August 21, 2025 a 04:28 am

NZDJPY: Trend and Support & Resistance Analysis

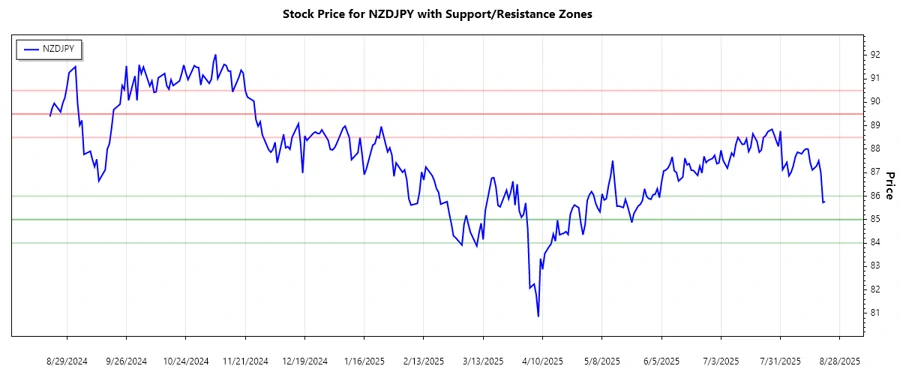

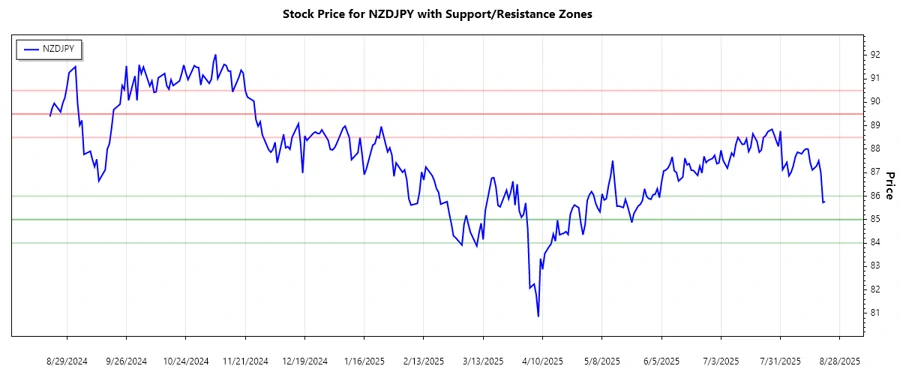

The NZDJPY pair has demonstrated varied movement patterns recently. Technical indicators signal that the currency is experiencing moderate volatility, with potential directional shifts influenced by global economic factors. Investors should remain cautious but opportunistic, considering both potential upward momentum and downside risks.

Trend Analysis

The NZDJPY currency showed a mixed trend over the past months. Calculating the EMA values, it is noted that the EMA20 is currently slightly below the EMA50. This indicates a ▼ Abwärtstrend, suggesting a bearish sentiment is dominating the market. Below is a snapshot of the past 7 days:

| Date | Closing Price | Trend |

|---|---|---|

| 2025-08-21 | 85.767 | ▼ |

| 2025-08-20 | 85.730 | ▼ |

| 2025-08-19 | 86.996 | ▲ |

| 2025-08-18 | 87.501 | ▲ |

| 2025-08-17 | 87.285 | ▲ |

| 2025-08-15 | 87.113 | ▲ |

| 2025-08-14 | 87.426 | ▲ |

The short-term bearish crossover suggests cautious trading. The graph reflects descending trends and possible support breaking.

Support and Resistance

Key support and resistance levels reveal crucial trading zones. Calculations suggest two primary support levels at 86.0 and 85.0 and resistance at 88.5 and 89.5:

| Zone | From | To | Direction |

|---|---|---|---|

| Support 1 | 85.0 | 86.0 | ▼ |

| Support 2 | 84.0 | 85.0 | ▼ |

| Resistance 1 | 88.5 | 89.5 | ▲ |

| Resistance 2 | 89.5 | 90.5 | ▲ |

Currently, the price resides between the first support zone, indicating potential for downside pressure. Breakouts or bounces at these levels could dictate future movements.

Conclusion

The NZDJPY currency pair is presenting more downside risks with signs of bearish trends in shorter moving averages. However, resilience at support zones may attract buyers. Key economic indicators and geopolitical events could shift the current balance. Investors should closely monitor the EMA20/EMA50 positions while being prepared for potential reversals or escalated declines. Amidst potential risks, opportunities exist for those vigilant of timely entry and exit strategies. Overall, the strategy should be guided by strong risk management and observance of market signals.