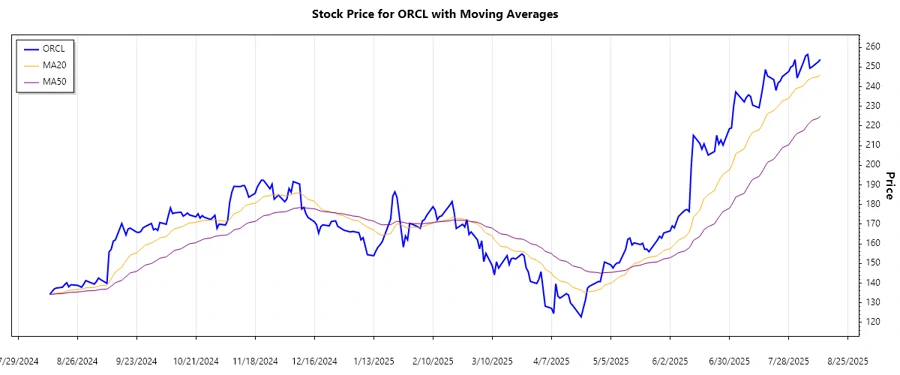

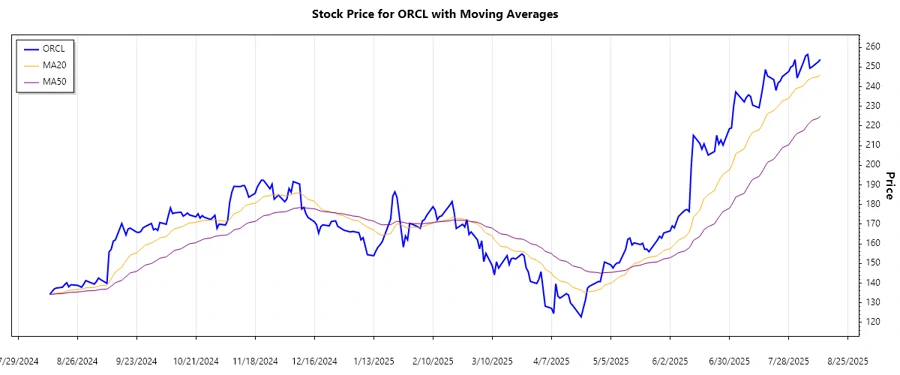

Upon analysis of the historical closing prices, the Exponential Moving Averages (EMAs) for 20 and 50 days are calculated to gauge the trend. Based on the data, the recent EMA20 is above the EMA50, indicating an 📈 upward trend.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-08-12 | 253.86 | 📈 |

| 2025-08-11 | 252.68 | 📈 |

| 2025-08-08 | 250.05 | 📈 |

| 2025-08-07 | 249.39 | 📈 |

| 2025-08-06 | 256.43 | 📈 |

| 2025-08-05 | 255.67 | 📈 |

| 2025-08-04 | 252.53 | 📈 |

The persistence of the recent upward movement suggests a continuation of bullish sentiment in the market.

Support and Resistance

The analysis identifies key levels of support and resistance based on the historical closing price data.

| Zone Type | From | To | |

|---|---|---|---|

| Resistance | 253.00 | 256.00 | 🔼 |

| Resistance | 245.00 | 248.00 | 🔼 |

| Support | 234.00 | 237.00 | 🔽 |

| Support | 229.00 | 232.00 | 🔽 |

The current price level is within a resistance zone, indicating potential challenges in breaking further upward.

Conclusion

Oracle's stock has shown a consistent upward trend, reinforced by strong EMA indicators. While the presence within a resistance zone implies caution, it also suggests a potential breakout if upward momentum continues. Long-term prospects remain robust owing to Oracle's strategic positioning in the tech sector and its expansive cloud infrastructure offerings. However, investors need to consider broader market conditions and Oracle's operational performance. The current analysis provides a balanced perspective on potential entry and exit points, aiding informed decision-making.