July 09, 2025 a 11:31 am

NDAQ: Dividend Analysis - Nasdaq, Inc.

📊 Nasdaq, Inc. presents an attractive opportunity for dividend-focused investors given its consistent dividend payouts and respectable yield. With a history of 14 years of uninterrupted dividends, this company demonstrates a commitment to returning capital to shareholders. While the growth rates have been moderate, the company's financials suggest stability in its payouts and future potential for growth. Keep an eye on potential shifts in its financial strategy, especially regarding cash flow management.

Overview

🗣️ Starting with the sector analysis, Nasdaq, Inc. is part of the Financial sector. It offers a modest dividend yield of 1.44%, which may appeal to income-oriented investors. Currently, the dividend per share is approximately $0.94, with a remarkable history of 14 years of dividends, signaling reliability. The company has not faced any cuts or suspensions recently, indicating stability in its financial health.

| Metric | Value |

|---|---|

| Sector | Financial |

| Dividend yield | 1.44 % |

| Current dividend per share | 0.94 USD |

| Dividend history | 14 years |

| Last cut or suspension | None |

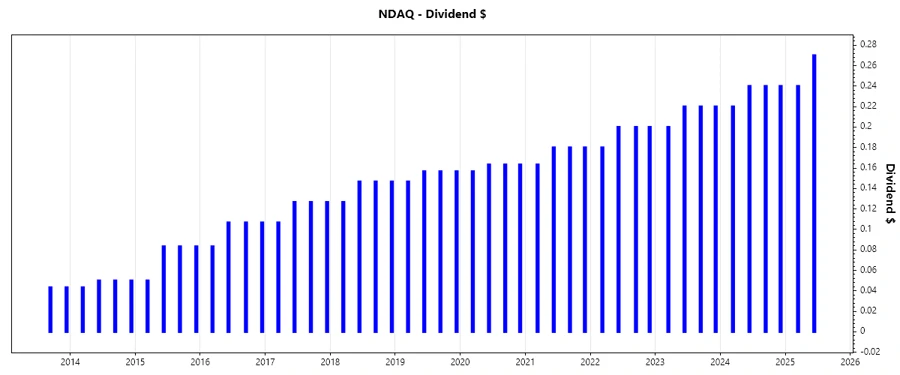

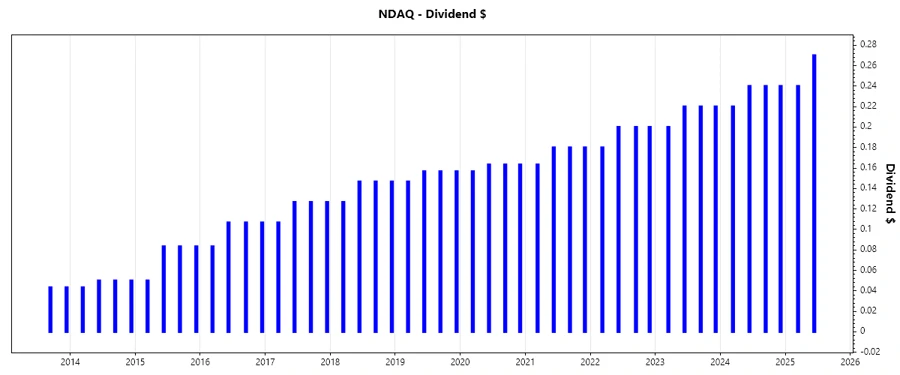

Dividend History

📈 Analyzing the dividend history provides insight into the company's commitment to reward shareholders. It is essential for evaluating reliability and growth potential. The consistent dividend payouts over the past years are a strong indicator of financial health and management competence.

| Year | Dividend per Share (USD) |

|---|---|

| 2025 | 0.51 |

| 2024 | 0.94 |

| 2023 | 0.86 |

| 2022 | 0.78 |

| 2021 | 0.70 |

Dividend Growth

📉 Understanding dividend growth is crucial for evaluating the company's potential to increase shareholder value over time. Steady growth indicates a healthy financial status and management's confidence in future prospects.

| Time | Growth |

|---|---|

| 3 years | 10.15 % |

| 5 years | 8.80 % |

The average dividend growth is 8.80% over 5 years. This shows moderate but steady dividend growth.

Payout Ratio

✅ Evaluating payout ratios is essential in understanding the sustainability of dividends. It gives insights into how much of the earnings are being returned to shareholders versus reinvested into the company.

| Key figure | Ratio |

|---|---|

| EPS-based | 42.33 % |

| Free cash flow-based | 29.11 % |

With an EPS-based payout of 42.33% and a FCF-based payout of 29.11%, Nasdaq, Inc. maintains a conservative approach in its dividend policy, ensuring ample room for reinvestment.

Cashflow & Capital Efficiency

🧮 Cash flow and capital efficiency metrics highlight the company's ability to generate cash and utilize capital effectively. These are critical for assessing the company's ability to support its dividend policy.

| Year | 2024 | 2023 | 2022 |

|---|---|---|---|

| Free Cash Flow Yield | 3.90 % | 5.20 % | 5.14 % |

| Earnings Yield | 2.51 % | 3.58 % | 3.72 % |

| CAPEX to Operating Cash Flow | 10.47 % | 9.32 % | 8.91 % |

| Stock-based Compensation to Revenue | 1.91 % | 2.01 % | 1.70 % |

| Free Cash Flow / Operating Cash Flow Ratio | 89.32 % | 90.68 % | 91.09 % |

Cash flow stability is substantial, with consistent efficiency ratios signaling robust underlying financial health critical for maintaining dividends.

Balance Sheet & Leverage Analysis

📊 A strong balance sheet with manageable leverage ratios is essential to mitigate risks, especially in volatile markets. It ensures the company can meet its obligations while maintaining dividend payments.

| Year | 2024 | 2023 | 2022 |

|---|---|---|---|

| Debt-to-Equity | 88.18 % | 100.51 % | 95.12 % |

| Debt-to-Assets | 32.46 % | 33.66 % | 28.04 % |

| Debt-to-Capital | 46.86 % | 50.13 % | 48.75 % |

| Net Debt to EBITDA | 3.57 | 5.22 | 2.74 |

| Current Ratio | 0.98 | 1.00 | 0.97 |

| Quick Ratio | 0.99 | 1.01 | 0.18 |

| Financial Leverage | 2.72 | 2.99 | 3.39 |

Financially stable with moderate leverage, Nasdaq, Inc. is well-positioned to withstand economic fluctuations, sustaining shareholder payouts and operational growth.

Fundamental Strength & Profitability

📈 Assessing fundamental strength and profitability metrics provides a comprehensive view of operational health and efficiency, crucial for future dividend sustainability.

| Year | 2024 | 2023 | 2022 |

|---|---|---|---|

| Return on Equity | 9.98 % | 9.79 % | 18.29 % |

| Return on Assets | 3.67 % | 3.28 % | 5.39 % |

| Net Margin | 15.09 % | 17.46 % | 18.07 % |

| EBIT Margin | 24.96 % | 27.59 % | 25.62 % |

| EBITDA Margin | 34.62 % | 32.92 % | 31.35 % |

| Gross Margin | 40.39 % | 64.23 % | 41.42 % |

| R&D to Revenue | 5.53 % | N/A | 0.00 % |

Nasdaq, Inc. demonstrates strong operational efficiency and profitable growth, enhancing its ability to uphold and increment dividends.

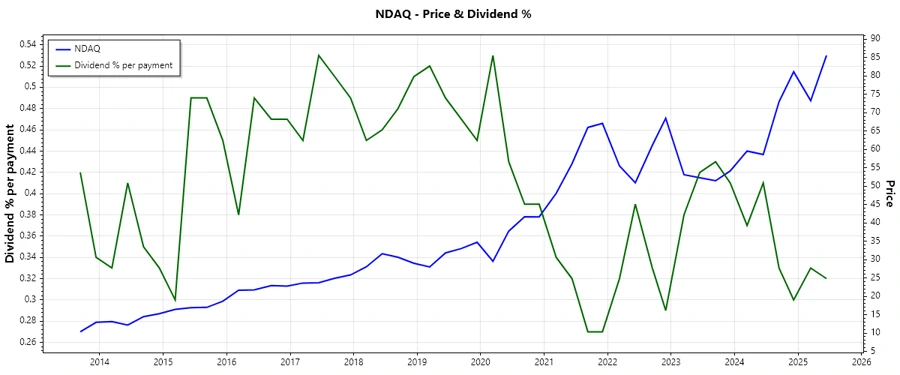

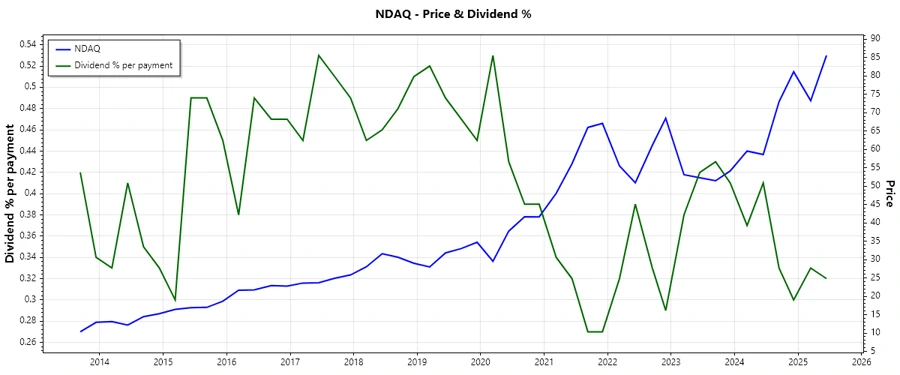

Price Development

Dividend Scoring System

| Criteria | Score | Score Bar |

|---|---|---|

| Dividend Yield | 2 | |

| Dividend Stability | 5 | |

| Dividend Growth | 3 | |

| Payout Ratio | 4 | |

| Financial Stability | 4 | |

| Dividend Continuity | 5 | |

| Cashflow Coverage | 4 | |

| Balance Sheet Quality | 3 |

Total Score: 30/40

Rating

⭐ Based on the comprehensive analysis, Nasdaq, Inc. is a reliable choice for dividend investors seeking stability and moderate growth. The company's firm financial foundation and robust dividend track record suggest it is well-positioned to sustain and potentially enhance its dividend offerings in upcoming years. Consider it as a mid-tier addition to a diversified dividend portfolio.