October 11, 2025 a 10:15 am

NOC: Fibonacci Analysis - Northrop Grumman Corporation

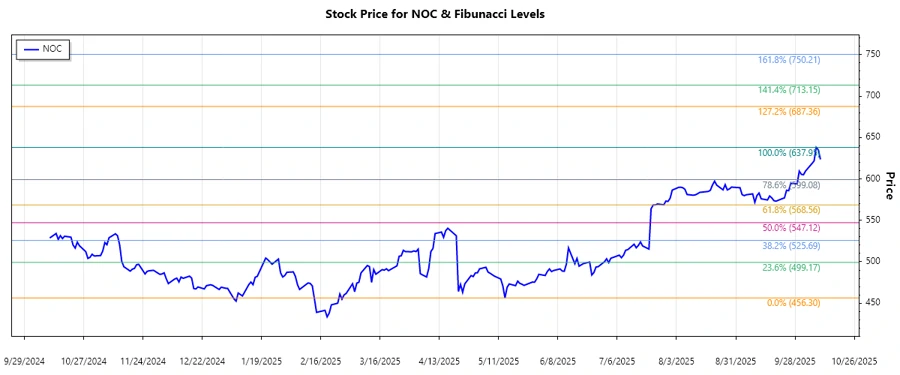

The Northrop Grumman Corporation (NOC) has been influenced predominantly by an uptrend in the analyzed period, positioning itself strongly within the aerospace and defense industry. As an industry leader offering a diverse range of systems in aeronautics, defense, and space, its recent price movements reflect a robust investor confidence. The trend analysis suggests a significant trajectory, potentially highlighting a strategic positioning within the market.

Fibonacci Analysis

| Trend Details | Values |

|---|---|

| Start Date | 2025-06-13 |

| End Date | 2025-10-10 |

| High Point (Price & Date) | $637.95 on 2025-10-08 |

| Low Point (Price & Date) | $456.30 on 2025-05-14 |

Fibonacci Levels

| Level | Price |

|---|---|

| 0.236 | $553.98 |

| 0.382 | $588.09 |

| 0.5 | $597.13 |

| 0.618 | $606.17 |

| 0.786 | $624.48 |

Currently, the stock price is at $623.49 as of 2025-10-10 and is in the 0.786 retracement zone, indicating a potential resistance area.

The technical implication of the stock being in this retracement zone may suggest a consolidation phase. Analysts should monitor for potential breakouts above the 0.786 level or reversals, as these are significant lines that might act as resistance or support, influencing future price movements.

Conclusion

Northrop Grumman Corporation's stock demonstrates a strong uptrend, reflective of its robust business operations and strategic sector positioning. This trend, confirmed by the recent Fibonacci analysis, showcases a possible encounter with a key resistance point, potentially influencing future price momentum. There are opportunities for continued growth if significant resistance levels are surpassed. However, investors should be mindful of consolidated corrections that could occur if the current resistance holds. Analysts and stakeholders must remain vigilant in analyzing these factors, coupled with industry developments, to make informed decisions.