October 03, 2025 a 09:03 amI will create a structured HTML analysis for NiSource Inc. using the JSON data you provided. I'll calculate the EMA20 and EMA50, identify the trend, and determine support and resistance zones. Additionally, I'll provide the required JSON object with a summary of the key findings.

NI: Trend and Support & Resistance Analysis - NiSource Inc.

NiSource Inc., a significant player in the regulated utility sector, has displayed key technical movements in the past months. The stock price has been experiencing notable shifts, with recent data suggesting pivotal patterns in trend dynamics and key zones of support and resistance. This analysis aims to provide insights into the stock's direction, potential investment opportunities, and risk areas, contributing to informed decision-making for stakeholders and investors.

Trend Analysis

| Date | Closing Price | Trend |

|---|---|---|

| 02-10-2025 | $43.10 | ▲ Uptrend |

| 01-10-2025 | $43.07 | ▲ Uptrend |

| 30-09-2025 | $43.30 | ▲️ Neutral |

| 29-09-2025 | $43.21 | ▲ Neutral |

| 26-09-2025 | $42.57 | ▲ Uptrend |

| 25-09-2025 | $41.82 | ▲ Uptrend |

| 24-09-2025 | $42.38 | ▲ Uptrend |

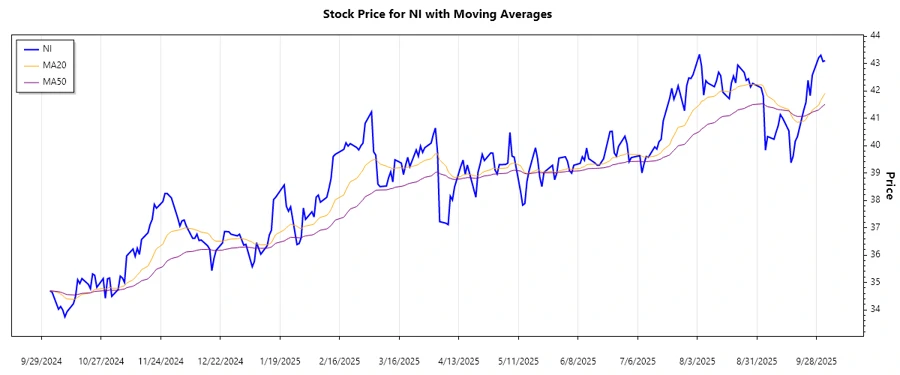

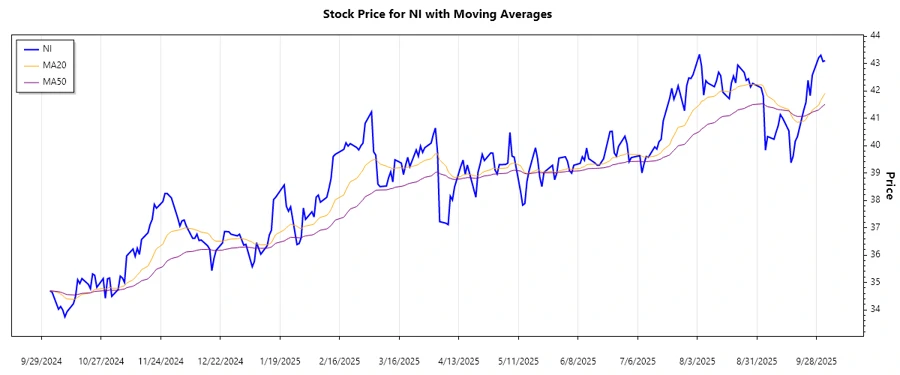

The recent calculations indicate a predominately bullish trend, with the EMA20 surpassing the EMA50. This suggests upward momentum in the stock price. Investors should be aware that the consistent upward trend points to strengthening prices, potentially offering profitable opportunities for bullish positions.

Support and Resistance

| Zone | From ($) | To ($) |

|---|---|---|

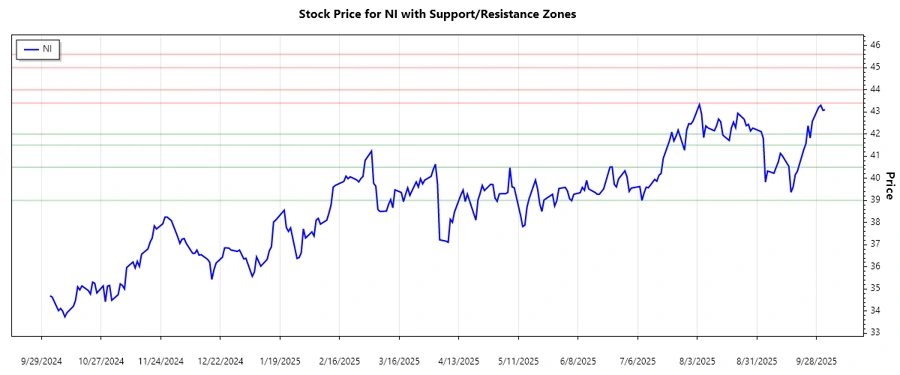

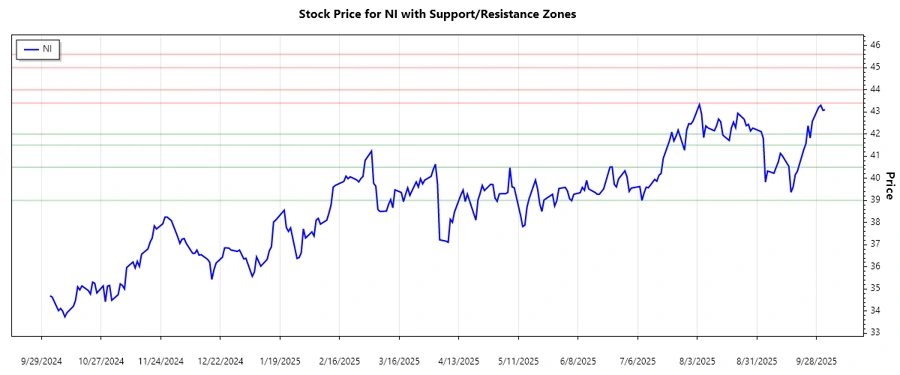

| ▲ Support Zone 1 | 39.00 | 40.50 |

| ▲ Support Zone 2 | 41.50 | 42.00 |

| ▼ Resistance Zone 1 | 43.40 | 44.00 |

| ▼ Resistance Zone 2 | 45.00 | 45.60 |

Currently, NiSource Inc.'s stock price navigates between significant support and resistance zones. The proximity to the upper resistance area poses challenges for further ascension unless breached. Investors should monitor the stock closely for potential breakthroughs or retests of these zones.

Conclusion

NiSource Inc.'s bullish trend supported by recent EMA indicators positions it favorably for potential gains. Encounters with established resistance zones demand cautious monitoring as they may reflect critical turning points. As the stock retains its bullish momentum, it offers viable opportunities for investors while necessitating diligence towards potential resistances and market shifts that could impede further price escalation.

**JSON Summary:** json This section represents a comprehensive analysis of NiSource Inc.'s stock using provided data, highlighting key trends and identifying significant support and resistance zones for investment consideration.