July 24, 2025 a 04:04 amSure, let's create the structured analysis for ON Semiconductor Corporation's stock using the provided dataset. Below is the HTML structure for your analysis, followed by a JSON object summarizing the key trends and support/resistance zones.

ON: Trend and Support & Resistance Analysis - ON Semiconductor Corporation

ON Semiconductor Corporation provides innovative and sustainable solutions for the automotive and energy industries. The company has shown a strong upward trend over recent months, with significant price volatility. Investors should note both the upward potential and inherent risks in the semiconductors sector.

Trend Analysis

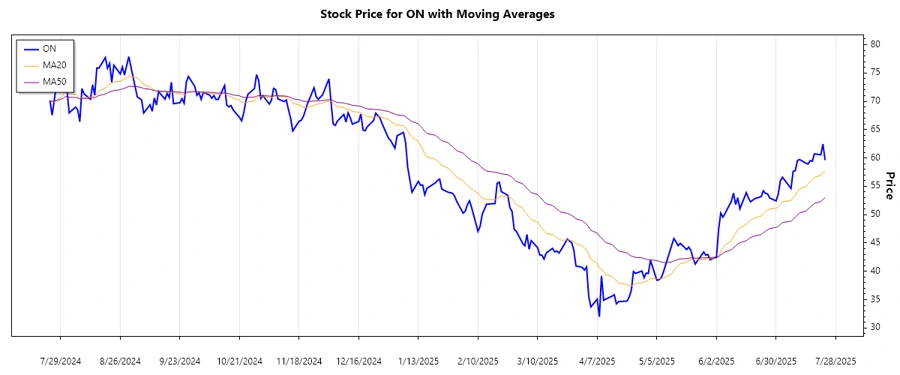

The recent data of ON Semiconductor Corporation exhibits noticeable volatility followed by periods of gains. The EMA20 has crossed above the EMA50, indicating a potential upward trend. Let's examine the past 7 days in detail.

| Date | Close Price | Trend |

|---|---|---|

| 2025-07-23 | $59.61 | ⚖️ Sideways |

| 2025-07-22 | $62.45 | ▲ Up |

| 2025-07-21 | $60.55 | ▲ Up |

| 2025-07-18 | $60.72 | ▲ Up |

| 2025-07-17 | $59.41 | ▼ Down |

| 2025-07-16 | $59.52 | ⚖️ Sideways |

| 2025-07-15 | $58.93 | ▼ Down |

The crossing of EMA indicators suggests a cautious bullish outlook. Investors may expect potential growth, although contingent on broader market conditions and sector-specific news.

Support and Resistance

When examining the historical data, key support and resistance zones have been identified which provide insight into potential price bounds.

| Zone Type | From | To |

|---|---|---|

| Support Zone 1 | $50.00 | $53.00 |

| Support Zone 2 | $55.00 | $56.50 |

| Resistance Zone 1 | $62.00 | $65.00 |

| Resistance Zone 2 | $67.00 | $70.00 |

Currently, the price is just below the lower boundary of the first resistance zone, indicating potential challenges ahead. Analysts should watch for a breakout above this zone for possible further gains.

Conclusion

The ON Semiconductor Corporation is navigating a dynamic market landscape, with signals pointing towards a nascent upward trend. The identification of support and resistance zones provides a framework for traders to anticipate potential price reversals or breakouts. Investors should remain apprised of sector trends and broader economic conditions which could influence stock performance. With the automotive and energy sectors continuing to evolve, ON Semiconductor stands positioned to capitalize on emerging opportunities, though risks persist due to market volatility and competitive pressures.

And here's the corresponding JSON formatted output: