September 13, 2025 a 09:01 am

NI: Analysts Ratings - NiSource Inc.

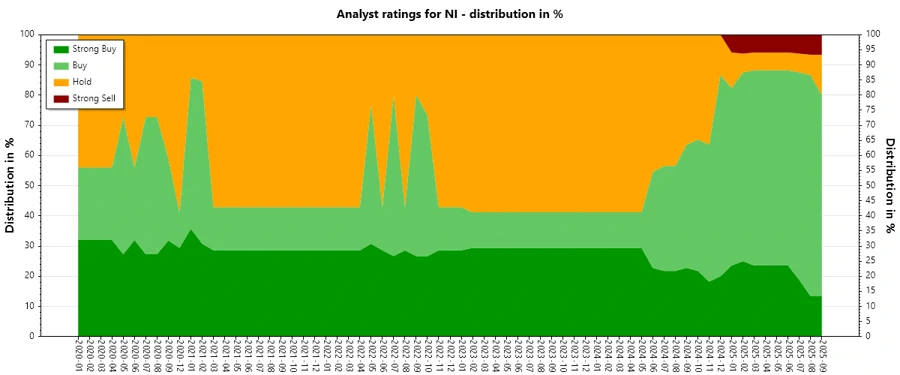

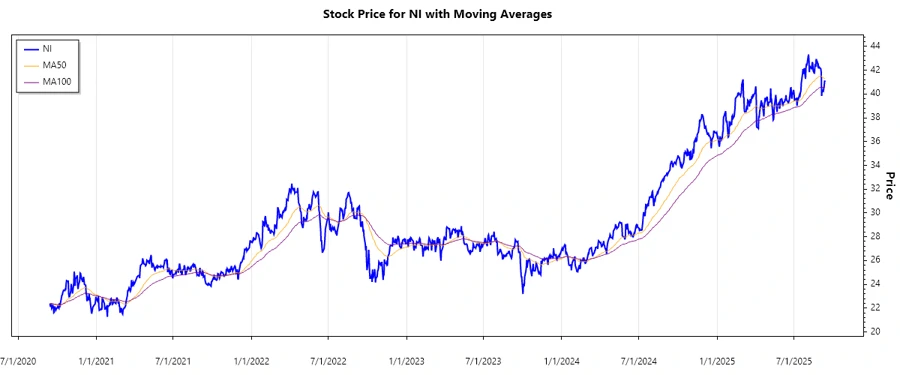

NiSource Inc., a prominent energy company in the United States, operates as a regulated utility for both natural gas and electricity. Despite its established market presence, recent analyst ratings reveal a cautious sentiment with a notable number of Buy recommendations transitioning into Hold, indicating a growing uncertainty or waiting period before taking decisive actions. Overall, this suggests a stabilizing, yet ambiguous outlook for NiSource, with analysts debating between maintaining current positions and potential shifts based on upcoming market developments.

Historical Stock Grades

| Recommendation Type | Count | Score |

|---|---|---|

| Strong Buy | 2 | |

| Buy | 10 | |

| Hold | 2 | |

| Sell | 0 | |

| Strong Sell | 1 |

Sentiment Development

Over the past months, the sentiment towards NiSource Inc. has shifted gradually. Notably, there is a decrease in Strong Buy ratings from earlier highs, coupled with an increase in Hold ratings. Analysts seem to be adopting a more cautious stance, reflective of potential market hesitations. The overall number of recommendations has remained relatively stable, while the composition indicates a slight increase in cautiousness.

- The number of Strong Buy ratings decreased from 5 in 2024 to 2 by September 2025.

- Hold recommendations saw a slight uptick, moving from 1 to 2 in recent assessments.

- The growing caution is indicated by a sustained level of Buy attitudes but a reduction in Strong Buy enthusiasm.

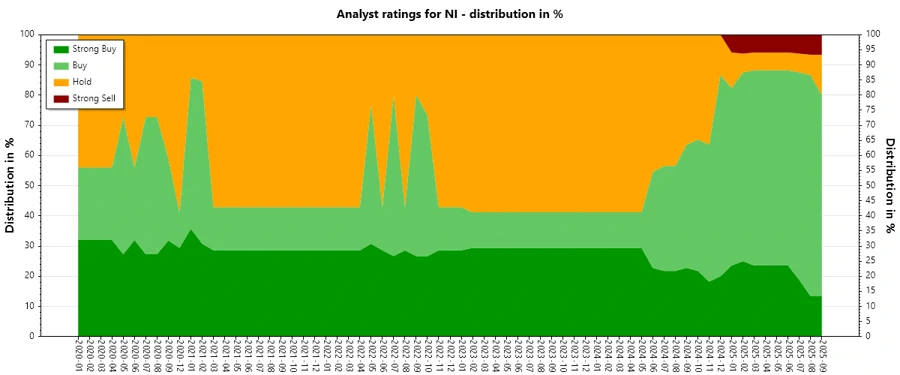

Percentage Trends

The distribution of analyst ratings over recent months reveals subtle, yet significant percentage shifts. Over the past year, the percentage of Strong Buy ratings decreased while Buy and Hold ratings maintained or slightly increased. This indicates a more balanced view towards potential market uncertainties or future performance outlooks.

- Strong Buy dropped from 18% to 14% year-over-year.

- Buy has remained relatively steady, around 70%.

- Hold ratings increased from 6% to 14%, matching the dip in Strong Buy.

- Strong Sell, while minimal, has made a reappearance, indicating select negative outlooks.

Latest Analyst Recommendations

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-09-05 | Hold | Buy | Jefferies |

| 2025-08-04 | Overweight | Overweight | Barclays |

| 2025-05-08 | Overweight | Overweight | Wells Fargo |

| 2025-05-08 | Buy | Buy | Guggenheim |

| 2025-04-28 | Outperform | Outperform | BMO Capital |

Analyst Recommendations with Change of Opinion

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-09-05 | Hold | Buy | Jefferies |

| 2023-06-06 | Buy | Neutral | UBS |

| 2023-06-05 | Buy | Neutral | UBS |

| 2022-11-09 | Outperform | Neutral | Credit Suisse |

| 2022-11-08 | Outperform | Neutral | Credit Suisse |

Interpretation

The current analyst sentiment towards NiSource Inc. reflects a cautious yet stable approach. The shift from Strong Buy to more conservative ratings such as Hold suggests growing wariness about short-term conditions. Although the majority remain in favor of maintaining a Buy stance, the emergence of Hold and a few scattered Strong Sell ratings imply an adjusted risk perception. As such, the company's market position appears stable yet subject to careful monitoring for future shifts.

Conclusion

NiSource Inc. exhibits a complex blend of recommended actions by analysts, split between maintaining current optimistic views and adapting to potential conservative outlooks. With a notable reduction in Strong Buy in favor of Buy and Hold recommendations, the company's market evaluation suggests prudent confidence mixed with underlying uncertainties. While the general sentiment remains positive, relative caution and strategic waiting appear prevalent. Consequently, NiSource continues to offer opportunities, though intertwined with market variables and evolving industry conditions that warrant careful observation.